Not everyone can put thousands of dollars on the table when they start out investing for the first time, and even if they can, they need to do dollar cost averaging. Many people wrongly assume that they need a lot of money to start investing for their retirement. This forces them to avoid risks in opening a typical investment retirement account or Roth IRA. However, almost anyone can start investing even when they have a lot less money, thanks to the dollar cost averaging tactic.

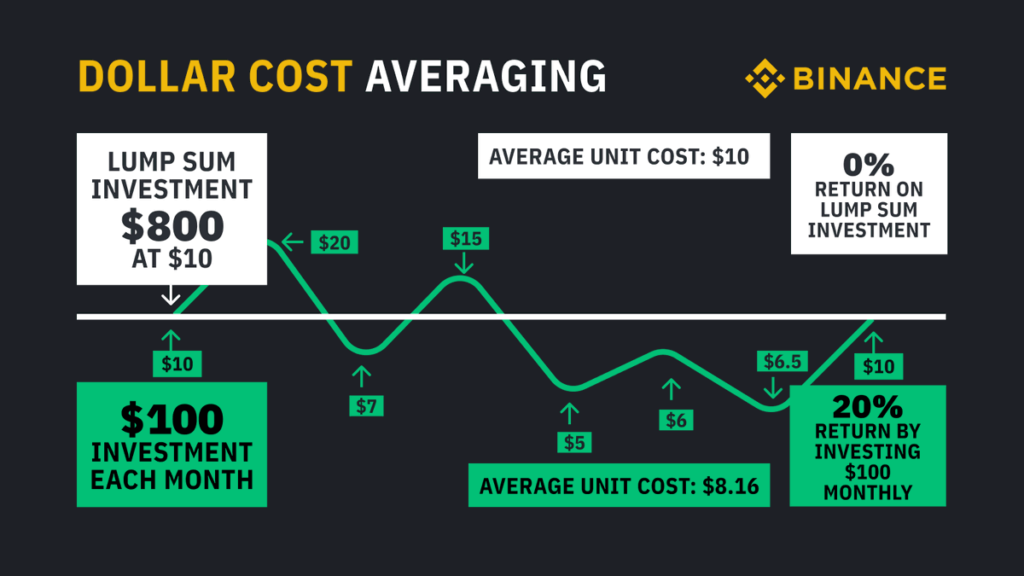

It is no secret that putting in a lump sum of money could be dangerous in the stock market. The investment might go down, and you might lose your money. That is why you need to put your money step by step. You need to make sure that your cost on that specific stock is not high. This process is called DCA, dollar cost averaging. It helps you to determine the average cost of your investments.

This tactic can lower your investing costs and reduce risk at the same time. This tactic allows you to buy shares regardless of price in smaller increments at regular periods as opposed to all at once. It can also help you cut your investing costs and increase profits over the long term.

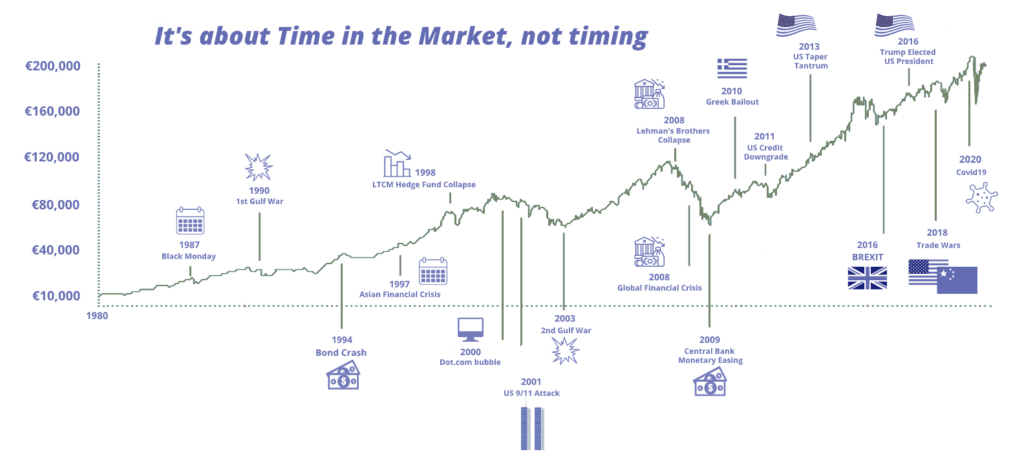

The time in the market affects your return more than trying to time the market. However, time in the market still could not play well if you put all of your money at the same time. You need to be in the market for longer times and optimize your investments.

What is Dollar Cost Averaging?

Investing can be difficult. Even seasoned investors who attempt to predict the financial markets to buy at a good time may not succeed. Dollar-cost averaging is the act of investing in an asset with a fixed amount continuously, no matter how much the asset costs at the time. By automating purchases, this method can make managing volatile markets simpler.

