When it comes to investing in real estate, there are various options available. Two popular choices are private REIT vs public REIT. But what exactly are these investment vehicles, and how do they differ? In this comprehensive comparison, we will delve into the world of private REIT vs public REIT to help you understand their definitions, structures, investment processes, pros and cons, and the factors to consider when making a decision.

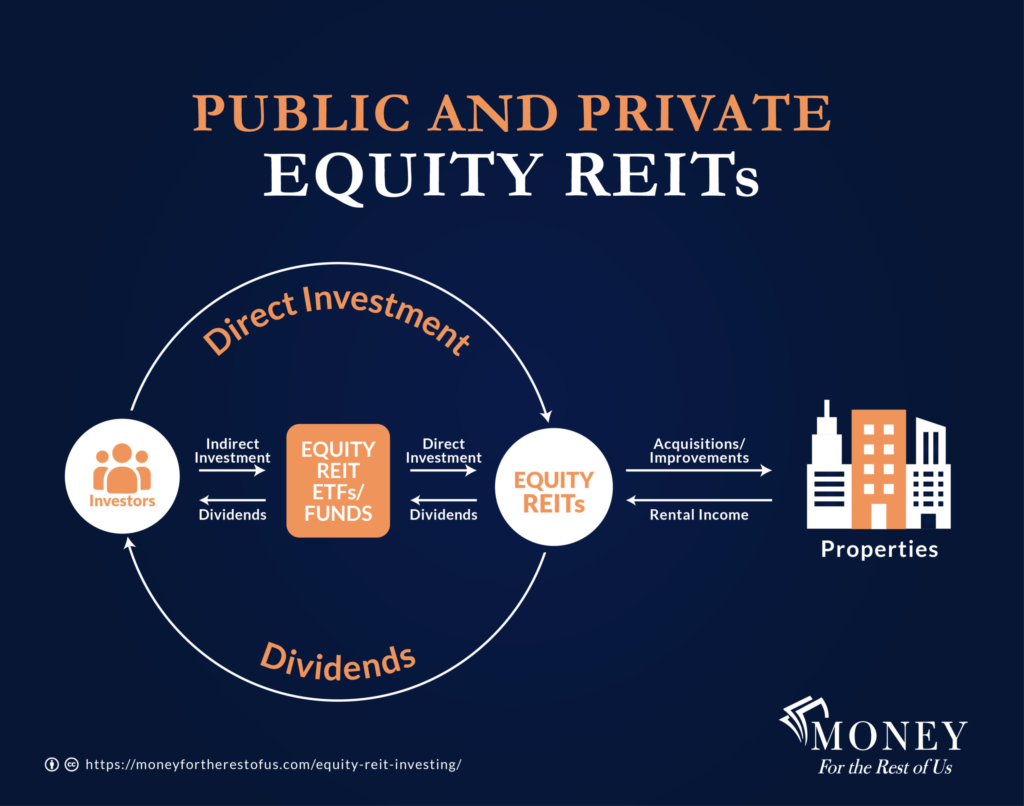

Real Estate Investment Trusts (REITs) are special types of real estate-focused companies that own, operate or finance income-generating properties. They allow investors to pool their money together and invest in a range of real estate assets. However, the key difference lies in the way they are structured and the accessibility for investors.

This blog post will explore the defining characteristics, investment processes, and pros and cons of private and public REITs. We will also compare them in terms of investment potential, risk and return, liquidity, and transparency. By understanding the differences between these two types of REITs, you will be better equipped to decide which is the right investment for you.

However, it is important to note that investing in REITs, whether private or public, comes with its own set of risks. That’s why it could be a good idea to consult with a financial advisor who can assess where you are standing and guide you toward the best options that fit your long-term financial goals.

Let’s dive into the world of private REIT vs public REIT and explore the important pieces that will help you make better and more informed investment decisions.

Understanding the Basics: Defining Private and Public REITs

Real Estate Investment Trusts (REITs), whether private or public, have become a popular and quite important investment option for retail investors seeking to own a piece of the real estate market. Before delving into the specifics of private and public REITs, it is crucial to clearly understand what these terms mean.

