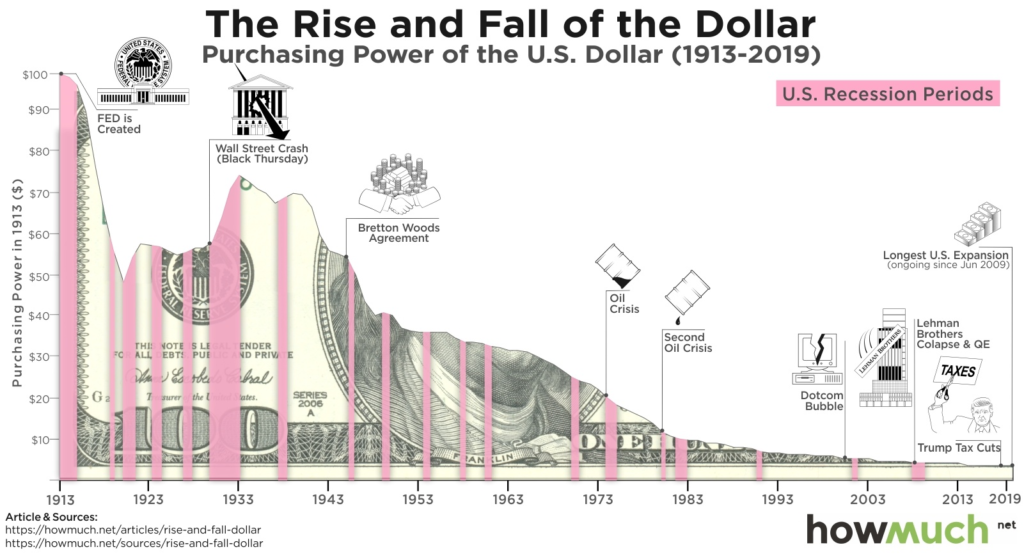

You probably have seen circumstances with high inflation, no matter how old you are and you felt the need to protect against inflation. It is a terrible thing to live through but also a common phenomenon. In 10 years, a dollar can not purchase the same amount of products. This is because of inflation. Inflation is the average cost value of a set of goods and services in an economy.

It applies to price rises over a given period. Inflation causes a given quantity of currency to be worth less than it was previously. As a result, finding the correct tactics and assets and learning how to protect against inflation is critical. You must know the best investments to protect against inflation and move your investments.

Inflation in an economy varies according to current circumstances. In the current case, the COVID-19 pandemic in 2020 started the first phase of increasing prices. Then the war in Europe, and Russia’s attack on Ukraine, made the trade of natural gas and oil harder.

How Does Inflation Work?

Your money buys less when prices increase throughout the economy. This equals less buying power and, thus, inflation. For instance, the average price of a cinema ticket in 1980 was approximately $2.9. However, the average cost of a movie ticket increased to $9.16 by 2019. A $10 from 1980 would buy two fewer movie tickets in 2019 than it did four decades earlier if you had saved it.

Yet, don’t conceive of inflation as increasing costs for a single good or service. A country’s overall economy, a specific sector or industry, may ultimately experience inflation. Producer & The Consumer Price Index (CPI) & (PPI) and Personal Consumption Expenditures Price Index (PCE) track the change in prices. All of them use different measures to track these changes. They also track producers’ prices in industries across the entire American economy. These are the two main measures of U.S. inflation.

Even though seeing your money’s value decrease is not the best, inflation could be healthy. Most economists see a tiny amount of inflation as a positive indicator of a robust economy. A moderate inflation rate encourages you to invest or use your money now rather than stowing it away and watching it lose value.

Deflation

Deflation is a decrease in prices across all economic sectors or the entire economy. The ability to buy more for less money tomorrow may seem appealing. But, experts say that deflation could be even more harmful to an economy than high inflation.

When deflation is here, buyers put off current purchases hoping for larger price drops in the future. Deflation can reduce or even stop economic growth if it is continuous. This would decimate wages and paralyze an economy.

Stagflation

Stagflation happens when a country has both high unemployment and high inflation. Consumer demand declines as people manage their expenditures because of high unemployment. You see a rebalance in your purchasing power due to the decline in demand, which lowers prices.

However, when stagflation occurs, prices stay high even while consumer spending falls. Stagflation makes it more and more expensive to buy the same products. We don’t need to look outside of the United for instances. The United States suffered stagflation in the middle to the late 1970s due to high prices brought on by OPEC oil embargoes. This increased inflation even while recessionary conditions reduced GDP and raised unemployment.

