Whether you’re an experienced or a beginner investor, “How do I diversify my portfolio?” is a crucial question for any investor aiming for financial stability and growth. Simply put, diversifying your portfolio is investing across different asset classes, industries, and geographic regions like different countries to reduce the overall risk and potentially increase returns.

Diving into portfolio diversification unveils a fundamental strategy that can manage risk and bolster returns over time. This comprehensive portfolio diversification guide breaks down the essentials of diversification, offering insights on why it matters, strategies across asset classes, geographical regions, and industries, and tips to maintain a well-balanced portfolio.

By the end of this blog post, you will have a solid understanding of portfolio diversification and the various strategies you can employ to build a well-diversified investment portfolio.

Understanding Portfolio Diversification: Why It’s Essential

Portfolio diversification is a fundamental concept in the world of investing. It refers to the strategy of spreading your portfolio investments to a variety of assets to reduce the risk of massive losses with a single investment impacting your overall portfolio. Diversification is based on the premise that different assets perform differently under various market conditions. By learning how do I diversify my portfolio, you are essentially creating a safety net for your investments.

There are several key reasons why learning how do I diversify my portfolio and learning portfolio diversification is essential:

Risk Reduction

One of the primary goals of diversification is to minimize risk. When you invest in a variety of assets that are not perfectly correlated, you can average the impact of a bad investment on your overall portfolio. For example, if you have invested heavily in Microsoft, essentially just one stock, and Microsoft experiences financial difficulties or a significant drop in stock price, you could lose all your money. However, if you had diversified your holdings across multiple stocks and other asset classes, the potential loss from one investment would be offset by gains in others.

Protection Against Volatility

Financial markets are inherently volatile, and asset prices can fluctuate significantly over time. Diversification can protect your portfolio from the short-term ups and downs of the market. Different asset classes generally perform differently in various economic conditions. For example, when stocks are going down, bonds might be going up due to high interest rates. By having multiple asset classes, you can reduce the volatility of your portfolio.

Potential for Higher Returns

While the primary objective of diversification is risk reduction, it can also lead to the potential for higher returns. By spreading your investments across different assets, you are more likely to have higher positive returns from various sources. For instance, if one sector or industry is performing poorly, other sectors may be thriving, thus balancing out your portfolio’s overall returns. You can take a piece of all the pies in the market by diversification.

Preservation of Capital

Preserving your capital is a crucial aspect of long-term investing. Diversification helps protect your investment capital by reducing the risk of significant losses. This strategy can be particularly important during market downturns or economic crises when certain sectors or industries may experience significant declines. It allows you to preserve your main capital and help mitigate the impact of such events on your portfolio and preserve your capital.

Flexibility and Adaptability

Diversifying your portfolio provides you with the flexibility and adaptability to navigate changing market conditions. By having exposure to a range of assets, you can adjust your portfolio as needed to take advantage of emerging investment opportunities or to manage risk. This flexibility allows you to align your portfolio with your investment goals and adapt to evolving market trends.

