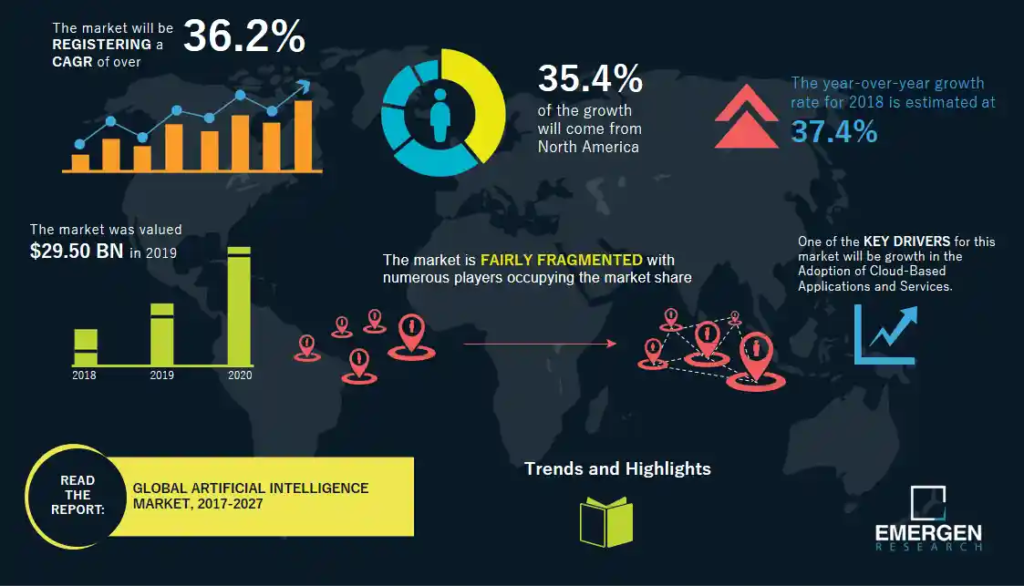

Artificial Intelligence (AI) is now one of the most transformative technologies of our time, revolutionizing industries and creating new opportunities for investors. The internet brought the first boom of our century, then real estate, then something else. Now, it looks like the latest thing is AI. Finding the best stocks in AI and Investing in AI stocks can help investors with risk appetite to catch the new stuff.

AI continues to shape our future, and it is crucial to identify the best stocks in AI to start investing in. In this blog post, we will explore the world of AI stocks and provide insights on choosing the best AI stocks for your investment portfolio.

AI and Its Effects on Stocks

The first step in understanding AI stocks is to grasp the concept itself. AI stocks are shares in companies that use AI in their products or development tools. These companies range from large tech giants to emerging startups, aiming to use AI’s power to drive innovation and growth.

To navigate the AI stock market effectively, it is crucial to be aware of the key players in the AI market. This includes established tech giants like Google, Microsoft, and IBM and emerging players such as NVIDIA and C3.ai. Understanding their market position, financial performance, and technological advancements can provide valuable insights into their potential for future growth.

It is also essential to recognize the role of AI across different industries. AI can potentially revolutionize sectors such as healthcare, finance, manufacturing, and transportation. By understanding how AI is applied in these industries, investors can identify companies at the forefront of innovation and likely to experience significant growth.

Financial data such as revenue growth, profitability, and valuation ratios are generally important, but in a developing industry, these might not be as green as you might want. Assessing the company’s management team is a solid part of the research because their expertise and track record can greatly influence the success of AI initiatives. Furthermore, analyzing the company’s AI technology, its potential for scalability, and its competitive advantage are what will bring long-term health to an AI stock.

Introduction to AI and Its Impact on the Stock Market

It is no secret that the newly emerged AI technology has immense potential to revolutionize various aspects of our world, and the stock market is one of those parts.

Understanding Artificial Intelligence (AI)

Artificial intelligence is a computer system that can perfectly perform tasks that require human intelligence. These tasks include speech recognition, decision-making, problem-solving, learning, and pattern recognition. AI can analyze large amounts of data sets, identify historical patterns, and make predictions or decisions based on that analysis.

The Growing Significance of AI in the Stock Market

The stock market is always moving, and it can change in value by numerous factors such as economic indicators, company performance, investor sentiment, and geopolitical events. AI’s potential to significantly impact the stock market by using these is extremely important.

Data Analysis and Pattern Recognition

AI algorithms excel at processing and analyzing vast amounts of data in real time. This capability allows AI systems to identify patterns, trends, and correlations that human analysts can’t identify easily. By leveraging AI, investors can better understand market trends, company performance, and investor sentiment, enabling more informed investment decisions.