Hyperinflation

When both inflation and a nation’s currency’s value fall fast, this creates hyperinflation. According to economists, hyperinflation occurs when monthly price increases are at least 50%. Hyperinflation generally occurs during civil unrest, war, or a regime overthrown. We also see the same reasons when we look into hyperinflation’s history. These causes effectively devalue a nation’s currency.

The most popular example of recent hyperinflation is Germany’s Weimar Republic in the early 1920s. Each month, prices increased by tens of thousands of percent, severely harming the German economy.

Inflation Phenomenon

In the economic system, inflation is a natural phenomenon. You can protect yourself from inflation with several strategies. An investor may prepare for inflation by buying assets that generate higher returns during inflation times. Having inflation-hedged asset classes on your portfolio or on your radar is a perfect way to protect yourself. Acting on these assets when you notice inflation taking shape in an economy will help your portfolio thrive when inflation arrives.

However, this is the hard part. Even if you know the best protection against inflation, you can still lose your money’s value in the short term. In the long run, some assets will give you higher returns than others.

We will examine six investments to protect against inflation and show what to invest in to protect against inflation. Some are short-term, and some are long-term. When you are investing during a period of inflation, you need to think long-term rather than short-term.

Commodities

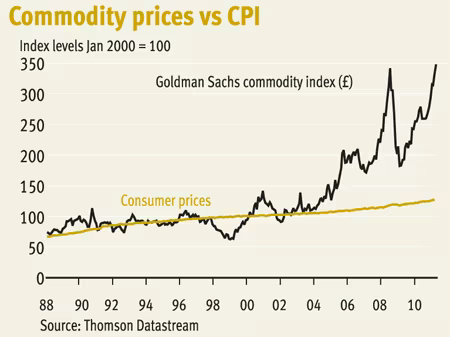

Grain, precious metals, power, oil, cattle, orange juice, and natural gas are all examples of commodities. You can also count forex (foreign currencies), emissions, and some other financial instruments. There is a weird relationship between commodities and inflation. Commodities serve as an indication of future inflation. When a commodity’s price increases, the price of the items made from that commodity also increases.

You have to be aware that commodities are extremely volatile. You need to be cautious when you are investing in commodities. Commodities are contingent on demand and supply variables. Even minor changes in supply because of geopolitical tensions or wars can have an impact on commodity prices. The most recent example we can talk about is the war Russia started against Ukraine. It affected natural gas the most.

Stocks

Stocks are controversial investments to protect against inflation. During inflationary periods, stocks tend to go down. However, the point about stock investing (both in normal economic times and inflationary periods) is to do it for the long term. Like dividend investing.

That is why, when you are investing in stocks when there is high inflation, you can expect the prices to go down in the short run. This gives you a great opportunity to dollar-cost average. After a while, you will be able to make returns once the inflation and recession worries ease down. Once everything goes back to how it is, people return to their normal lives and start investing again.

Stocks with high cash flow and cash reserves with good management tend to perform the best during inflation times. Because these things are great against inflation, they protect the company and continue the business as usual. These three things ensure that the company is inflation-proof and can sustain itself even when people are not buying anything.

Bonds

Bonds are also seen as commodities that can be a big bet against inflation. This might be true as their rates rise with inflation and increasing interest rates. However, they still do not provide enough to cover your losses in the long run.

A 60/40 split between stocks and bonds in your portfolio is highly recommended. This could be a good hedge against inflation. However, they will most likely underperform the market in the long run. So you need to know how big of a role you can give to bonds in your portfolio. They generally do not perform well, but the risk of you losing money is extremely low. Low risk, low win.

