In today’s world, there are a variety of options available to individuals looking to invest their money and grow their wealth. These are financial instruments. The choices can be overwhelming. From stocks and bonds to mutual funds and exchange-traded funds (ETFs). How do you determine which financial instruments are for you and which are the best?

This is a difficult question. The answer will depend on your risk tolerance, goals, and personal preferences. It is important to think about how much time you want to spend managing your investments and whether you want to access your money quickly or not. Some financial instruments also offer a variety of options to the investor, but they might come with higher risks.

That’s why you must be able to navigate the world of investing and identify the best financial instruments, which is not as easy as you might think. This article will provide an overview of different financial instruments, their pros and cons, and how to decide which one is right for you. Keep reading if you’re ready to take the next step in your financial journey.

What Are Financial Instruments?

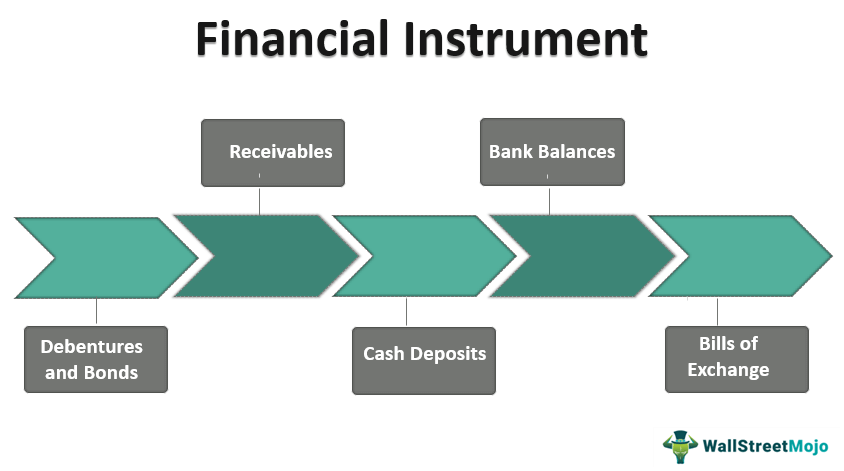

Financial instruments are a type of investment that individuals can trade publicly, like the stock market. They are a way of transferring risk from one party to another. Investing in financial instruments is one of the best ways to grow wealth and achieve your goals. Investors invest in financial instruments to earn money from the fluctuations in the prices of these instruments. They can also gain interest or dividends by just holding them. We can classify financial instruments in four categories:

- Equities (e.g., stocks)

- Debt (e.g., bonds)

- Derivatives (e.g., futures and options)

- Currencies (e.g., foreign exchange)

Some of these options are high risk, high return, and some of them are low risk, low return. What you choose to invest in depends on your risk appetite and how much you can afford to lose. But overall, they generally work on definitive things backing these instruments.

Why Should I Care About Financial Instruments?

Financial instruments can play a significant role in your overall financial plan. They are also a great to help in achieving a variety of financial goals. They also provide passive income without spending as much time and effort as you do with your career or side hustle. Financial instruments are the easiest way to start your investing journey. Investing is perhaps the easiest method to financial freedom.

Here are a few reasons why you might want to consider financial instruments as part of your investment strategy:

- Some financial instruments, such as stocks and real estate, have the potential to appreciate in value over time, which can help you grow your wealth.

- By investing in a variety of financial instruments, you can diversify your portfolio and spread risk across different asset classes. This can help protect your portfolio from the impact of market downturns and reduce volatility, and you will create an extra income source.

- Some financial instruments, such as rental properties, dividends stocks, and bonds, can generate passive income through regular interest payments, dividends, or rent. This can provide a steady stream of income and help support your financial goals.

- Many financial instruments, such as mutual funds and exchange-traded funds (ETFs), have experts managing them have the expertise and resources to research and select investments. This can be especially helpful for investors who lack the time or knowledge to manage their own investments.