Different Ways to Diversify Your Portfolio

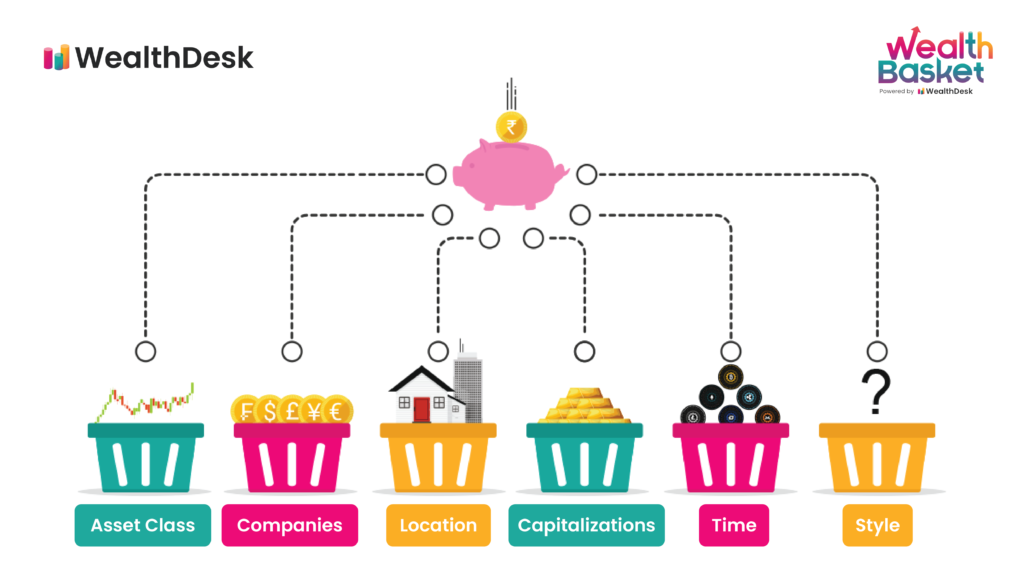

Learning how to diversify your portfolio involves more than just spreading your investments across different assets. It also requires considering various factors such as asset classes, industries, geographic regions, and even time.

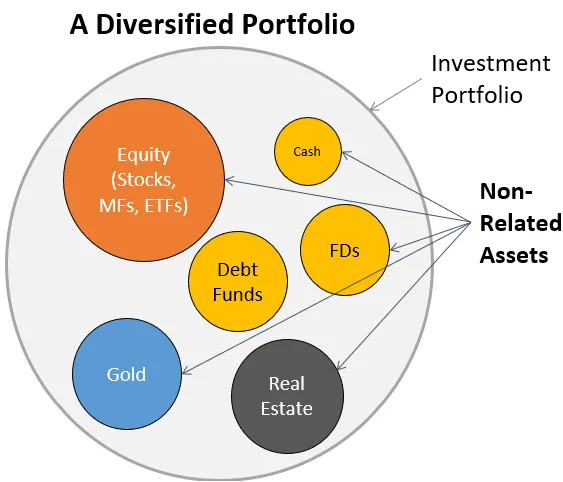

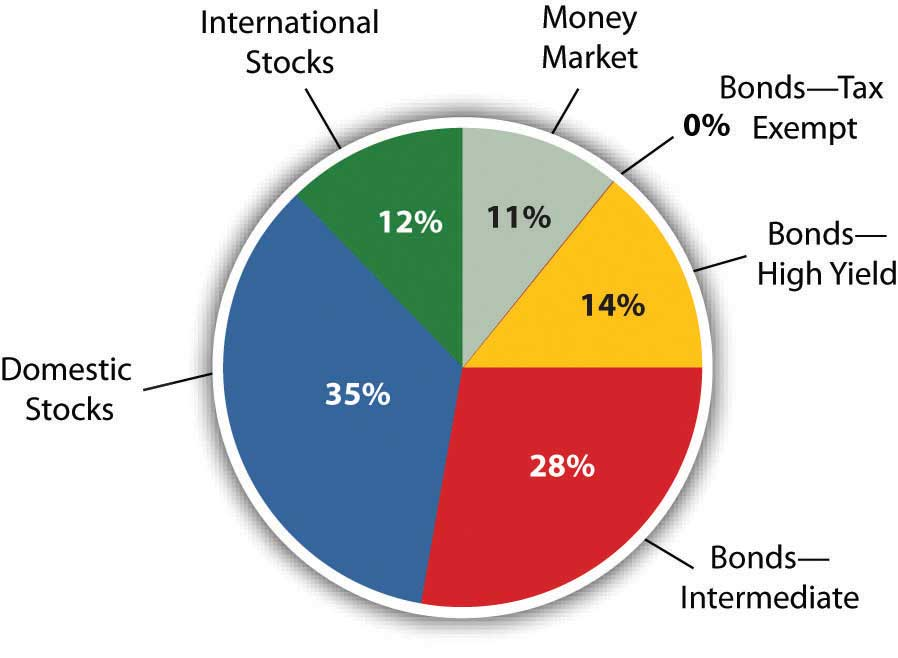

Diversification Across Asset Classes

One of the fundamental ways to diversify your portfolio is by allocating your investments across different asset classes. Asset classes include stocks, bonds, cash equivalents, real estate, and commodities. Each investment asset class has a different risk level and can have different return characteristics. When you invest in a combination of these classes, you can extremely reduce one asset’s bad performance and affect your overall portfolio.

For example, during periods of economic expansion and stock market growth, stocks tend to perform well. However, during economic downturns or periods of market volatility, bonds, and cash equivalents may provide more stability.

Diversification Across Industries

Investing in a wide range of industries is another effective way to diversify your portfolio. Different industries perform differently at various stages of the economic cycle. For instance, technology companies may experience rapid growth during periods of innovation, while consumer staples companies tend to be more stable and less affected by economic fluctuations.