In short, Private REITs are not traded on public stock exchanges and are typically offered to accredited investors or institutions. They are privately owned and managed, with a limited number of shareholders. On the other hand, public REITs are listed on stock exchanges, making them available to individual investors. They have more shareholders and are subject to more stringent regulatory requirements.

Let’s now take a deeper look at both Private REIT vs Public REIT to see what they actually are, their structure, and every other detail of them before we start comparing them.

What is a Private REIT?

As the name suggests, a private REIT is a real estate investment trust that is not publicly traded on stock exchanges. They are owned and managed by a limited number of shareholders. This means that they are private.

Typically, accredited investors or institutions who meet a certain investment threshold or net worth have access to Private REITs. These investment vehicles often focus on specific real estate sectors or geographical regions.

Structure of a Private REIT

Private REITs are typically established as private companies or partnerships, and they are governed by their own set of rules and regulations. Unlike public REITs, which are subject to regulatory oversight, private REITs have more flexibility in their operations and reporting requirements.

Private REITs usually focus on specific real estate sectors or geographical regions, allowing investors to target their investments according to their preferences and investment goals. These sectors can include residential properties, commercial properties, healthcare facilities, or industrial properties, among others.

The structure of a private REIT can vary, but it generally involves a management team responsible for acquiring, managing, and disposing of real estate assets on behalf of shareholders. Private REITs may also have a board of directors or an advisory committee to provide oversight and strategic guidance.

How to Invest in a Private REIT

Investing in a private REIT commonly requires meeting specific financial criteria, such as being an accredited investor or having a certain level of net worth or income. Accredited investors are individuals who meet certain financial thresholds, demonstrating their ability to assume the risks associated with investing in private offerings.

Private REITs often have minimum investment requirements, which can range from thousands of dollars to millions of dollars. These investment vehicles may also have lock-up periods, during which investors are unable to redeem or sell their shares. It is important to carefully review the offering documents and understand the terms and conditions before investing in a private REIT.

Pros of Private REITs

- Diversification and Professional Management. Private REITs allow investors to diversify their real estate holdings by pooling their funds with other investors. They also provide professional management, as the REIT’s management team handles the acquisition, management, and sale of properties.

- Potential for Higher Returns. Private REITs may offer the potential for higher returns compared to other investment options. This is due to their focus on specific sectors or regions, which can yield higher rental income or property appreciation.

- Potential Tax Benefits. Private REITs may provide certain tax advantages based on several factors. For example, the ability to defer capital gains taxes through 1031 exchanges or the potential for pass-through tax treatment are some of the common ones.

Cons of Private REITs

- Limited Liquidity. Unlike publicly-traded REITs, private REITs have limited liquidity. Investors may face challenges in selling their shares or accessing their invested capital, as there may be restrictions or lock-up periods in place.

- Higher Investment Minimums. Private REITs often have higher investment minimums compared to publicly traded REITs, which can limit accessibility for some investors.

- Lack of Transparency. Private REITs do not have the same level of regulatory oversight as public REITs, which can result in less transparency regarding their operations and financial performance.

What is a Public REIT?

A Public REIT is a legitimate and more formal REIT that is listed and traded on public stock exchanges. Public REITs are accessible to individual investors and have a larger number of shareholders. They offer the opportunity for individual retail investors to invest in real estate with little money, like investing in a stock.

They are subject to regulatory requirements, including reporting and disclosure obligations, which provide investors with transparency and accountability.

The key difference between private and public REITs lies in their structure and accessibility. Private REITs cater to a select group of investors, while public REITs offer the opportunity for broader participation in real estate investments.

Definition and Structure of a Public REIT

Public REITs are enlisted with the Securities and Exchange Commission (SEC). This means that they operate under specific regulatory requirements, which makes them safer. They are structured as corporations or trusts, and by law, they must pay dividends to shareholders from a significant portion of their income. This distribution allows these types of REITs to have certain tax benefits, such as not paying corporate income taxes, if they meet certain criteria.

Public REITs typically have a larger number of shareholders compared to private REITs. This broad ownership base allows individual investors to buy and sell shares in the real estate industry easily through public stock exchanges. It provides liquidity and transparency to investors.