It’s important to note that financial instruments carry varying levels of risk. You have to know your goals, risk tolerance, and what it is you want to focus on before taking on this risk. I suggest that you first take a few months to analyze yourself and the potential instruments you would like to invest in.

What is the Most Basic Financial Instrument?

Every financial instrument is actually complicated in its essence. They all rely on different things, comply with regulations and rules, and go up and down with risks. However, some are easier to manage and invest in than others.

One of the most basic financial instruments is a savings account. A savings account is a type of deposit account offered by banks and credit unions. It allows individuals to save money and earn interest on their deposits. Savings accounts are generally considered to be low-risk investments and offer a simple way for individuals to save and grow their money over time.

A savings account is not actually a financial instrumen. In environments where interest rates are at a good level, they can provide some sort of return.

They are often used as an emergency fund or for short-term saving goals, such as a down payment on a house or a vacation. Savings accounts are FDIC-insured up to $250,000 per depositor, providing additional protection for depositors.

Is There a Best Financial Instrument?

The best financial instrument is the one that suits your needs. There is no single “best” financial instrument that is suitable for all investors. The best financial instrument for you will depend on your specific investment goals and risk tolerance. Some financial instruments may be better suited for long-term growth, while others may be more appropriate for generating passive income or hedging risk.

It’s important to carefully consider your investment goals and risk tolerance before deciding which financial instruments to invest in. Since there is no “best,” generally, a good idea is to diversify your portfolio and invest in a variety of financial instruments. It helps to spread risk and potentially maximize returns. Knowing what you are looking for and what you want to achieve before investing in a financial instrument is important.

For example, if you are looking for a short-term investment, then a certificate of deposit would be the best option. If you are looking for a long-term investment, then stocks or bonds would be the best option. That’s why you must take your time and decide which option is “best” for you.

What Are the Best and Most Common Financial Instruments to Invest in?

As I mentioned above, there are many financial instruments to invest in. It’s up to you to determine which one fits you the best. However, there are common instruments people invest in that provide good value and don’t have many risks as other instruments. Of course, you can change this up as you wish, but here are the three best and most common financial instruments to invest in.