Algorithmic Trading and Automation

AI-powered algorithmic trading systems have gained popularity in recent years. These systems use AI algorithms to automatically execute trades based on predefined rules or strategies. AI-driven automation can enable faster and more efficient trading, reducing human error and emotional biases. Additionally, AI-powered trading systems can quickly react to market fluctuations and execute trades at optimal times, potentially generating higher returns.

Sentiment Analysis and Predictive Analytics

We can also use AI to analyze social media posts and their sentiments, news articles, and other critical information sources to gauge investor sentiment and make predictions about market movements. Sentiment analysis algorithms can process and interpret large volumes of unstructured data, providing insights into market sentiment and potential market trends. This information can be valuable for investors in making strategic investment decisions.

Benefits and Challenges of AI in the Stock Market

Integrating AI in the stock market offers several benefits, including improved decision-making, enhanced efficiency, and increased accessibility to data-driven insights. However, it also brings certain challenges that need to be addressed.

Benefits of AI in the Stock Market

- Enhanced decision-making through advanced data analysis and pattern recognition

- Increased trading efficiency through algorithmic trading and automation

- Access to real-time insights and predictive analytics

- Improved risk management through AI-driven risk assessment models

Challenges of AI in the Stock Market

- Ethical Considerations Surrounding AI-driven decision-making and Potential Biases

- Making sure of financial data’s security and privacy.

- Potential for increased market volatility due to algorithmic trading

- Need for regulatory frameworks to address the risks associated with AI in trading

Understanding the Basics of AI Stocks

To effectively navigate the world of AI stocks, it is crucial to have a solid understanding of the basics. Everyone knows IBM, Nvidia, Intel, and so on. Where and what else should you look for, and how should you do that?

What are AI Stocks?

AI stocks are shares in companies actively involved in developing, implementing, or utilizing artificial intelligence technologies. These companies leverage AI to enhance their products, services, or operations, thereby driving innovation and growth. AI stocks can be found across various sectors, including technology, healthcare, finance, manufacturing, and more.

Investing in AI stocks allows investors to take part in the growth and profitability of AI companies leading the revolution. Investing in these stocks can provide opportunities for significant returns as long as AI continues to transform our world.

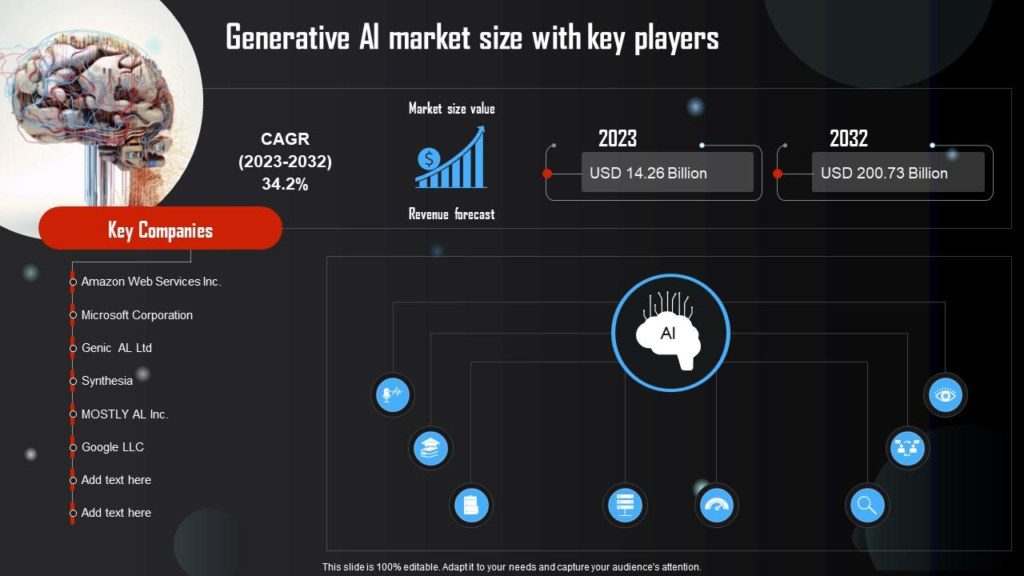

Key Players in the AI Market

The AI market is composed of a diverse range of companies, including both established tech giants and emerging startups. Understanding the key players in the AI market is essential for identifying potential investment opportunities. Here are some notable names in the AI industry.

- Microsoft

- IBM

- NVIDIA

- C3.ai

These are just a few examples of the prominent players in the AI market. It is important to stay updated on the latest developments and emerging companies in the AI space, as the landscape is continuously evolving.