The approach is about managing your risk in the stock market. You can do this tactic when purchasing equities, exchange-traded funds (ETFs), or mutual funds. You divide the amount of money you want to invest into smaller, more frequent purchases. This allows you to invest in a given investment over time rather than all at once at a single purchase price. As a result, you are likely to pay too much before prices decline.

Of course, prices don’t always go in one direction. Nevertheless, by spreading out your purchase and making more purchases, you increase your probability of paying a lower average price. Additionally, dollar cost averaging enables you to consistently put your money to work. This tactic effectively does away with the need to try to time the market to buy at the best pricing.

If you are investing $100 every week, you might buy less the next week because the share price increased. Yet, you might buy more two weeks later because the share price decreased. If the market goes down continuously in a bear market, you make sure that your investments’ average cost matches the current cost of the market. You can win more once the market starts going up.

Is There a Best Time to Invest?

Whether you should invest today or wait a bit more until the market goes down is always the question. Waiting for the market to go down and trying to find the perfect spot to buy the stocks is extremely difficult. It also doesn’t work the way you expect it to work. Even if you buy at the very bottom of the market each year, you still make a maximum of 5% more profit than if you had continuously bought at the same time every week.

Many people have tried timing the market to purchase assets at low prices. In principle, this seems simple enough. Even for experienced stock pickers, predicting how the market will behave in the near future is practically difficult. The price that is low today can be high the next week. Additionally, this week’s high might seem like a relatively modest price a month from now.

Because asset prices often increase over the long run, dollar cost averaging is effective. Yet, during the short run, stock prices do not constantly increase. Instead, they chase after transient highs and lows that might not conform to any pattern. That is why there is no best time to invest. All you need to do is continuously put your money into your investments and do dollar cost averaging.

How Does Dollar Cost Averaging Work?

By consistently buying the same modest amount of an asset, dollar cost averaging removes emotion from investing. This implies that you purchase more shares at low prices and less at high prices.

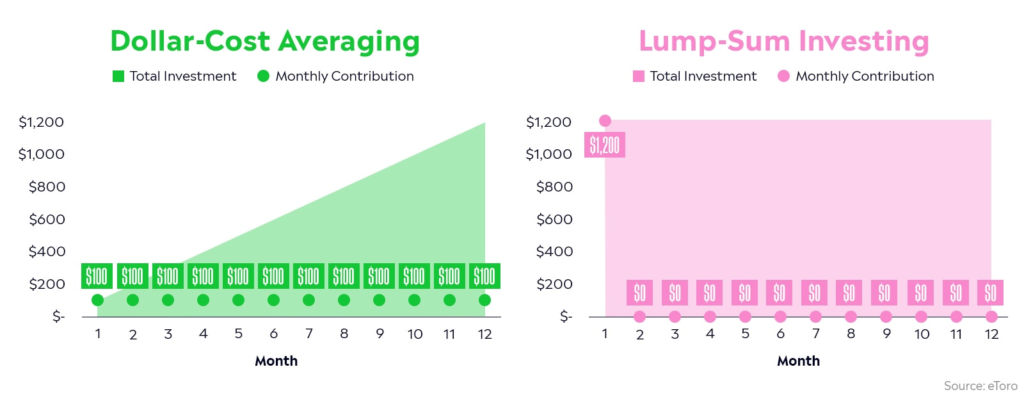

Let’s say you want to put $1,200 into a mutual fund this year. You have two options: invest your entire sum at the start or end of the year or invest $100 per month. This might not look like it would make much of a difference in which method you choose, but it does. If you stretch out your purchases over a 12-month period in $100 monthly parts, you might have more shares than you would if you bought everything at once.

If you have 500$ to invest in one stock and you do dollar cost averaging with 100$ a month, it will take you 5 months to spend the money. In that 5 months, the share price will fluctuate. You might buy 20 shares in the first month for 5$ per stock. 25 in the second one, and less or more the next month. In the end, let’s say you will end up with 135 shares, and you have a dollar cost average of $3.70. However, if you invested all that money in the first month with a 5$ average cost, you would have 100 shares and a 5$ cost on it.

You spent the same amount of money in both scenarios. Yet, you have more shares and lower costs in one of them. That’s exactly how dollar cost averaging works. It gives you more stocks and lowers costs. However, you have to note that markets fluctuate, which might not always happen. If you keep doing it over a long-term period, you will see the benefits.

Dollar Cost Averaging Is Good For Those With Less Money to Invest

Starting to invest might seem like a big deal for many because we believe that we need a lump sum of money. This might not be the case if you do dollar cost averaging. Dollar cost averaging allows you to start investing with tiny sums of money. You might not have a sizable quantity that you can invest at the same time. Dollar cost averaging allows you to continually invest smaller sums of money.

By doing this, you can take advantage of market growth without having to wait to accumulate a greater sum of money saved up. Regular investments you make with dollar cost averaging make sure you keep investing even when the market is falling. Maintaining investments amid market downturns might be scary for some people. In contrast, you run the risk of missing out on potential future gain if you decide not to invest money or sell your current holdings in bear markets.

Are There Any Risks?