How to Invest in a Public REIT

Investing in a public REIT is relatively straightforward. Investors can purchase shares of a public REIT through stockbrokers, online trading platforms, or financial institutions. The shares are generally available for trade on stock exchanges. For example, the New York Stock Exchange (NYSE) or NASDAQ. Market demand and supply determine their prices, which are generally similar to other stocks.

Public REITs offer various investment options, including individual shares, exchange-traded funds (ETFs), and mutual funds that focus on real estate investments. These investment vehicles provide individuals with the ability to better tailor and diversify their investment portfolio by considering their risk tolerance, investment horizon, and specific real estate sectors or regions they wish to invest.

Pros of Public REITs

- Liquidity. Public REITs are available for trade on stock exchanges, so any type of investor can buy or sell shares on a daily basis. This liquidity allows investors to access their invested capital more readily compared to private REITs.

- Transparency and Regulation. These REITs are subject to stringent reporting and disclosure requirements imposed by regulatory authorities, such as the SEC. This provides investors with transparency regarding the REIT’s financial performance, operations, and governance.

- Diversification and Accessibility. Public REITs offer investors the opportunity to diversify their portfolio or overall real estate holdings by letting them invest in a wide range of properties and sectors. They are accessible to individual investors without the same income or net worth requirements as private REITs.

Cons of Public REITs

- Market Volatility. Public REITs are influenced by market conditions and investor sentiment, which can result in price volatility. Fluctuations in the stock market may impact the value of investments in public REITs.

- Potential for Lower Returns. Public REITs may offer slightly lower returns compared to private REITs, as they are subject to more competition and market forces. However, this can be different depending on the specific investments and market conditions.

- Lack of Control. Investing in public REITs means entrusting the management of the properties and assets to the REIT’s management team. Investors have limited control over the decision-making process.

Comparing Private REIT vs Public REIT

When deciding between private REIT vs public REIT, it is crucial to know the key differentiators and similarities between these two investment options.

Investment Potential

Private REIT vs public REIT offer different investment potentials due to their distinct structures and investment strategies. Private REITs often focus on specific sectors or regions, allowing investors to target their investments according to their preferences. This targeted approach may provide opportunities for higher returns if the chosen sector or region performs well. However, it also exposes investors to sector-specific risks and limits diversification.

On the other hand, public REITs offer broader investment potential as they typically invest in a diversified range of real estate properties across various sectors and regions to ensure stability. This type of diversification helps eliminate the risks associated with individual assets or sectors. Public REITs also often have professional management teams that employ strategies to optimize returns for shareholders.

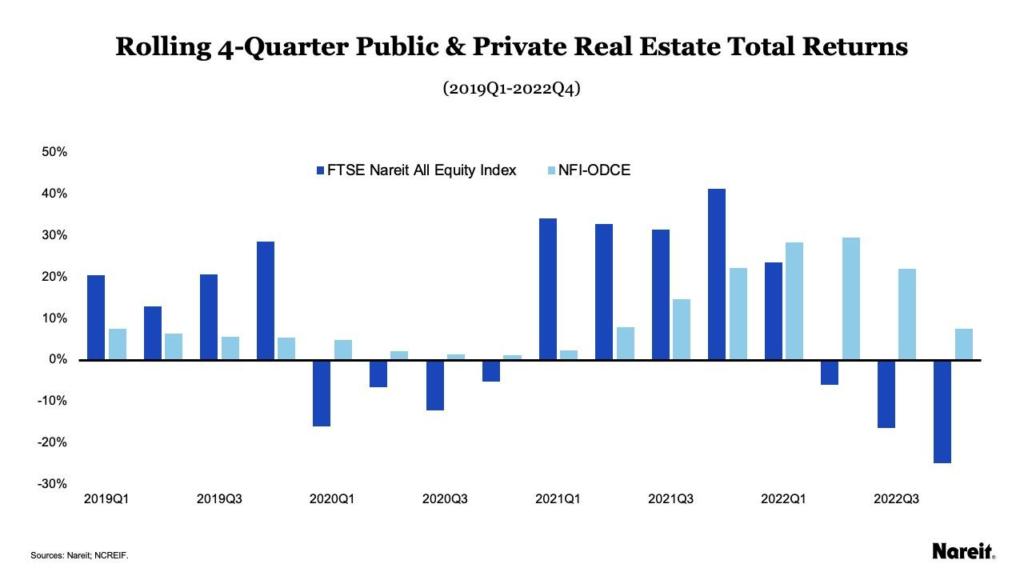

Risk and Return

Private REITs tend to have higher potential returns compared to public REITs due to their targeted approach and potential for higher rental income or property appreciation. However, this potential for higher returns has higher risks, including the concentration risk associated with investing in specific sectors or regions.

