If you’re just starting off, you might be going between investing ETF vs stocks and it’s a totally legitimate question. This is the century-old question with investing. The answer to ETF vs stocks is that it depends. In certain cases, stocks are a good investment, although ETFs are preferable in others. Exchange-traded funds might decrease the difficulties for inexperienced investors. They can also provide a straightforward approach to achieve high returns. This makes ETFs an excellent starting point. It’s worth to remember that even though they are easy to run, they do have their drawbacks.

How do you determine which is better and fits well to your investment strategy? There is no certain answer that is suitable for everyone. It all comes down to what you are willing to do with your investments and money. With ETFs, spending a few hours every month to track its situation is enough. You can make recurring payments and let it ride for decades. If you opt for stocks, it is a different case. You would need to create a fitting portfolio.

Determining Which is Better with ETF vs Stocks War

Stocks portfolio will likely to have several companies. If you want good diversification, it will probably have more than ten. The problem with individual stocks is that you need to spend a few hours each month on each of the stocks you own. You need to make sure they are in a good path and could provide value in the future. ETFs do not require this much effort but could provide lower value.

Overall, both of these options has advantages and disadvantages. Both could give you good returns over years and help you achieve your financial freedom. The most important thing in determining between ETFs and stocks is your ideals. If you know what you can cover and follow through each month, it will be easier to make the decision.

However, you still need to understand both of these options very well if you want to make the best decision. This article will compare ETF vs stocks and explain what they are. This will give you a better understanding of these options and help you choose which one to go for.

Exchange Traded Funds

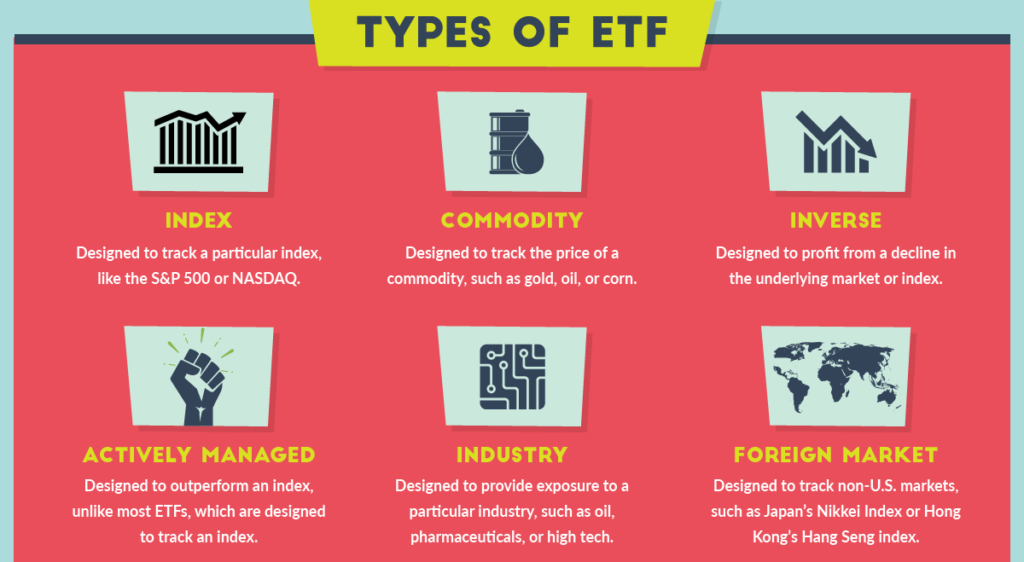

ETF is an exchange-traded fund and a pooled investment asset that functions similarly to a mutual fund. ETFs often follow a specific index, sector, commodity, or other assets. Different to mutual funds, you can buy and sell ETFs on a stock market in the same way with conventional stocks. A single ETF may hold dozens, if not hundreds, of equities. So in short for ETF vs stocks, ETF is a combination of single stocks and a stock is just one stock.

In ETF vs stocks consideration, the upside for ETF Investors is that they can own an indirect investment in all the stocks (or other assets) that the fund owns by purchasing a single share of the ETF. It’s an excellent (and frequently low-cost) approach to acquire a stock portfolio of different companies.

An ETF can track anything from a single commodity’s price to a huge and diversified group of commodities. ETFs can even follow certain investing strategies. ETFs frequently invest in equities with a specific focus. These include large firms, value-priced stocks, dividend-paying companies. ETFs can also focus on a specialized industry, such as financial corporations. Some specialist ETFs may help you to generate larger returns.

There are ETFs for green energy, dividend stocks, and so on. The SPDR S&P 500 ETF (SPY), which tracks the S&P 500 Index, was the first ETF and is still an actively traded ETF today.

Pros and Cons of ETFs

Pros

- ETFs allow you to invest in hundreds or even thousands of firms by purchasing a single fund.

- ETFs provide the power of diversity. Low risk, high profit compared to the level of risk.

- Over time, a well-diversified ETF based on the S&P 500 can outperform most investors.

- ETFs often has less volatility than individual equities.

- The best ETFs have low expense ratios. These are the costs of the fund as a proportion of your investment. For every $10,000 you invest, the top may cost only a few dollars each year.

- You can purchase ETFs and trade them whenever the markets are open.

- Most major online brokers offer no-cost ETF trading.

- Investment in ETFs and earning large returns do not require a lot of information and time.

