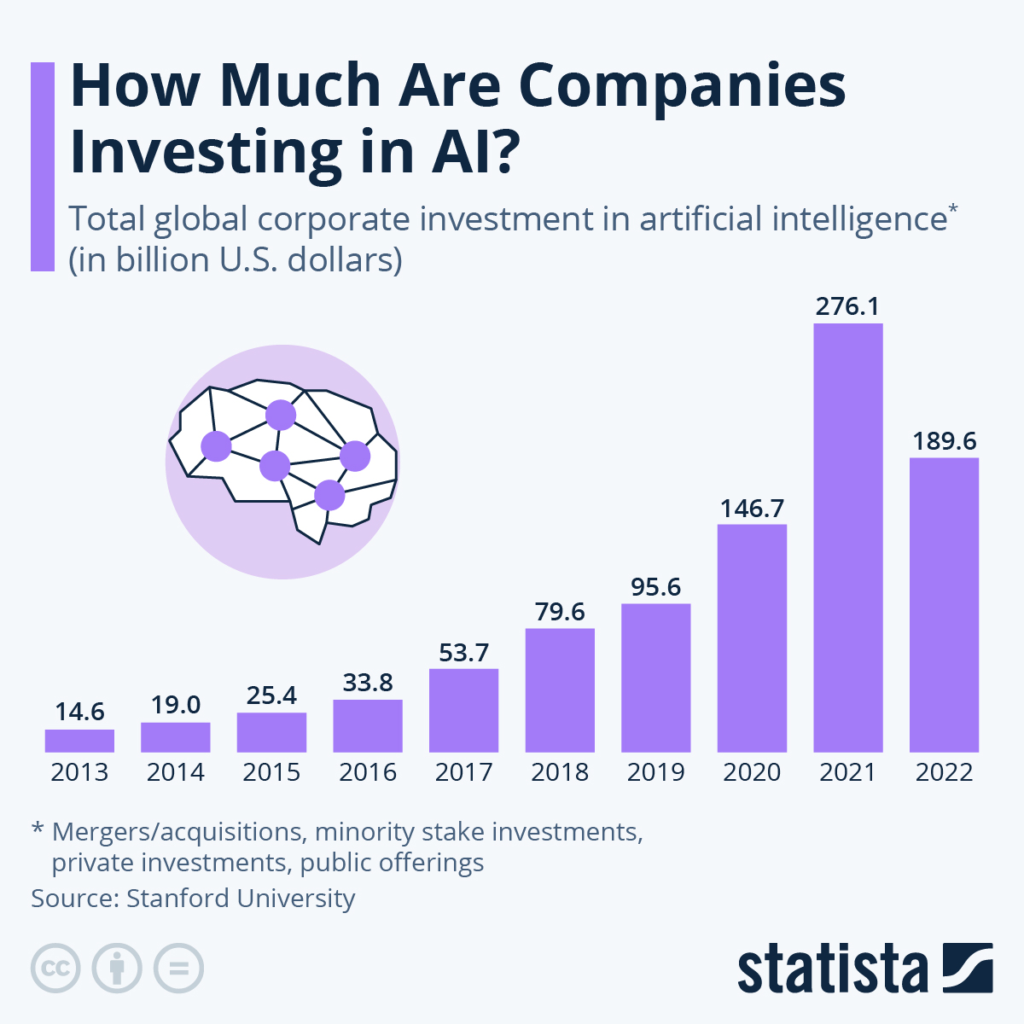

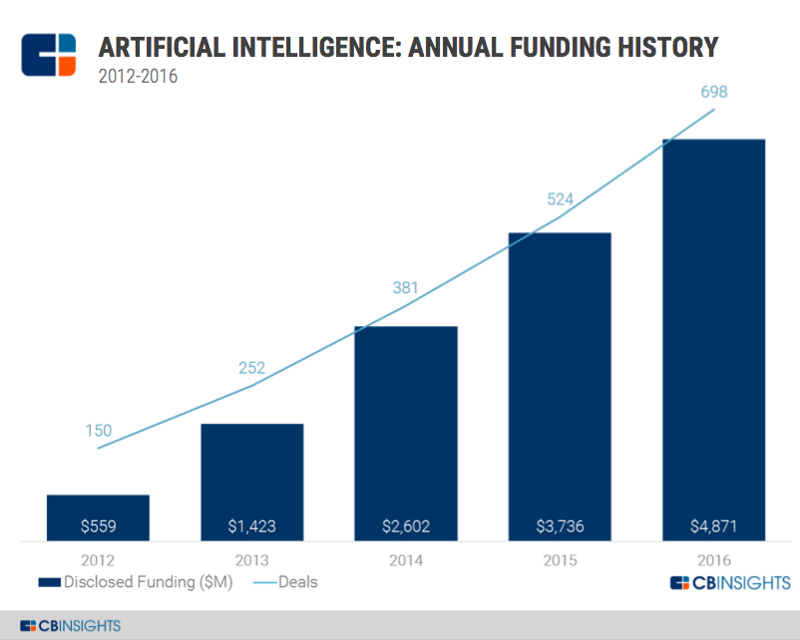

Artificial intelligence (AI) has been getting into our lives more lately with significant advancements. One of the crucial parts is using AI in investing, so everyone has been wondering how to use AI in investing. With its ability to process large amounts of data, analyze complex patterns, and make predictions, AI has become an invaluable tool for investors looking to enhance their strategies and maximize their returns.

In this blog post, we take a look at the basics of how AI can influence investing and guide you through incorporating AI into your investment strategy. We will discuss why using AI is becoming essential in investing and the tools and resources required to implement AI effectively.

How AI Can Influence Investing

Artificial intelligence (AI) can revolutionize the investing world thanks to its ability to provide investors with powerful tools and insights that weren’t there before. If you want to use AI in investing, you first need to understand AI’s role and influence on investing.

The Role of AI in Investing

AI essentially means developing computer systems that can perform delicate and detailed tasks that typically require intense human intelligence. When applied to investing, AI can analyze large sets of data, identify specific patterns and trends, and make predictions based on historical data and complex algorithms. This ability to process and interpret data rapidly gives AI a significant advantage in making informed investment decisions.

Advantages of Using AI in Investing

- Data Processing

- Pattern Recognition

- Speed and Efficiency

- Emotionless Decision-Making

Applications of AI in Investing

AI is being used in various ways to enhance investment strategies and decision-making processes. These applications that use AI aim to make the process of finding the right investments more streamlined and effective.

- Portfolio Optimization. AI algorithms have the ability to analyze all the historical data and optimize your portfolio by identifying the optimal asset allocations based on risk tolerance, return objectives, and market conditions.

- Risk Assessment. AI can assess investment risks by analyzing historical market data, identifying potential risks, and providing risk management strategies to minimize potential losses.

- Trading Algorithms. AI-supported algorithms can execute trades based on predefined criteria, such as price movements, volume, or market indicators. These algorithms can operate 24/7, taking advantage of market opportunities in real-time.