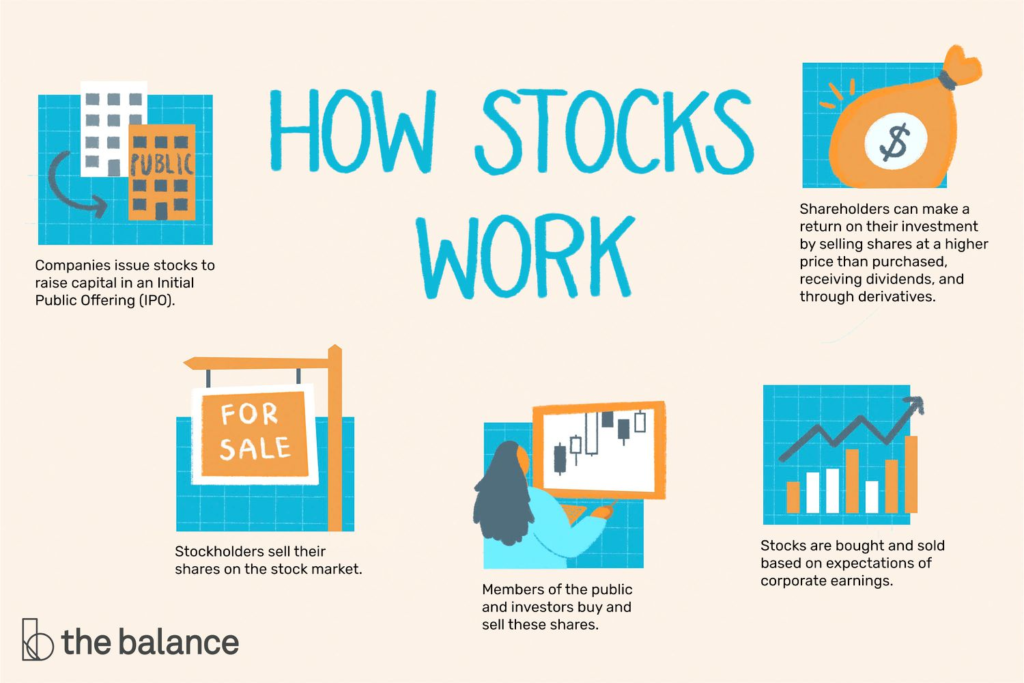

Stocks

Stocks, also known as equities, represent ownership in a company. You can buy and sell them at a market price on an exchange like the New York Stock Exchange or NASDAQ. When you buy stocks, you become a shareholder in the company and might be entitled to a portion of the company’s profits if they pay out dividends.

Stocks can be a good investment for those looking for long-term growth, as they have the potential to increase in value over time. Some examples of well-known stocks include Apple, Google, and Amazon. However, stocks can be extremely risky if you bet on the wrong horse .You must always diversify your stock portfolio with at least 15 to 20 individual stocks or just go for an ETF.

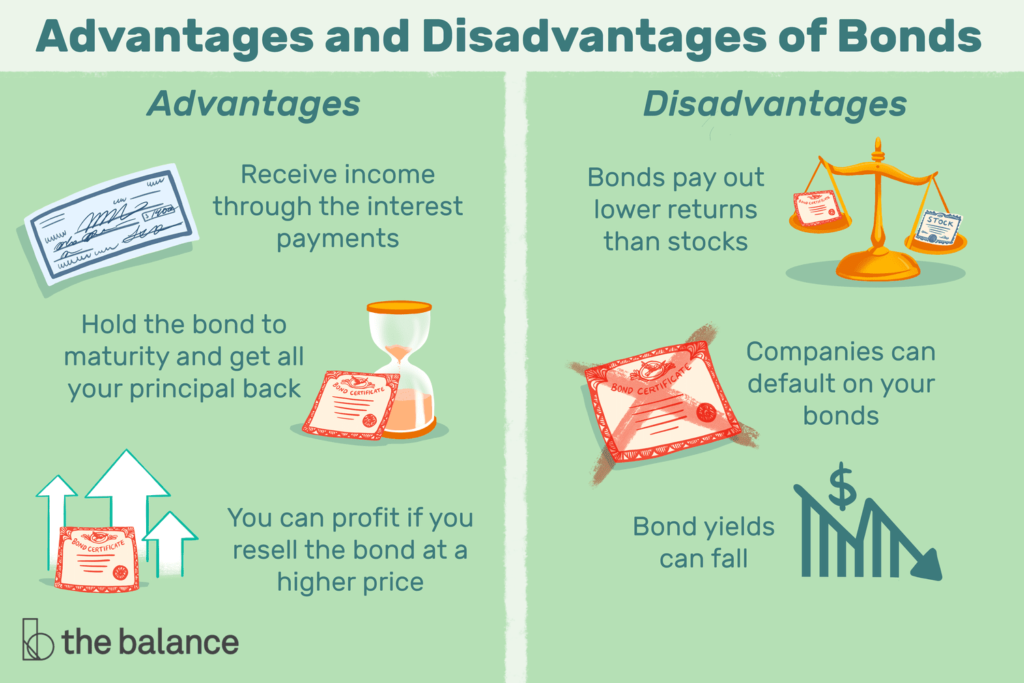

Bonds

Bonds are debt securities issued by companies, municipalities, and governments to raise capital. When you purchase any issuer’s bond, you are essentially loaning money to the issuer. You loan this money in exchange for regular interest payments and the return of your principal when the bond matures.

Bonds are generally one of the less riskier options than stocks, but they also offer lower potential returns. Examples of bond issuers include the U.S. Treasury, municipalities, and large corporations.

