Choosing between paying off debt or invest might be like a puzzle. It’s always complicated and time-consuming. On top of that, you might never be sure if you are doing the right thing. You have to wait and see. This takes a lot of time. That is why the answer to the question “is it better to pay off debt or invest” is tricky. There is no solid answer to make you happy. Because choosing to pay debt or invest have several consequences whatever you choose.

You probably heard similar advices about paying off debt or invest. Most of those advices can hold true. However, the key here is you. Your financial situation matters more. The type of debts are also important. Starting by checking the rate of interest of the debt is generally a good idea. You can compare this interest rate to the expected return of your investments. You can start deciding from there.

The advice sounds good on paper, it is difficult to implement in reality. Even experienced specialists struggle to estimate accurate investment returns. It doesn’t seem reasonable to make your judgment on a single statistic pulled out of thin air. Let’s see if you should invest or pay off debt. There are many things you should consider. Because not everyone is the same. You have to understand yourself first. For that, you need to know what parameteres to look at. Deciding comes later.

What is The General Consensus?

As I mentioned above, there is no general answer. All the answers boils down to you. Yet, there are traditional and commonly used tactics. Taking a look at these might help you. After all, you are going to make a decision in the end. It could give you a good context.

The general consensus is to simultaneously pay off debt and make investments. You should make an effort to constantly add money to generally three accounts. Retirement, emergency fund, and debt repayment. This could be more or less depending on you. Some already have a good emergency fund. In that case, it might not make sense to put money to that fund. Whatever your situation, it is worth to do seperate your money. Even if it means you can only set aside $10 or $20 per salary each month for any of your accounts.

Paying your debts and a good retirement preparation is important. However, they are not equally important. Depending on your financial goals and situation, one might be more important. Overcomitting to investing and paying the minimum on your debt is risky. You could pay too much in interest over time. This can limit your capacity to reach your goals. However, if you don’t invest at all, you risk not achieving your objectives.

What Factors to Consider Before Choosing to Pay Off Debt or Invest?

Doing both is generally better than doing one. In most situations, most people opt for this. Yet, there are still considerations you need to make. It helps you to understand the situation better. After all, the two most important financial goals are investing and debt repayment. It can be difficult to decide how much weight to give to each goal. Here are a few things to think about:

Interest Rate on the Debt

There are two types of debt. High-interest and low-interest. High-interest debts are generally credit card debts. They eat your money when you don’t pay it. You should focus on paying off those high-interest debts first. If you don’t have it, that’s a good start. With high-interest debts on your should, you can never achieve your goals. Credit card interest rates are very high and they cost a lot of money. Start by setting up a plan to pay off your credit card debt.

To understand better, look at the numbers. That is the most effective approach to choosing what to do. Compare the annual interest on your credit card to the rate of return on your investments. The average annual interest rate (APR) for credit cards is typically higher than 20%. An average rate of return for stock market assets of roughly 10%. That’s why, if you invest while carrying credit card debt, you will pay a huge chunk of interest rate on your debt. You will also potentially make less from investments. Unless you have a sizable investing portfolio, you lose money.

Pay off high-interest debt as fast as you can to free up funds for investments. However, you should never stop making contributions to your retirement account. Early retirement savings contributions are important. The money will gain interest in that account. That will compound over time to earn more income. However, some debt interest rates tend to be lower. Student loans and mortgages are the two most common examples. As opposed to high-interest debts, you don’t need to be as tough with those. If you have these low-interest debts, you can do a mix of paying debt and investing.

Amount of Your Debt

Credit utilization rate is important when you decide to pay your debts. Your credit scores will decline with the increase on credit card balances. You should keep your credit utilization in control. Otherwise, you’ll pay more in interest when you borrow money again.

Take a step back and review your budget if a card debt is more than 25% of your total credit limit. If you can only afford the minimum payment on all the obligations, that is even more troublesome. You can make your life much easier if you lower your utilization rate. There are variety of ways to do this. When you are considering your debt amount, it’s not how much you owe. It’s how much utilization you are making. Take a close look on your limits. Do not try to exceed a certain percentage.