- Sentiment Analysis. Social media sentiment, news articles, and other textual data are important in determining the market’s present and future sentiment. AI can analyze this to gauge market sentiment and identify potential market trends or shifts in investor sentiment.

- Fraud Detection. AI can help detect fraudulent activities in financial markets by analyzing patterns and anomalies in trading data, flagging suspicious transactions, and reducing the risk of financial fraud.

How to Incorporate AI in Your Investing Strategy

Incorporating AI into your investing strategy can be a game-changer. You can make better-informed decisions and achieve better investment outcomes. That’s why you have to learn why using AI is becoming essential in investing, the tools and resources required for AI investing, and the steps to implement AI in your investing process.

Why Using AI is Becoming Essential in Investing

- Data Complexity. The financial markets generate an enormous amount of data, including price movements, economic indicators, news, and social media sentiment. AI can effectively process and analyze this complex data to identify patterns and trends that may go unnoticed by human investors.

- Speed and Efficiency. AI processes and analyzes huge chunks of data in real-time, enabling investors to make faster and more timely decisions. In today’s fast-paced markets, speed and efficiency can be crucial in capitalizing on investment opportunities and minimizing potential losses.

- Enhanced Decision-Making. By leveraging AI, investors can access powerful tools that provide objective and data-driven insights. AI can help identify potential risks, optimize portfolio allocation, and generate investment recommendations, ultimately enhancing decision-making capabilities.

- Predictive Capabilities. AI uses all the available historical data to make future predictions and identify investment opportunities. These predictive capabilities can help investors stay ahead of the curve and identify lucrative investment prospects.

Tools and Resources Required for AI Investing

- Data Sources. You need access to high-quality and diverse data sources to incorporate AI into your investing strategy. This may include financial market data, economic indicators, company financial statements, news articles, and social media data. Reliable data providers and platforms are essential for obtaining accurate and comprehensive data.