Just like with everything, dollar cost averaging also comes with its risks. The hypothetical examples could show us that dollar cost averaging is almost always better than putting in a lump sum of money. Yet, this is not the case all the time.

According to studies from the Financial Planning Association and Vanguard, dollar cost averaging can perform worse than lump sum investment over extremely long periods of time. So, if you have a lot of money, it’s usually a good idea to invest it as soon as possible. Yet, if you combine high monthly investments with investing as soon as you can, you could still do a better job.

It is worth remembering that you shouldn’t accept this study’s findings at face value. You might not have much money set up, and delaying might mean you lose out on any rewards. It may be less stressful for you mentally to invest small amounts of a large sum over time rather than investing a lot of money all at once.

Additionally, dollar cost averaging nevertheless fosters financial growth. The same study by the Financial Planning Association and Vanguard also showed that investors who implemented dollar cost averaging did experience significant investment gain. Generally at a somewhat slower rate than if they had made a single large investment. Dollar-cost averaging surpassed lump sum investing 33% of the time. Dollar-cost averaging gives good returns while lowering your risk.

Benefits of Dollar Cost Averaging

Dollar cost averaging’s benefits are not just financial. There are also mental benefits to doing dollar cost averaging and helping your financial journey because financial wellness is not just having the money to invest, it is also knowing how to act with your money.

Low Risk

Dollar-cost averaging lowers the risk of investments while protecting wealth from a market meltdown. It protects your money that you invested over long periods of time. Since you have been investing for a while, you presumably bought in the lower range price before the market raised and crashed.

Dollar cost averaging overthrows lump-sum investing when the market rallies because of false market mood. When you buy a security when its price is falsely high because of market mood, you buy a lesser amount. However, when you do dollar-cost averaging, you buy several amounts in several different price ranges.

Some slumps last longer than others, further eroding the net worth of the portfolio. Using dollar cost averaging provides the least amount of loss and perhaps high profits. DCA might lessen regret by offering short-term downside protection against a sudden decline in the price of a security.

A declining market is sometimes seen as a buying opportunity and it generally is. DCA can considerably increase the potential long-term return on a portfolio when the market begins to climb.

Low Cost

The main point of dollar cost averaging is decreasing your costs on any given security. Since you buy continuously with the same amount of money at a certain time each month or year, your cost is significantly lower. If you invest a lump sum and you just ride it out, your risks are higher and potentially higher costs.

When you buy market security when prices are falling promises a larger return for the investor. By employing the DCA approach, you can buy more assets than you would have if you had bought them at a high price. One of the other drawbacks of lump-sum investing is that you can buy at the highest price and never have the chance to lower your cost.

Since you lower your cost while doing DCA, you don’t have to worry about whether the market will return back to its highs or not anytime soon. Your cost will be significantly lower than those highs. Because you were buying before, during, and after those high prices.

Habit of Investing

Dollar-cost averaging is all about creating a habit and keeping to it. You have to set a certain date when you will invest each month or year. This is the main principle of dollar cost averaging and makes it useful. While you are doing this, you create yourself a habit. Something that is extremely hard to do is to keep up with your habit of investing. Dollar-cost averaging helps you to deal with this easier.

Regularly adding funds to an investing account gives you that discipline of saving. Because the portfolio’s balance rises even while its current assets lose value. Even though you’ll generally be in a good spot over a long-term period of time, there could still be some lows. As we mentioned, markets go up and down. As a part of those ups and down, the portfolio may suffer from a protracted market collapse.

Nevertheless, the idea stays the same. Since you have a goal and try to make that investment on the date you choose, you create the habit. This habit helps you to invest regularly and make better decisions with your investment portfolio.

Better Returns

Because you are taking your time investing in the assets you choose, you are lowering the risks. When you lower the risks, it brings out several other advantages. One of those advantages is better returns than lump-sum or other types of investment styles.

To illustrate better, let’s say you start dollar-cost averaging right before the 2008 market crash. You started buying $100 worth of assets each month. You buy at high prices, and your costs are higher. When the market crashes, you keep doing the same thing and keep buying. You eventually lower your costs significantly after a certain period of time. Because your costs are low, you get better returns once the market starts recovering.

If you made a lump-sum purchase at the same time the other person started doing DCA, you’d have no chance of lowering your costs. You would have to wait years in the stock market before you can break even and start making returns. Dollar-cost averaging gives you better returns even in the short term if you stick with it.

Helps With Emotional Investing

There are many reasons about the cause of emotional investing. One of those causes is making a sizable lump-sum investment and trying to avoid losses. When you make a lump-sum investment, you have higher chances of panic selling or panic buying when the market crashes. The dollar cost average eliminates this.

Since you have a plan and a goal, you eliminate emotional investment, and you focus on the right thing. Eliminating emotions is one of the hardest things in investing. By doing dollar cost averaging, you can help yourself eliminate it. Investor can concentrate their efforts on the task at hand. The investor can cut out the media hype regarding the stock market’s near-term performance and direction. Because DCA investors are using a disciplined buying technique.