By diversifying across industries, you reduce the risk of being heavily concentrated in a single sector. This approach allows you to take advantage of the growth of the potential of multiple industries and can help protect your investment portfolio from the impact of industry-specific risks.

Diversification Across Geographic Regions

Geographic diversification involves investing in different countries, continents, and regions around the world. It helps reduce the risk associated with localized events such as political instability, regulatory changes, or economic downturns in a specific country or region.

Investing internationally provides exposure to different economies, currencies, and market dynamics. For example, if your portfolio is heavily concentrated in the United States and the US market experiences a downturn, having investments in other regions, such as Europe or Asia, can help offset potential losses.

Diversification Through Time (Dollar Cost Averaging)

Diversification through time, also known as dollar-cost averaging (DCA), is a long-term strategy. This strategy basically involves investing a certain amount of money at regular intervals, regardless of market conditions. Dollar-cost averaging reduces short-term market fluctuation impact on your portfolio and is quite a common method.

When the market is experiencing volatility, dollar-cost averaging allows for more purchases when prices are low and fewer shares when prices are high. Over time, this strategy can help smooth out the overall purchase price of your investments and reduce the risk of poor investment results based on short-term market movements.

Diversification Within Each Asset Class

Diversifying within each asset class is equally important. For example, within the stock market, whether local or international stock market, you can diversify by investing in companies of different sizes (small-cap, mid-cap, large-cap), different sectors (technology, healthcare, finance), and even different regions.

Similarly, within the bond market, you can diversify by buying bonds that have different maturities, credit ratings, and issuers. By diversifying within each asset class, you can further reduce risk and potentially capture the benefits of different investment opportunities.

How to Diversify Within Each Asset Class

Learning how to diversify your portfolio within each asset class is crucial for optimal risk management and potential returns. When you learn how to diversify your portfolio through different asset classes, you can reduce the risk by a lot. This is because asset classes are generally the type that allows for the highest return if you do it correctly.

Diversifying Among Stocks

When learnin how to diversify your portfolio within the stock market, it’s important to consider factors such as company size, sector, and geographic location. Here are some strategies to diversify your stock holdings:

- Invest in Different Sectors: Allocate your investments across various sectors. These may include technology, healthcare, finance, consumer goods, energy, or others. This way, you reduce your risk of being overly exposed to a single sector’s performance.

- Consider Different Company Sizes: Invest in stocks of companies with different market capitalizations, including large-cap, mid-cap, and small-cap stocks. Each size category may have different risk and return characteristics, providing diversification benefits.

- Geographic Diversification: Consider investing in stocks of companies located in different countries or regions. This provides exposure to different economies, regulatory environments, and market conditions. You can achieve geographic diversification through global or international funds.

- A blend of Growth and Value Stocks: You can also choose to balance your investment portfolio with a mix of growth stocks (companies experiencing rapid growth) and value stocks (companies considered undervalued). This combination can help capture different market trends and potentially enhance returns.

Diversifying Among Bonds

Diversification within the bond market involves considering factors such as bond type, duration, credit quality, and issuer. Here are some strategies for diversifying your bond holdings:

- Invest in Different Bond Types: Allocate your bond investments across various types, such as government bonds, corporate bonds, municipal bonds, and international bonds. Each bond type carries different risks and returns, providing diversification.

- Consider Different Bond Durations: Invest in bonds with varying maturities, including short-term, intermediate-term, and long-term bonds. Different durations have different sensitivities to interest rate changes, allowing you to manage interest rate risk in your portfolio.

- Diversify Credit Quality: Invest in bonds with different credit ratings, ranging from high-quality investment-grade bonds to lower-rated, higher-yield bonds. Diversifying credit quality helps manage credit risk and potential defaults.

- Issuer Diversification: Spread your bond investments across different issuers, including governments, corporations, and municipalities. This reduces the risk associated with any single issuer’s financial health or creditworthiness.

Diversifying Among Mutual Funds and ETFs

Mutual funds and exchange-traded funds (ETFs) aim to offer a lot of diversification within a single investment vehicle. They generally charge you a small fee for managing that ETF or fund, but they are extremely easy to manage. You don’t manage investments one by one. The managers do all the work. Here are some strategies for diversifying your investments within mutual funds and ETFs:

- Asset Class Allocation: Choose mutual funds or ETFs that invest in different asset classes, such as stocks, bonds, real estate, or commodities. This way, you diversify your investments across multiple asset classes within a single fund.