- Machine Learning and AI Algorithms. Machine learning makes AI, and AI’s help in investing. This ML algorithm learns from the past to identify patterns and make predictions. You can use different ML techniques, such as regression analysis, decision trees, neural networks, and support vector machines, to develop AI models for investing.

- Computing Power. AI systems need significant computing power to process and analyze large datasets. High-performance computers or cloud-based computing services can provide the necessary computational resources for AI investing.

- Data Preprocessing and Cleaning Tools. Before feeding data into AI algorithms, it is crucial to preprocess and clean the data to ensure its quality and eliminate any biases or errors. Data preprocessing tools like data cleaning software and feature selection algorithms can help streamline this process.

- Backtesting and Simulation Tools. This method allows investors to evaluate the performance of their investment strategies using historical data. Simulation tools enable investors to test their chosen strategies in a simulated environment before using real money. Simulation and backtesting can help assess the effectiveness of AI-based investment strategies.

Steps to Implement AI in Your Investing Process

- Define Your Investment Goals. Start by clearly defining your investment objectives, risk tolerance, and time horizon. This will guide the development of your AI investing strategy.

- Identify Suitable AI Techniques. Research and identify the AI techniques that align with your investment goals. Consider factors such as the complexity of your investment strategy, data availability, and technical expertise.

- Data Collection and Preparation. Collect relevant data from reliable sources and preprocess it to ensure its quality and compatibility with AI algorithms. This may involve cleaning and transforming the data and selecting appropriate features.

- Develop AI Models. Utilize machine learning algorithms and techniques to develop AI models that can analyze and interpret the collected data. Train your models using historical data and refine them through iterative processes.

- Test and Evaluate. Perform rigorous testing and evaluation of your AI models using backtesting and simulation tools. Assess their performance against historical data and fine-tune the models as needed.

- Implement and Monitor. Once you are satisfied with the performance of your AI models, implement them in your investing process. Keep monitoring their performance and make necessary adjustments as market conditions evolve.

How to Use AI to Analyze Market Trends

Analyzing market trends, whether with or without AI, is important for investing, as it helps investors identify patterns, understand market dynamics, and make informed decisions. With the power of AI, analyzing market trends can be taken to a whole new level.

Having a general understanding of the importance of market trend analysis, AI tools for market trend analysis, and how to apply AI analysis to your investment decisions can be a game changer.

Understanding the Importance of Market Trend Analysis

- Identifying Opportunities. Market trend analysis allows investors to identify potential investment opportunities by spotting emerging trends, market cycles, and shifts in investor sentiment. When investors understand the market’s direction, they can position their investments strategically to capitalize on these opportunities.

- Risk Management. Analyzing market trends helps investors assess and manage risks associated with their investments. By monitoring trends, investors can identify potential market downturns, volatility, or changes in sector performance, allowing them to adjust their portfolios and mitigate potential losses.

- Timing Investment Decisions. Market trend analysis provides valuable insights into the timing of investment decisions. Investors can choose the most optimal option by understanding whether the market is in an uptrend, downtrend, or consolidation phase.

- Market Sentiment. Analyzing market trends helps gauge market sentiment, which has a massive role in driving market movements. By understanding the market sentiment, investors can understand the market dynamics to make better investment decisions.

AI Tools for Market Trend Analysis

- Machine Learning Algorithms. AI utilizes various machine learning algorithms. Some of these include neural networks, vector machines, and random forests, to analyze market trends. These algorithms process the available historical data to identify patterns and make predictions for potential market movements.

- Natural Language Processing (NLP). With NLP, AI can analyze and interpret textual data, such as news articles, social media posts, and financial reports. AI can provide insights into market trends and investor sentiment with this information.

- Pattern Recognition. AI tools excel at identifying complex patterns and correlations in market data. By analyzing historical price data, volume, and other market indicators, AI can identify recurring patterns, such as support and resistance levels, trend reversals, or chart patterns, assisting in trend analysis.

- Data Visualization. AI tools can generate visualizations, such as charts, graphs, and heat maps, to represent market trends visually. These visual representations allow investors to invest wisely with more informed decisions.

Applying AI Analysis to Your Investment Decisions

Data Collection

Gather relevant market data from reliable sources, including historical price data, economic indicators, news articles, and social media sentiment. Ensure the data is comprehensive, accurate, and up to date.

