Setting long-term financial goals is a critical step toward financial security. You’re more inclined to overspend if you’re not working toward a defined goal. You’ll run out of money when you need it for unexpected costs, let alone when you want to retire. You may find yourself trapped in a bad cycle of credit card debt and believe you will never have enough money to be fully insured. This leaves you more susceptible than necessary to deal with some of life’s key threats.

Even the most risk-free person cannot anticipate every problem you might encounter. The globe discovered this during the COVID-19 pandemic, and many families continuously learn every month. Thinking ahead allows you to think through potential scenarios and do your best to prepare for them. It should be a process that always goes on so that you may modify your life and ambitions to accommodate the inevitable changes.

Annual financial planning allows you to take a look at your goals, adjust them, and assess your progress from the previous year. If you have never prepared long-term financial goals before, it might be hard to do this. That’s because you probably don’t have any long-term financial goals examples in your head.

However, now is the time to do so that you can get your finances in order and learn more as you go. This article will talk about how to set your long-term financial goals right and get ready for any kind of problem, as well as your retirement. We will also try to show you the best way to achieve long-term financial goals and which long-term money goals you should opt for.

What is a Long-Term Financial Plan?

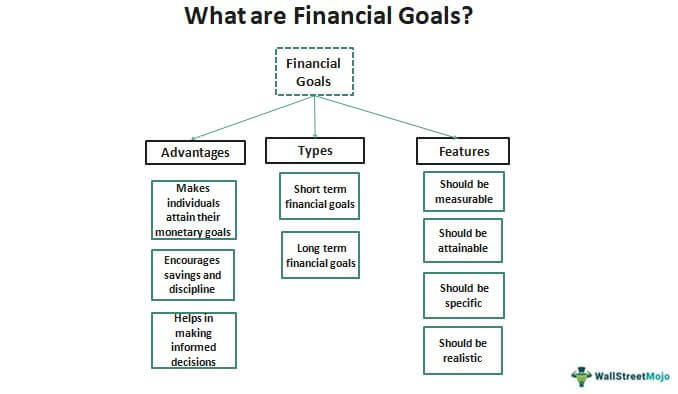

Long-term financial planning could have several meanings for individuals and for businesses. However, suppose you want a long-term financial plan for your personal finances. In that case, the definition is a bit narrower. In simplest terms, an investing strategy or plan for a timeframe of more than one year that you prepare yourself for something you want or need. Generally, setting up a long-term financial plan for overall financial health and retirement could be harder. That is because it requires you to not see any result back from your investments and efforts for some time.

In addition, long-term financial goal planning is more unpredictable than short-term financial goal planning. That is because market developments are more predictable in the near run. Long-term planning, on the other hand, is about enjoying retirement’s financial stability. Thus, while long-term planning is vital, one’s strategy must be adaptable to account for the inherent unpredictability.

Why Is Long-Term Financial Planning Important?

We all go to university and start working with a paycheck, and that’s when most of us go the wrong way and live our life without any financial planning for the future. Suppose you do not plan for your future and have no long-term plan. In that case, you will likely work even after your retirement age because you don’t have any funds to cover your needs after retirement. That is why long-term financial planning is important, and you must not overlook it.

If you simply concentrate on financial objectives that are relevant to your present financial situation, you may find yourself not suitable for future life events. For example, while saving for an emergency fund is a fantastic short-term aim, you will have no preparation for retirement. Because you do not save money outside of that fund. Long-term financial objectives raise awareness of events that may occur decades in the future and assist in ensuring you’ll be ready when they do.

How Do You Create Long-Term Financial Goals?

Creating a long-term financial plan is no easy feat. Mostly because of age, location, and other differentiator factors in everyone’s lives. In addition, your life aim could be different than others. That is why not every long-term financial plan could fit well into your planning. You need to identify what you need and create your long-term financial goals according to that.

Understand Your Needs

Even though your retirement or the thing you want to achieve in life is probably several decades away, anticipating your demands will boost your chances of fulfilling them when they arrive. Consider the anticipated costs you’ll face at that certain point in your life. How much money might you get from social security? Will you have to pay rent or a mortgage? How much money will you need from your retirement account to pay your projected retirement expenses?

You may structure your current monthly savings strategy to meet your anticipated future demands. Comparing these demands to your existing income can help you assess whether these goals are achievable and whether you need to locate additional sources of income.

Stay Away and Pay off Your Credit Card Debt

Credit cards might provide you with instant access to cash when you need them the most. However, credit card debt can swiftly derail your financial success. In an ideal world, you would pay down your credit card each month without incurring any interest.

If you have acquired credit card debt, it must be your first goal to pay it off. High-interest rates, often exceeding 15%, cancel out any gains made by investing the same money while carrying the loan. Use a credit card repayment calculator to find out how long it will take to pay off your credit cards.

Focus on Increasing Your Earnings

Making more money is the obvious solution to safeguarding your financial life, but how should you do so? Assessing wherever you want to go in five years is a good place to start. Does your chosen career path necessitate a greater degree of education than you possess? Is there a glass ceiling in your current employment that prevents you from progressing?