- Fund Manager and Strategy: Consider investing in funds managed by different fund managers or with different investment strategies. This helps diversify your exposure to different investment approaches and decision-making processes.

- Geographic and Sector Focus: Select funds that focus on different geographic regions or sectors. This provides diversification across different markets and industries.

- Expense Ratio and Fund Size: Evaluate the expense ratios and fund sizes of mutual funds and ETFs. Lower expense ratios and larger fund sizes can indicate better cost efficiency and liquidity, respectively.

Diversifying Among Real Estate Investments

Diversifying real estate investments involves considering different types of properties, locations, and investment strategies. Here are some strategies for diversifying your real estate holdings:

- Property Types: Invest in different types of real estate properties, such as residential, commercial, industrial, or mixed-use properties. Each type has different risk and return profiles, providing diversification benefits.

- Geographic Diversification: Allocate your real estate investments across different locations, including different cities, regions, or even countries. This helps reduce the risk associated with localized economic factors or real estate market fluctuations.

- Investment Strategies: Consider different real estate investment strategies, such as direct ownership, real estate investment trusts (REITs), or real estate crowdfunding platforms. Each strategy offers unique benefits and diversification opportunities.

- Risk Profiles: Evaluate the risk profiles of real estate investments, such as core, value-add, or opportunistic strategies. Diversifying across different risk profiles can help balance your real estate portfolio.

Maintaining and Rebalancing Your Diversified Portfolio

Once you have established a diversified portfolio, it is important to maintain and rebalance it regularly. The goal here is to make sure that your portfolio stays in line with your investment goals and risk tolerance.

How Often Should You Rebalance?

Rebalancing refers to the process of adjusting your portfolio’s asset allocation back to its original target allocation. The frequency of rebalancing depends on your investment strategy, risk tolerance, and market conditions. Here are a few factors to consider:

- Time Horizon and Risk Tolerance: If you have a longer time horizon like for decades aiming for retirement and can tolerate more risk, you may rebalance less frequently, such as on an annual or biennial basis. However, if you have a shorter time horizon or prefer a more conservative approach, more frequent rebalancing, such as semi-annually or quarterly, may be appropriate.

- Threshold Approach: Some investors choose to rebalance only when their portfolio’s asset allocation deviates from the target allocation by a certain percentage, typically around 5% or 10%. This approach allows for a more flexible rebalancing strategy based on significant deviations.

- Calendar-Based Approach: Another approach is to rebalance on a fixed schedule, regardless of market conditions. For example, you may choose to rebalance every quarter or at the beginning or end of each year. This method helps maintain discipline and consistency in portfolio management.

How to Rebalance Your Portfolio

You can consider different things when it comes to rebalancing your portfolio. However, as I said above, if you are young and have a lot of time ahead, I suggest not touching it and not rebalancing it at all.

- Sell and Buy: If a particular asset class has grown significantly and now exceeds its target allocation, you may consider selling some of those assets and using the proceeds to buy assets from underrepresented asset classes. This approach helps bring your portfolio back to its desired asset allocation.

- New Contributions: If you continue to make regular contributions to your portfolio, you can allocate these new funds to asset classes that are currently underrepresented. This method allows you to rebalance gradually over time without incurring transaction costs.

- Dividends and Capital Gains: Reinvesting dividends and capital gains can also contribute to rebalancing. If certain assets generate income or appreciation, you can use these proceeds to purchase assets in underrepresented areas.

- Tax Considerations: When rebalancing a taxable portfolio, be mindful of potential tax implications. If you sell assets that have gone up in value, this may trigger capital gains taxes. Consider talking with a tax professional to minimize tax consequences while rebalancing your portfolio.

Why Regular Portfolio Review is Important

Regularly reviewing your portfolio is integral to maintaining a diversified investment approach. Here’s why it’s important:

- Monitoring Performance: Regular portfolio reviews allow you to assess the performance of your investments. By tracking how different asset classes and investments are performing, you can identify areas that may require adjustments.

- Changes in Goals or Risk Tolerance: Your investment goals and risk tolerance may change over time. Regular portfolio reviews provide an opportunity to reassess your objectives and make any necessary adjustments to your asset allocation.

- Market and Economic Changes: Markets and economies are dynamic, and conditions can change over time. Regular portfolio reviews help you stay informed about what is going on in the market, follow the latest trends, and be aware of economic developments and certain regulatory changes that may impact the value of your investments.