Real Estate

Real estate can be a good investment for those looking for long-term appreciation and the potential for passive income through rental properties. There are several ways to invest in real estate. You can directly purchase rental properties, flip houses, or invest in real estate investment trusts (REITs). REITs are generally listed on stock exchanges. According to US laws, REITs listed in US stock markets must pay out 90% of their revenue as a dividend to the shareholders.

Different Types of Investments with Examples

Let’s say you decided to invest in a financial instrument. However, you don’t know what good ones are and what an example would look like. This might be overwhelming as most financial instruments have quite a lot of options to choose from.

- The most common instrument is stocks. Among hundreds of thousands of stocks in hundreds of exchanges around the world, finding good ones is a big trouble. Perhaps the most popular stocks right now are Apple (AAPL), Microsoft (MSFT), Tesla (TSLA), Nvidia Corp. (NVDA), etc.

- Mutual funds pool money from many investors and use it to buy a diversified portfolio of stocks, bonds, or other securities. Examples of mutual funds include Vanguard 500 Index Fund and Fidelity Contrafund.

- Bonds are debt securities issued by companies, municipalities, and governments to raise capital. Examples of bond issuers include the U.S. Treasury, municipalities, and large corporations.

Of course, examples aren’t just limited to these. There is a variety of them to choose from. These are some of the most popular ones, and most people choose to invest in them when they decide it. I suggest not hopping on the most popular choices when you are investing, except for a few exceptions. The popular ones might go down in value real quick once their popularity fades off.

What are some of the Worst Financial Instruments to Invest in?

Not all financial instruments are good to invest in. There are also bad choices you can make. These choices generally include high-risk options that does not have a fundamental like good financial instruments.

Here are some of the worst financial instruments you can invest in. Of course, as I stated before, these might not be the worst for you if your risk appetite and goals are different. These are just some of the extremely risky instruments and aren’t worth the risk 98% of the time.

Penny Stocks

Penny stocks are low-priced, highly speculative stocks that trade for less than $5 per share. They are shares in companies that have low market capitalizations. They are often traded over the counter (OTC) and may not be on major stock exchanges like NASDAQ or the New York Stock Exchange (NYSE).

Penny stocks can have association with scams and fraudulent activity. Often small, unproven companies with little financial transparency issues them. This makes it it difficult for investors to gauge the stock’s true value. Additionally, penny stocks are not subject to the same regulatory oversight as larger, more established stocks, making them vulnerable to manipulation and insider trading. One of the other risks with penny stocks is that they can be difficult to sell if you want to get out before they lose value.

Binary Options

Binary options are financial instruments that allow investors to bet on whether the price of an asset will go up or down within a certain time frame. While they may seem like a straightforward way to trade, binary options are highly risky and can result in significant losses. Most regulatory bodies worldwide even banned most of them.

Cryptocurrencies

Cryptocurrencies, such as Bitcoin and Ethereum, popularity have significantly increased in recent years due to their high volatility and potential for huge returns. However, they are also some of the riskiest financial instruments to invest in. Governments or financial institutions do not regulate cryptocurrencies. This makes them vulnerable to fraud and market manipulation. Additionally, the value of cryptocurrencies can fluctuate significantly in a short period of time, leading to potential losses for investors.

Structured Notes

Structured notes are complex securities that combine debt and equity positions with derivatives to provide an investor with specific return or payoff characteristics. They often come with high risk and high fees. They often sell these products as low-risk investments, but they can be difficult for investors to understand and may contain hidden risks.

Additionally, generally financial institutions experiencing financial difficulties issue these structured investment products. This makes them even riskier for investors.

The Verdict

To conclude, there are quite a lot of financial instruments that you can invest in. They are a good choice if you want to start investing and growing wealth. I believe every person should start investing in financial instruments as early as they can. They require little to no effort and could provide very good value appreciation and income in the long run.

Choosing the best financial instruments depends on your needs, risk appetite, financial goals, and other personal financial details. That’s why taking the time to research to determine which one is the best is a must for everyone. Steer away from investing in instruments that are extremely volatile and not regulated enough, like penny stocks or cryptocurrencies.