REITs

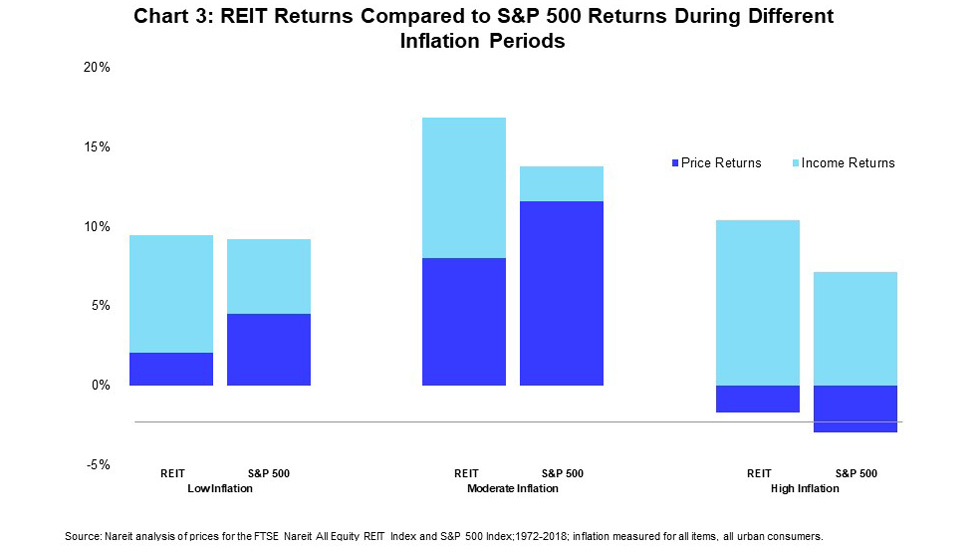

REITs are corporations that own and manage revenue-producing real estate. When inflation rises, so do property values and rental revenue. Real Estate Investment Trusts (REITs) is a trust that has to pay out dividends to their owners by law. REITs have some disadvantages. Such as their vulnerability to the demand of other high-yield investments. Treasury assets often become more interesting when interest rates climb. This can cause capital to flee REITs, lowering their share values

REITs must also pay property taxes. This can account for up to 25% of overall operating expenditures. If state or municipal governments choose to raise property taxes to make up for budget shortages, this will reduce cash flows to shareholders. However, REITs with good management and sectors that have to work no matter what is always a winner. One example of this is Medical Properties Trust, Inc (MPW), which owns and leases hospital buildings.

All in all, REITs are not only a good asset to protect against inflation, but they can also replace physical real estate. If you don’t want to have the hardships of dealing with tenants or other stuff, REITs could give you the same value as physical real estate. You can weigh down things by comparing REITs and physical real estate. However, it helps you remove the headache if you choose to go to REITs.

Physical Real Estate

The value of physical real estate typically increases more quickly than inflation. Physical real estate includes raw land, residential, and commercial properties. These three have different reasons to buy and different capital to enter. The median sale price of homes sold in the United States has constantly been increasing. Federal Reserve Bank of St. Louis’s report shows us that there was a shift of around 550%. Increasing from $63,700 in 1980 to $347,500 in Q1 2021.

Physical real estate is an asset that produces regular income streams and a gain in asset value over a longer holding time. Stocks, commodities, bonds, and other asset types do not do that. Real estate is frequently referred to as a “hard asset” due to these factors. Physical real estate helps you to keep your income up with the inflation rate. This makes inflation not all bad.

This is the reason why many investors turn to real estate. Preserving your income and increasing your capital at the same time is easy with physical real estate. Physical real estate values have a history of rising over time. This increase is typically faster than inflation. According to the Green Street Commercial Property Price Index, the average value of all forms of physical real estate has climbed by 180% over the previous 20 years.

TIPS

There are specific U.S. Treasury Bonds to protect from inflation. Treasury inflation-protected securities (TIPS) bonds are indexed to the inflation rate. TIPS payout at a predetermined rate twice a year. The rate of return also includes the adjusted principal because the principal value of TIPS fluctuates in relation to the rate of inflation. TIPS are available in three maturities: five, ten, and thirty years.

Although TIPS may seem like a lucrative investment, there are a few risks that investors need to be aware of. The principal amount may decrease if there is deflation or a decline in the Consumer Price Index (CPI). You will also need to pay additional tax if the bond’s face value rises (which could destroy any benefit you may receive from TIPS). Last but not least, TIPS are susceptible to any shift in a country’s interest rates. So if you sell your investment before its maturity, you can lose some money.

Suggested Portfolio to Protect Against Inflation

There are six different assets in this article and many others out there to protect against inflation. However, you can’t possibly have all these assets in your portfolio. You need to choose a few among them and create an ideal portfolio for yourself. This might seem hard, but it shouldn’t be. You can create a good portfolio depending on your capital and how much you can afford to invest. However, there is a traditional portfolio that many people use. It is a great hedge against inflation. That is the 60/40 stock & bond portfolio.

This traditional portfolio is a safe and conventional blend of stocks and bonds in a conservative portfolio. You can most certainly choose to do it yourself and buy different stocks and bonds. However, if you don’t want to deal with it and make this process easier, there is a specific portfolio ETF for that. Dimensional DFA Global Allocation 60/40 Portfolio gives you this allocation. If you don’t want to put in the time or want to avoid paying an investment advisor, just buy this ETF.

Using a 60/40 stock/bond portfolio as an investment strategy is straightforward. However, it also has some negative sides, just like all investment strategies. In the long run, a 60/40 portfolio will perform worse than one that is entirely made up of stocks. Because of compound interest, a 60/40 portfolio may underperform an all-equity portfolio for long periods. It’s crucial to remember that while a 60/40 portfolio will keep you safer and help you buffer against inflation, you’ll probably lose out on rewards compared to a portfolio with a higher proportion of stocks.