The Role of AI in Different Industries

AI can improve efficiency, enhance decision-making processes, and enable innovative solutions that can impact almost all industries. Here are some industries where AI is making a significant impact.

Healthcare

We can use AI to analyze medical data, assist in diagnosing diseases, and develop personalized treatment plans. It can also help streamline administrative processes and improve patient care.

Finance

Analyzing the vast amounts of data in finance has always been time-consuming work. AI is revolutionizing the finance industry through algorithms that can analyze this data and help in investment decisions, risk assessment, fraud detection, and customer service.

Manufacturing

AI-powered robotics and automation are reducing the time and costs needed to manufacture items and increase efficiency while enhancing quality control without extra time.

Transportation

AI can create autonomous vehicles that can run on its own. This can help to optimize the traffic flow and increase efficiency in the logistics of transportation and supply chain.

Retail and E-commerce

AI is utilized in personalized marketing, demand forecasting, inventory management, and customer service, enhancing the shopping experience.

How to Evaluate AI Stocks

Evaluating AI stocks requires a comprehensive analysis that goes beyond traditional financial metrics. An investor needs to know these key factors when evaluating AI stocks, including financial metrics, company management, and the company’s AI technology and its potential.

Financial Metrics to Consider

When evaluating AI stocks, it is important to analyze the company’s financial performance to gain insights into its profitability and growth potential. Here are some key financial metrics that you must look at.

- Revenue Growth. Assess the company’s revenue growth rate over the past few years to determine if it consistently generates increasing sales. Strong revenue growth indicates a growing customer base and market demand for the company’s AI products or services.

- Profitability. Evaluate the company’s profitability through metrics such as gross and operating profit margin and net profit margin. A healthy and improving profitability indicates that the company is effectively monetizing its AI technology.

- Return on Investment (ROI). Examine the company’s return on investment metrics, such as return on assets (ROA) and return on equity (ROE). These metrics measure the company’s ability to generate returns for its investors, reflecting its efficiency in utilizing its assets and equity.

- Cash Flow. Analyze the company’s cash flow statements to understand how much cash it generates and manage its operations effectively. Positive and increasing cash flows are essential for sustaining growth and funding further AI research and development.

- Valuation Ratios. Consider valuation ratios such as price-to-earnings (P/E) ratio, price-to-sales (P/S) ratio, and price-to-book (P/B) ratio. These ratios provide insights into how the company’s stock price compares to its earnings, sales, and book value. It is important to compare these ratios with industry benchmarks to assess whether the stock is overvalued or undervalued.

The Importance of Company Management

Without effective management, any company will suffer. This becomes particularly important in the rapidly evolving AI industry. When evaluating AI stocks, consider the following factors related to company management.

- Leadership Expertise. Assess the management team’s experience and expertise in AI technology, as well as their track record of successfully implementing AI strategies. A strong and visionary leadership team is important to drive crucial AI innovation and maximize the potential of AI initiatives.

- Research and Development (R&D) Investment. Investigate the company’s investment in AI research and development. Companies that spend resources on R&D demonstrate a strong will to stay at the forefront of AI advancements.

- Partnerships and Collaborations. Evaluate the company’s partnerships and collaborations with other AI companies, research institutions, or industry leaders. These partnerships can enhance the company’s access to talent, technology, and market opportunities.

- Intellectual Property (IP) Portfolio. Assess the company’s IP portfolio, including patents and proprietary technology. A strong IP portfolio can provide a competitive advantage and protect the company’s AI innovations from potential infringement.

Consideration of the Company’s AI Technology and its Potential

The quality and potential of the company’s AI technology are critical factors to evaluate when considering AI stocks. Here are some key points to consider.

- AI Capabilities. Evaluate the company’s AI capabilities and the uniqueness of its AI technology. Consider factors such as the AI algorithms they use, how accurate and efficient those AI models are, and the scalability and adaptability of their AI solutions.

- Competitive Advantage. Assess whether the company has a competitive advantage in the AI market. This could be proprietary algorithms, unique datasets, or specialized expertise that differentiates it from competitors.

- Market Potential. Consider the market potential for the company’s AI products or services. Assess the size of the target market, the demand for AI solutions in that market, and the company’s ability to capture a significant market share.

- Long-Term Growth Opportunities. Evaluate the company’s potential for long-term growth by considering its AI technology roadmap, expansion plans, and ability to adapt to evolving AI trends and market demands.

Top and Best Stocks in AI to Invest

Now, you know what to look for when determining the best stocks in AI and choosing which AI stocks to invest in. There are already players in the market that have caught people’s attention, either the leading ones that are mountains or the mid-sized or smaller ones that are up and coming.