Preprocessing and Feature Engineering

Clean and preprocess the collected data, removing any outliers or errors. Perform feature engineering to extract meaningful features that will be used by AI algorithms for trend analysis.

Training AI Models

Utilize machine learning algorithms to train AI models using historical market data. The models will learn from patterns and trends in the data, enabling them to make predictions about future market movements.

Monitoring and Validation

Keep a close eye on the performance of AI models and validate their predictions against real-time market data. See if the accuracy is correct and the models are reliable to make adjustments as necessary.

Integration with Investment Strategy

Incorporate the insights provided by AI analysis into your investment strategy. Consider the predictions and trends identified by AI when making investment decisions, but also factor in other fundamental and technical analysis tools to ensure a holistic approach.

How to Use AI to Predict Future Investment Opportunities

Predicting future investment opportunities is a key goal for investors, as it allows them to proactively identify potential profitable investments. AI’s help allows these investors to analyze the data more thoroughly and make more accurate predictions.

The Role of AI in Forecasting Investment Opportunities

- Analyzing Historical Data. AI algorithms analyze all of the available historical market data, including price movements, volume, economic indicators, and company financials. With this, AI can identify patterns and relationships in this data to make predictions about future market trends and investment opportunities.

- Complex Data Analysis. Just as AI can analyze historical data, it can also analyze complex data and identify intricate relationships that may not be apparent to human investors. That way, it can uncover hidden patterns and factors that can impact investment opportunities.

- Real-Time Analysis. AI can analyze real-time market data and news to understand potential trends and lucrative investment opportunities. This way, investors can stay ahead of the curve and act quickly on market developments.

How to Use AI Predictions in Your Investment Strategy

- Combine AI with Fundamental Analysis. While AI can provide valuable predictions, it is important to mix these insights together with fundamental analysis. Factors such as company financials, industry trends, and market conditions help to better define your strategy.

- Diversify Your Portfolio. Use AI predictions to identify the most optimal diversification based on your investment minds across various sectors and asset classes. Diversification can lower the risk potential and maximize returns.

- Risk Management. AI predictions can assist in identifying potential risks and market downturns. Use risk management strategies even if you are using AI to protect your investments.

- Continuous Monitoring. Keep monitoring the AI models’ performance and validate their predictions against real-time data. Don’t be afraid to change your investment strategy based on new information and evolving market conditions.

How to Maintain and Update Your AI Investing Tools

Maintaining and updating your AI investing tools is crucial to ensure their effectiveness and accuracy over time.

Software Updates

- Stay Current with Technology. AI technology is continuously evolving, and new advancements are made regularly. It is important to stay updated with the latest software updates, bug fixes, and new features to ensure that your AI investing tools are utilizing the most advanced algorithms and techniques.

- Performance Enhancements. Software updates often include performance enhancements that can improve the speed, accuracy, and functionality of your AI tools. You can take advantage of these improvements and optimize your investing strategy by keeping your tools up to date.

- Address Security Vulnerabilities. Software updates also address security vulnerabilities that may have been discovered since the release of the previous version. By promptly installing updates, you can protect your AI tools and data from potential threats and security breaches.

The Importance of Data in AI Investing

- High-Quality Data. The quality of data used in AI investing is crucial for accurate predictions and analysis. Ensure that your data sources are reliable, accurate, and up to date. Validate and preprocess the data to remove any errors or inconsistencies that may impact the performance of your AI models.

- Data Diversity. Incorporate diverse data sources to capture a comprehensive view of the market. By including various types of data, such as financial statements, economic indicators, news articles, and social media sentiment, you can improve the accuracy and robustness of your AI models.

- Data Cleaning and Preprocessing. Properly clean and preprocess your data to eliminate outliers, handle missing values, and normalize the data. This ensures that your AI models are trained on high-quality and consistent data, leading to more reliable predictions.

Conclusion

The future of AI in investing is undeniably promising. As AI continues to evolve and change, it is becoming more essential for investors looking to make more informed decisions and money.

AI is revolutionizing the world of investing by providing powerful tools and insights that were previously unavailable. By understanding the basics of AI, incorporating it into your investment strategy, and utilizing its capabilities to analyze market trends and predict future opportunities, you can optimize your investing endeavors.

As the field of AI continues to evolve, we can expect further advancements and innovations in AI investing. Investors must always keep themselves informed, adapt to new technologies, and continue to refine their AI strategies. By embracing the potential of AI in investing, you can position yourself for success in the dynamic and ever-changing financial landscape.