6% Rule to Determine Whether to Pay off Debt or Invest

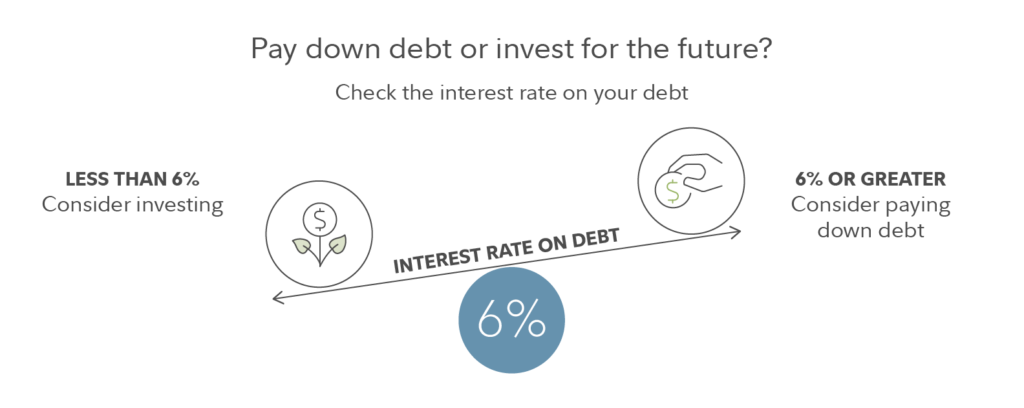

Fidelity has a 6% rule. Generally people with some debt and good financial situation makes use of this. If they are struggling to determine whether to invest or pay off debt, using the 6% rule could make sense. Fidelity says that it’s reasonable to pay off any debt with a 6% interest rate or higher early. This assumes several things about you. Not everyone should do this even if they are financially stable. Having at least ten years till retiring is the first thing. Second is having a diversified portfolio with a 50% allocation to equities. This shows that you are already investing successfully. In addition to that, your investments should be in a tax-advantaged account such as a 401(k) or IRA.

If the interest rate is less than 6%, it makes more sense to invest the additional money. With low interest rates, the long-term investment gains are more likely to give you more. They will eventually outperform the benefit of paying off your debt quicker.

Can You Do Both?

Paying off debt and investing shouldn’t be excluse to one another. There is always the option to do both most of the time. For instance, if you don’t already have an emergency fund, you could choose to set one up while paying your bills. An investment is not always the one you make towards assets.

Your emergency fund which is in cash and highly liquid is an investment. It is actually one of the most important investments to make. As an example, mutual funds fund is a suitable option for your emergency fund.

Generally, there will always be exceptions to the guidelines. If this advice doesn’t quite apply to your situation, consider it with a grain of salt.

SEC4 says that almost no investment can guarantee returns of 18% or more. This number is equal to your high-interest credit card debts. If you have high-interest debt, concentrate on that first. Especially the highest-rate card or loan.

Credit card balances are the biggest blockage to achieving long-term financial health. Extremely high interest loans must be in the highest priority. Payday loans are one of those very high interest loans. Pay these off first so that you will have space to spend more money on other things.

Yet, an individual should always make their monthly progress. Progress towards your retirement and debt pay off. A troublingly high proportion of individuals don’t save enough money for retirement. Too many people freeze up because they regularly use credit. This makes them to feel they can’t afford to invest. Because their credit accounts aren’t paid in full.

In actuality, they can actually afford retirement investments. They just choose not to. Consumers must figure out how to accomplish both.

Know Your Budget and Emergency Fund Before Deciding to Pay Off Debt or Invest

Budgeting is something that you can’t overlook if you want to pay off debt, invest, or do both. This is something you have to do according to John Hancock and I agree with it. You have to have solid budgeting. Spend the effort to keep track of how much money comes in and how much goes out. It is difficult to balance essential costs. Costs like rent, utilities, transit, and groceries.

You must have even a small emergency fund before investing or paying off debt. This fund is for high and unexpected costs. These costs might include as auto repairs, hospital expenses, and loss of employment. However, there is nothing certain. Anything that is an unexpected payment that exceeds your income is an extra cost. Putting even $1,000 for startes in your fund is important. This reduces the likelihood for these costs to raise your debt. If you have high-interest debt, you might consider a lower figure. Until at least you pay off your most expensive loan.

There is a general consensus to setting your fund. Depending on your lifestyle and what you want, set a budget for monthly expenses. Then, ideally, you should multiply that by the number of months. The ideal timeframe to have is somewhere between 6 to 12 months. My opinion is to have a fund for 12 months. That way, in case you lose your income, you can live 12 months without debt. It will help you to have a better understanding of your finances. This funding will also help you to decide whether to pay off debt or invest. A bigger picture is always easier to read then small pieces.