Here are stocks from each size that you can invest in. Please note that this is not investment advice, and you must research before investing your money.

Leading AI Companies and their Stocks

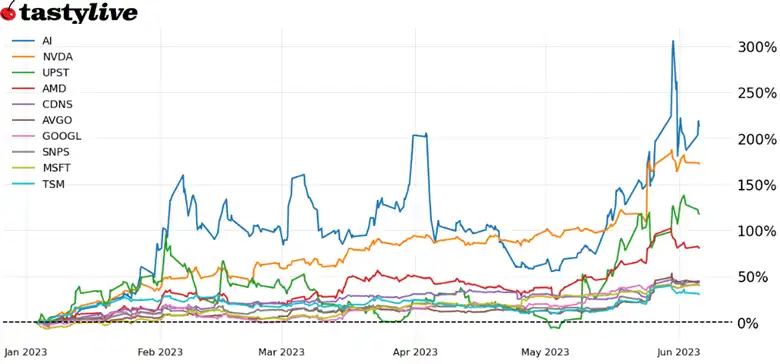

- Alphabet Inc. (GOOGL) (+55.23% in 2023). Google’s parent company, Alphabet, is a dominant force in the AI industry. With its advanced AI technologies, including Google Assistant and the DeepMind project, Alphabet continues to drive innovation and leverage AI across various sectors.

- Microsoft Corporation (MSFT) (+54.70% in 2023). Microsoft has invested significantly in AI, with its AI platform Azure Machine Learning and AI-powered products like Cortana. Microsoft’s strong presence in cloud computing and enterprise software positions it as a key player in the AI market.

- International Business Machines Corporation (IBM) (+13.07% in 2023). IBM’s AI platform, Watson, is recognized for its cognitive computing capabilities. IBM’s expertise in AI has been applied in industries such as healthcare, finance, and customer service. The company’s commitment to AI research and development makes it a noteworthy contender in the AI market.

- NVIDIA Corporation (NVDA) (+236.09% in 2023). NVIDIA specializes in graphics processing units (GPUs), essential for AI applications requiring parallel processing. Their GPUs are widely used in AI research, autonomous vehicles, and data centers. As the demand for AI accelerates, NVIDIA is well-positioned to benefit from this growth.

- Amazon.com, Inc. (AMZN) (+77.25% in 2023). Amazon has integrated AI into various aspects of its business, including its e-commerce platform, cloud services (Amazon Web Services), and voice assistant, Alexa. With its vast customer base and commitment to AI-driven innovation, Amazon remains a prominent player in the AI landscape.

Emerging AI Companies and Their Potential

- C3.ai (AI). C3.ai is an AI software company that provides enterprise AI solutions across industries. With its platform’s ability to rapidly build and deploy AI applications, C3.ai has gained attention for its potential to drive AI adoption and generate significant growth.

- Palantir Technologies Inc. (PLTR). Palantir is a data analytics company specializing in AI-driven solutions for government agencies and commercial clients. Its software platforms enable organizations to analyze and interpret large datasets, making it a promising player in the AI market.

- Snowflake Inc. (SNOW). Snowflake is a cloud-based data warehousing company that leverages AI to help organizations manage and analyze their data efficiently. With its innovative approach to data management and scalability, Snowflake has the potential to benefit from the increasing demand for AI-driven data solutions.

- UiPath Inc. (PATH). UiPath is a robotic process automation (RPA) tool that utilizes AI to automate repetitive business tasks. As AI adoption continues to grow, UiPath’s AI-powered automation solutions are in high demand, positioning the company for potential future growth.

AI Stocks with Strong Growth Potential

Apart from the established and emerging players, there are other AI stocks with strong growth potential that investors may consider.

- Salesforce.com, Inc. (CRM). This company is essentially a customer relationship management (CRM) tool that has integrated AI capabilities into its platform. With its AI-powered solutions, such as Salesforce Einstein, the company is well-positioned to take profit from the growing demand for AI-driven CRM solutions.

- Twilio Inc. (TWLO). Twilio is a cloud communications platform that can help businesses integrate messaging, voice, and video capabilities into their applications. With its AI-powered solutions, Twilio has the potential to benefit from the increasing adoption of AI-driven communication technologies.

- ServiceNow, Inc. (NOW). ServiceNow is an IT service management company that utilizes AI to automate and streamline various IT processes. As organizations increasingly adopt AI technologies to enhance their IT operations, ServiceNow’s AI capabilities position them for potential growth.

Investors should conduct thorough research and consider their investment goals, their willingness to take risks, and loss tolerance before investing in any AI stocks. It is also important to stay updated on the latest developments in the AI industry and monitor the performance of the selected AI stocks.