Whether in a good financial situation or not, inflation hurts everyone and knowing how to protect yourself from inflation is extremely crucial. The worst part is that inflation is not a once-in-a-lifetime problem and you always need to know these ways to protect yourself from inflation. It has been a massive problem every decade and has affected millions. Inflation is a money-eating and life-threatening phenomenon that no one likes. It becomes essentially critical with mid or low-income families. You can see when inflation will hit. However, there is nothing that you, as an individual, can do to block inflation from happening.

In addition, inflation will most likely happen more than once in your lifetime. No matter if it is big or small, it will happen. Along with it, it will bring extra economical problems like a recession.

Therefore, you must be aware of ways to protect against inflation. You might wonder what to buy to protect against inflation or the best investments to protect against inflation. There is no certain answer to any of these questions. However, I will try to show you how you can actually protect yourself from inflation. On top of that, how should you invest properly to protect your savings from crushing inflation?

What is Inflation?

To protect yourself from it, you must first understand what inflation is. You can think of inflation as increases in prices. This gradually results in lower purchasing power. Over a certain period of time, you will have less purchasing power than before. The average price of a basket of essential products shows us how far the purchasing power is declining. This is the measurement criteria of inflation. When there is inflation, a unit of currency buys less. Because there is an increase in pricing, which you see as a percentage on the documents.

The essential products we count are the requirements for a human to live a comfortable life. That’s why these human requirements go beyond one or two things. People require a variety of services for a comfortable life. Commodities like food, grains, metal, and fuel are some of those services and goods. Utilities like power, transportation, and services like labor, entertainment, and health care.

The goal of measuring inflation is to determine the effect of price changes for various goods and services. It shows a single value representation of the rise in the cost of goods and services over time in an economy.

There is also the negative version of inflation. We call this phenomenon deflation. This happens when prices fall and buying power rises. It might seem like it is something good for the economy, but deflation hurts an economy more than inflation in the long run. When the prices constantly decrease, consumers stop purchasing. They hope to get it for a lower price later on. This hurts the economy because there is no spending.

What Causes Inflation?

Generally, the cause of inflation is a rise in the supply of money. There could be a variety of economic causes for that. A nation’s money supply could increase because of several things. The money supply increases because the government and the central bank make more money available in the markets.

Demand-Pull

Inflation driven by demand is one factor. With demand-pull inflation, there is a rise in demand for products and services but not a substantial rise in supply. In the short run, firms can’t increase their output quickly enough to fulfill the demand. Prices rise as a result.

Cost-Push

In some circumstances, the reason for price increases has two reasons. Both because of an increase in production costs for firms and a rise in demand. Cost-push inflation is the problem in question. For instance, rising labor or raw materials expenses may compel businesses to raise the price of their products and services. A general price increase and higher inflation rates may result if enough businesses are impacted and raise their prices.

Devaluation

Devaluation is when a currency loses value in relation to other currencies. As a result, imports become more expensive, and inflation happens. If the value of the dollar falls versus the euro, you need more dollars to buy the same number of euros. A company may need to boost pricing if it imports items from Europe to cover the higher cost.

Rising Salaries

There are many different opinions on whether rising salaries affect inflation or not. Higher salaries may seem like a good thing for workers. However, some economists worry that there could be negative effects. This is especially true if the minimum wage is increased. Employees will have much more money to spend on goods and services if they earn more money. Businesses might boost their prices in response to increased demand.

How to Protect Yourself from Inflation?

Finding the best ways to protect against inflation is not easy. Stock market? Commodities? Cash? Every asset’s price will go down in an economic downturn with high inflation and recession. We saw house prices and the stock market going down in 2008. We also see commodities going down, and cash is always a melting asset under inflation. When there is inflation, the only thing that will not affect you from it is to have a steady or increasing cash flow all the time. This could be through your work or through your assets.

“It doesn’t make any difference what’s happened to the price level [of an asset].”

Warren Buffett

This is the best protection if you have a steady cash flow each month, and you can increase that cash flow. However, it is important to not keep that income in cash. Because inflation eats up your cash in the most brutal way without you realizing it. You need to know where to put that money and let that money work for you. In addition, you need to be willing to see that money go down a little bit. B against inflation, only commodities might perform upwards. Most asset classes will go down, depending on the type of crisis we are in.