- Opportunities for Improvement: Through portfolio reviews, you may identify opportunities for improvement, such as reallocating assets to potentially higher-performing investments or identifying areas of overexposure or concentration that need adjustment.

Common Mistakes to Avoid When Learning to Diversify Your Portfolio

While diversifying your portfolio is a prudent strategy, it’s important to be aware of common mistakes that can hinder your efforts. In this section, we will discuss some common pitfalls to avoid when diversifying your portfolio.

Over diversification

One common mistake is over-diversification, which occurs when you excessively spread your investments across too many different assets. While diversification is beneficial, over-diversification can lead to diluted returns and increased complexity in managing your portfolio. It can also result in higher transaction costs and reduced focus on your best investment ideas. It’s important to strike a balance between diversification and maintaining a manageable portfolio size.

To avoid over-diversification, focus on quality over quantity when selecting investments. Rather than investing in a multitude of assets, concentrate on a well-researched selection of high-quality investments across various asset classes, sectors, and geographic regions.

Ignoring Your Risk Tolerance

Diversification should align with your risk tolerance. Neglecting to consider your risk tolerance can lead to a portfolio that is either too conservative, which may limit potential returns, or too aggressive, which may expose you to excessive risk. Knowing how much you can tolerate risk is crucial in deciding the appropriate asset allocation and diversification strategy for your portfolio.

Think about certain factors such as your investment goals, time horizon, and risk tolerance with market volatility. If you have a longer time horizon and can tolerate higher risk, you may have a higher allocation to equities. Conversely, if you have a shorter time horizon or lower risk tolerance, you may opt for a more conservative allocation with a higher emphasis on fixed-income investments.

Failing to Adjust Your Portfolio as Your Goals Change

Another mistake is failing to adjust your portfolio as your investment goals change over time. Your financial goals evolve as you progress through different life stages, and your portfolio should reflect these changes. Failing to adjust your portfolio accordingly may result in an imbalance between risk and return expectations.

Regularly review your investment objectives and make adjustments to your asset allocation and diversification strategy as needed. If your goals shift towards capital preservation or income generation, you may need to reallocate your investments accordingly. Conversely, if your goals shift towards growth or higher returns, you may consider adjusting your portfolio to include more growth-oriented assets.

Chasing Performance and Herd Mentality

Chasing performance can be a significant pitfall when diversifying your portfolio. It involves investing in assets solely based on their recent strong performance without considering their long-term potential or suitability for your portfolio. This behavior often leads to buying high and selling low, as performance tends to revert to the mean over time.

Avoid falling victim to the herd mentality, where you make investment decisions based on the actions of others rather than your own research and analysis. Following the crowd can lead to buying assets when they are overvalued and selling when they are undervalued. Instead, focus on your own investment goals, risk tolerance, and long-term strategy.

Lack of Regular Portfolio Monitoring

Failing to regularly monitor your portfolio is a common mistake that can interfere with your diversification efforts. Markets are dynamic and extremely active, and economic conditions can change rapidly. Without regular monitoring, your portfolio may become misaligned with your intended asset allocation and risk profile.

Set aside time frequently to review your portfolio’s performance, asset allocation, and individual investments. This allows you to identify any deviations from your target allocation and make necessary adjustments. Follow the market trends, economic developments, and industry-specific factors that may impact your investments.

Avoid these common mistakes when diversifying your portfolio. Over-diversification, ignoring your risk tolerance, failing to adjust your portfolio as goals change, chasing performance, and lack of regular monitoring can hinder the effectiveness of your diversification strategy. By being mindful of these pitfalls, you can build and maintain a well-diversified portfolio that aligns with your investment objectives and risk tolerance.

Conclusion

Learning how to diversify your yortfolio is extremely important and portfolio diversification is a critical strategy for investors seeking to manage risk, enhance returns, and achieve their long-term financial goals. Spread your investments across different asset classes, industries, and geographic regions, and through time, to get the benefits of diversification easily.

In conclusion, learning how to diversify your portfolio can be a powerful tool that can help investors manage risk, capture returns from various sources, and adapt to changing market conditions. By carefully selecting a mix of assets, regularly monitoring and rebalancing the portfolio, and avoiding common mistakes, investors can build a well-diversified portfolio that matches their investment goals and risk tolerance. Diversification is the bedrock of successful investing and should be considered by all individuals seeking long-term financial growth and stability.