Discuss your goals with your manager. They may be able to offer training to help you climb the success ladder. If your present employer is unable or unwilling to assist, try doing your own upskilling. Obtain credentials on your own or enroll in a graduate program. Finding strategies to boost your profits is preferable to wasting years in a dead-end career.

What Are Some Examples of Financial Goals?

An individual might have a lot of reasons why you want to set long-term financial goals, and it might be hard to pinpoint your exact problem or your goal. Several things are extremely important in most people’s lives, and many people set their long-term financial goals for these problems. We will give you some long-term financial goals examples and explain how you can achieve them.

Funding Your Vacations

As an employee, having a vacation allows you to unwind from work and recover prior to returning to the workplace. You may also create memories with your loved ones and friends, which may be necessary for achieving a healthy work-life balance.

Plan that vacation to the place you have always wished to see. You may look at travel and lodging prices and how much money you’ll need for meals, souvenirs, and tourist activities. It might also be extremely useful to consider your financial situation before leaving so that you have resources for other goals in your life. Making this annual and creating a financial plan for it is extremely common.

Getting Rid of Student Debt

Tuition, campus housing, and supplies may necessitate the use of student loan programs. You may incur extra student loan debt if you choose to study beyond an undergrad course, such as a Ph.D. degree or law school. Consider creating a financial goal for repaying your student debts in a certain time frame. Calculate the amount you can pay towards your student debt while still meeting your monthly costs. Eliminating student loan debt may demonstrate your dedication and create a sense of success.

Paying Off Credit Card Debt

Eliminating credit card debt allows you to focus on other costs. You may determine how much money you want to put on your credit card, and you can postpone using it to prevent adding to the outstanding debt. You may also plan how you will use the card in the future. You may, for example, elect to charge just during the Christmas season or in emergencies.

Buying a House

Buying your own house is yet another instance of a financial objective. You can save money to move to a certain place and live in a property that suits your preferences. For instance, if you wish to live downtown, you may save up to buy an apartment or townhouse.

If you desire to live in a peaceful community, consider purchasing a home in the suburbs. Becoming a homeowner might require calculating the house’s price and the space you want. You can also select whether the mortgage costs are within your budget.

Launching Your Business

As an expert, you may opt to go into business for yourself. Becoming a business owner may be costly, especially if you’re in charge of establishing and running it. Consider how much money renting or purchasing a building may cost. You should also examine how much you can pay your employees and the prices at which you can supply services to clients.

Financial Freedom

Financial freedom is defined as the capacity to use your economic means without fear of overspending. For example, if you wish to go to a particular event, you may feel at ease paying for a trip, and a hotel stay.

Financial independence may be a long-term aim for your financial situation. You can set short-term goals, like as paying off school loans and credit card debt, to reduce your spending and boost your freedom. Financial freedom goals could cover everything we mentioned above. Ideally, this is the pursuit you should have and not a single objective.

What Should You Do to Achieve Long-Term Financial Goals

You now know about long-term financial goals, long-term financial goals examples, and what is your financial goal. It is now time to discover the best way to achieve the long-term financial goals you set for yourself. You need to have long-term money goals and certain ways to do it.

Know Your Life Costs

Understanding the expenses of what you want to achieve is a critical step. This help you with creating financial objectives and positioning yourself better. Even if your goals are distant in the future, it’s useful to have a sense of how much they’ll cost.

Whether it’s funding a family vacation somewhere you want, upgrading your car to enjoy a promotion or retiring early and following a pastime you’ve always wanted to explore. You can easily change the projected expenses afterward. A crucial consideration is whether these ambitions have fixed or variable costs and if you expect the expenses to fluctuate over time.

Invest

Never save more than the emergency fund that you set for yourself. Saving money will never help you achieve your goals because inflation will eat that money away. Besides, your bank will provide you with something close to zero return on the money you keep in your account. Find the best way to invest your future plans and invest your money. This could be bonds, stocks, commodities, or anything else that you feel comfortable with.

Because all investments include some level of risk, selecting the ideal asset class mix to match your strategy with your appetite for risk and goals is critical. In general, the aggression of your strategy decisions must reflect how far you are from the moment you want to start spending your money. A financial advisor can assist you to balance your portfolio and divide your investments based on your needs and when you want access to your money.

Watch Your Progress

Costs and market circumstances can alter and evolve, affecting both the price of what you want to eventually finance and the quantity of money you have to attain that aim. Maintain market awareness and consult with your financial advisor frequently. Your adviser will have the most up-to-date knowledge and will be able to tell you exactly how developments affect your assets and your path to financial success.

However, don’t become overly preoccupied with every minor movement. This may include taking a step back from the daily news and resisting the urge to make impulsive decisions. You may be on pace to meet your financial objectives in the long run.

Think Outside of The Box

Several methods exist to increase the money required to meet your financial objectives. Investment and wealth-growth plans are unique to each individual and should be adjusted to the desired outcome. Check in with your financial planner, who may be able to help you identify various innovative ways to achieve your financial objectives, such as selling your abilities or finding out alternative assets to expand your wealth.

Everybody has ambitions, and most of the time, those aspirations are expensive. Maintain your financial objectives through planning, budgeting, and carefully analyzing your alternatives for obtaining wealth as your career progresses.