Special Assets

The increase in stock prices is part of a high inflationary economic situation. That’s why stocks are generally the best hedge against price increases. The money supply increase I mentioned above mostly happens through putting bank credits. The financial system is the best place to put this extra money supply into the market. Nearly all modern countries and economies increase the money supply like this. That’s why a large portion of the immediate impact on prices occurs in financial assets. Because these assets’ values are in their native currencies, such as equities, their prices increases.

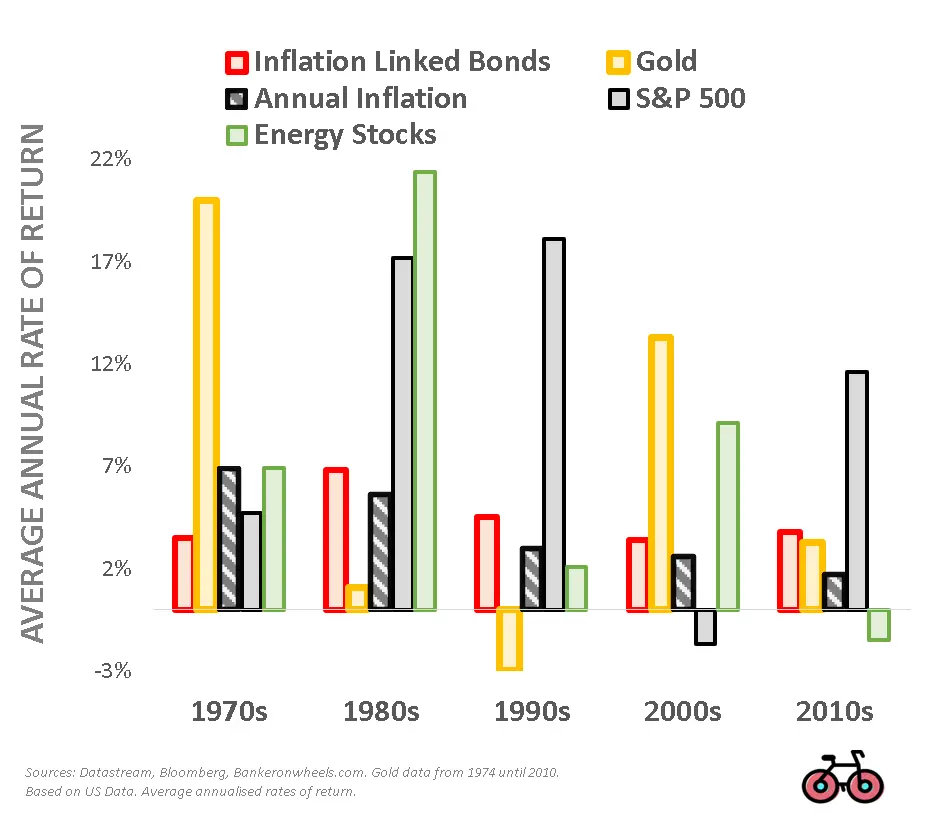

There are special financial tools available that you can use to protect investments. Treasury Inflation-Protected Securities (TIPS) is one of those assets. This is a low-risk Treasury instrument. It is indexed to inflation; that’s why it gains more or equal to inflation. With TIPS, the invested principal increases by the rate of inflation. A TIPS fund or a TIPS ETF are additional options. You will need a brokerage account to gain access to stocks, ETFs, and other investments. Even though the past doesn’t really show the best example, gold is also a hedge against inflation.

Best Investments to Protect Against Inflation

Most asset prices will go down in a high inflation economic environment. People will be willing to spend their money immediately instead of waiting since prices are rising. People will also stop investing in various assets until inflation goes down. Because there is a risk of those assets losing their value and people losing their job and income. However, generally high inflation periods offer the best time to invest and make some money in the next years.

There are two ways inflation might go after a certain period of time. Either it will explode and create hyperinflation or go down. This will make everyone relaxed and return to the normal economy. 95% of the time, the latter happens in the modern world. That is why the best way to protect against inflation is to keep investing the way you were before the inflation crisis.