Cons

- Even in a strong year, ETFs will underperform the top equities in the fund. Investors might have just held those shares and done better than holding the ETF.

- Owning an ETF has an additional cost, known as the expense ratio.

- Because not all ETFs are the same, investors must understand what they hold and what returns they might get.

- ETFs are not guaranteed to make you money. Just like individual stocks, you have the possibility to lose money on your investment.

- You have no influence over what is invested in any particular fund, and you are not required to acquire shares in that fund.

Diversification of ETFs

ETFs offer huge diversification either in one sector or in general stock market because of the huge diversification. These benefits include decreased risk and volatility. That is why an ETF is generally safer to acquire than an individual stock. Risks are lower and you get massive diversification with one asset.

The return on an ETF is in parallel with the assets that it invests in. An ETF’s is the weighted average of all of its investments. As a result, if it has a large number of strong equities, the ETF will grow. If it holds a large number of underperforming equities, the ETF will suffer.

To put it simply, with ETFs you buy buy a bundle of stocks that invests in them altogether. If an ETF has 5% in Microsoft stock, 5% in Apple, and the rest in other stocks are equally divided, every 100$ you invest in this ETF will mean $5 in Microsoft, $5 in Apple, etc. Your money will be in an ETF’s other stocks.

Who Run ETFs?

Professionals run these ETFs. They track all of these companies that an ETF invests in. Depending on the situation, they increase or decrease the weight of the investment in the ETF. These professionals might even drop a company altogether if they think the company is not going to perform well in the long run. That is why you don’t have to follow financials of a company or their management because the managers of the ETF already does it for you. When you buy stocks, you need to do all the management by yourself.

It is worth remembering that ETFs are not the best choice for higher returns. There are some ETFs that offers high returns but they are also high risk. Majority of ETFs generally do not perform higher than the general stock market. Since you spread your money across hundreds of stocks, the returns you get might be lower than the market return in a bull market. Nevertheless, things might change in a bear market. You will spare yourself from the volatility since you hold many stocks.

However, ETFs also might provide lower returns than if you were to pick individual stocks. Picking individual stocks are riskier and they do not provide higher returns than ETFs all the time. That is because you need to choose the right stocks to underperform the market. With the right due diligence and if you know what you want, you might. Nevertheless, as I mentioned, this is risky business. Let’s move on to stocks and talk about them.

Stocks

In the event of a publicly traded firm, a stock represents a fractional ownership stake in the company. These stocks normally trade on an exchange. When you buy a stock, you’re betting on the success of one firm – and only one.

Stocks may rise and fall in the short term for a variety of reasons .Market mood frequently dictates how a stock performs day to day. However, in the long run, a stock closely tracks the company’s growth. As the company’s earnings grow, the stock tends to climb as well.

Individual stocks are extremely risky if you don’t know what you are doing and you might end up losing a lot of money if you invest in wrong stock or stocks. Stock picking strategies play a major role in being successful if you want to invest in individual stocks and not ETFs.

Individual stocks can perform well over time, but they can be quite volatile in the near term, swinging dramatically. It’s not uncommon for high-flying equities to fall 50% in a single year on the way to long-term excess returns. A solid stock, on the other hand, may rise by 50% or more in a single year, especially if the general market is hot.

Stock Investing Strategies

You can either opt for dividend stocks or growth stocks, or some combination of both. Even though dividend stocks are less riskier, the whole point of investing in dividend stocks are extremely different than other types of investing. You buy dividend stocks to not sell whereas with growth stocks, you expect a fundamental rise in your capital in short or long-term and sell them once the time comes.

Determining which strategy to go for depends on your financial goals. If you are investing for the long-term, dividend investing is generally the best way. If your aim is to make gains in the short-term by betting on the right companies, value or growth stocks might be a better choice for you. You first need to understand your goals in your investing journey. Once you determine your needs, you can make your choice easier.

Whatever strategy you will opt for, remember that stocks require extensive research and due diligence. In addition to that, you have to do this research frequently. This allows you to make sure that the stocks you are holding in your portfolio continue to do what they have been doing. The research could include management, financial indicators, economical indicators, and overall sector trust. This is one of the most problematic side of individual stock investing because it takes a lot of time.

Pros and Cons of Stocks

Pros

- You could earn high returns from stock investing if you choose the right stock.

- Individual stocks could potentially earn more than an ETF where you receive the weighted average performance of the holdings.

- You could receive higher yields in dividends with individual stocks because there aren’t hundreds of companies in one stock.

- If you follow the companies well and understand its financials, you could buy the stocks at a high discount.

- Major online brokers have reduced their stock trading commissions to zero, making it free to enter and exit an investment.

- Long-term stock holders may benefit from lower capital gains tax rates.

- Within a mutual fund or ETF, you can still hold equities with the potential to increase your wealth.

Cons

- Stocks are extremely volatile and there could be massive price increases or decreases in short time.

- Since you put your eggs in a small basket, you have the potential to lose most of your money in the event of those companies doing poorly.

- Just like ETFs, stocks do not guaranteed to make you money.

- You must possess a profitable firm in order to generate money, as a stock follows a company’s success over time. You will lose money if you choose a loser.

- Individual stock analysis and valuation take a lot of work, and many people either lack the time or the motivation to do so.

- Although you can write off losses and receive a tax credit, you will still have to pay taxes on any capital gains you make.