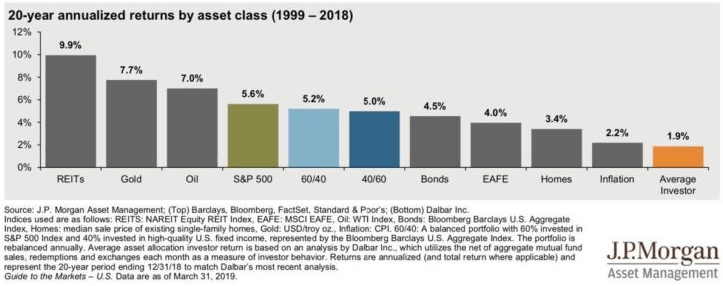

I recommend buying assets like stocks in the real estate or bank sector. Real estate might go down, but if you opt for companies with good management, you can grab some amazing deals. It helps to increase your capital in no time. Whatever happens, you need to continue to the dollar-cost average the more it goes down. Keep believing in your investments.

You can also opt for commodities like gold. Many people see it as a hedge against inflation. However, it might not provide as much as you would want to. It will not continuously go up 10% in a year (the US inflation rate is 8.9% as of June 2022). Investing in physical real estate is also tough. When there is inflation, there is also a high-interest rate. Getting a mortgage will be tough, with high-interest rates.

Gold

Many people see gold as an inflation hedge. In reality, a lot of individuals have considered gold to be an “alternative currency.” This is true, especially in nations where the national currency is depreciating. These nations use gold or other stable currencies when their own currency fails. Since it is a genuine, physical asset, gold often protects its worth.

However, gold is not the perfect inflation hedge. Central banks frequently raise interest rates in response to rising inflation as part of their monetary policy. When rates are high, yields are greater. Keeping onto an asset like gold that pays no yields is less attractive than hanging onto an asset that does.

REITs

Companies that hold and manage properties with an income stream are real estate investment trusts (REITs). When inflation rises, property values and rental revenue typically increase as well. A group of properties makes up a REIT, which distributes dividends to its investors.

Vanguard Real Estate ETF is a popular choice if you want broad exposure to real estate together with a low expense. Additionally, REITs have significant disadvantages. They have a high vulnerability to the market for other high-yield assets. Treasury assets often gain appeal as interest rates climb. The share prices of REITs may decline as a result of this withdrawal of capital.

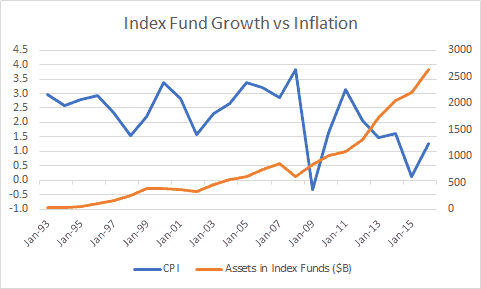

Stocks

In the long run, stocks have the greatest upside potential, even in a high inflation economy. Businesses that need minimal capital benefit from inflation. Businesses that work with natural resources are inflation losers.

The S&P 500 index has a high concentration of communication and technology companies. They represent a 35% ownership share in the Index. In theory, both technology and communication services are low-capital enterprises. That’s why they should benefit from inflation.

The S&P500 index contains the 500 largest U.S. public firms. Look into the SPDR S&P 500 ETF if you want to invest in the S&P 500. You can also use this ETF as a watchlist for potential stocks you want to invest in.

Entire Bond Market

Bloomberg Aggregate Bond Index tracks the entire U.S. bond market. The index covers government, corporate, taxable, and municipal bonds. Individual investors can choose to invest in funds that seek to mimic the performance of the index to invest in this index. The iShares Core U.S. Aggregate Bond ETF is one of many funds that follow this index (AGG). The Bloomberg U.S. Aggregate Bond Index has some drawbacks as a primary fixed-income investment.

Importance of Cash-Flow in Acting to Protect Yourself From Inflation

In general, your money will lose its value whatever you decide to do with it in a high inflation setting. People will be reluctant to invest in any asset classes. You are definitely going to lose money in the short run. That is why whatever investment you make, expect to lose its value. Apart from commodities (which could still prove to lose value realistically), few asset classes can provide a high return. However, one thing will protect your money from guaranteed inflation. Cash-flow.

“The best thing you can do is to be exceptionally good at something.”

Warren Buffett

Having cash flow without the fear of losing it is the best hedge against inflation. This cash flow could be either through your assets, your job, or your business. The best example of that could be dividend investing. If you hold companies or indexes with a history of not cutting or abolishing their dividends, you will be safe no matter what happens.