Public REITs, on the other hand, offer relatively lower potential returns compared to private REITs due to their diversified nature. However, they also carry lower risks as they spread the investment across a variety of properties and sectors. Public REITs are subject to market conditions, and their returns are influenced by factors such as interest rates and investor sentiment.

Liquidity

Private REITs have limited liquidity compared to public REITs. Investors in private REITs may face challenges in selling their shares or accessing their invested capital due to lock-up periods or restrictions imposed by the REIT. This lack of liquidity can limit flexibility and make it difficult to react quickly against changing market conditions or certain financial needs.

Public REITs offer high liquidity as their shares are traded on stock exchanges. Investors can buy or sell their public REIT shares on a daily basis, providing them with the ability to access their invested capital more readily. This type of quick liquidity allows investors to react quickly to market changes or capitalize on investment opportunities.

Transparency

Public REITs are subject to stringent reporting and disclosure requirements imposed by regulatory authorities, such as the SEC. These things make sure that investors have access to accurate and punctual information about the REIT’s financial performance, operations, and governance. This transparency provides investors with confidence and helps them assess the pros and cons of investing in public REITs.

On the other hand, private REITs are not subject to the same level of regulatory oversight. They have more flexibility in their reporting and disclosure obligations, which may result in less transparency compared to public REITs. Investors in private REITs may have limited information about the REIT’s financials, operations, or future plans, making it important to conduct thorough due diligence before investing.

Making the Decision: Which is the Right Investment for You?

Choosing between private REITs and public REITs requires careful consideration of various factors.

Factors to Consider

- Risk Tolerance. Just like with any other investment, you must first start by assessing your risk tolerance and investment preferences. Private REITs tend to carry higher risks due to their targeted approach and limited liquidity. If you are comfortable with higher risks and have a longer investment horizon, private REITs may be suitable. On the other hand, if you prefer a more diversified and liquid investment with lower risks, public REITs may be a better fit.

- Investment Horizon: Consider your investment horizon and financial goals. Private REITs often require a longer-term commitment due to potential lock-up periods or limited liquidity. If you have a longer investment horizon and can afford to tie up your capital for an extended period, private REITs may align with your goals. If you prefer flexibility and the ability to access your invested capital more readily, public REITs may be preferable.

- Investment Minimums: Evaluate your available investment capital. Private REITs usually have higher investment minimums compared to public REITs. If you meet the minimum requirements and have a substantial amount to invest, private REITs may be an option. If you have a smaller investment amount or prefer to start with a lower investment, public REITs offer more accessibility.

- Diversification: Consider your desire for diversification. Private REITs often focus on specific sectors or regions, which may limit diversification. If you prefer a targeted investment approach and have confidence in a particular sector or region, private REITs may suit your needs. If diversification and exposure to a broader range of properties and sectors is important to you, public REITs offer greater diversification potential.

Consultation with Financial Advisor

Most companies and people recommend consulting with a qualified financial advisor or investment professional when it comes to deciding on an investment. They can assess your individual circumstances, risk tolerance, and financial goals to provide personalized guidance. A specialized advisor can help you consider the pros and cons of private REITs and public REITs based on your specific needs and preferences.

Long-Term Financial Goals

Ultimately, the decision between private REITs and public REITs should align with your long-term financial goals. Think about all the related factors like your desired return on investment, income requirements, risk tolerance, and investment horizon. By carefully evaluating these factors and maybe getting professional advice if you need it, you can make a decision that matches your financial objectives.

Conclusion

In conclusion, private REITs and public REITs offer distinct advantages and considerations. Private REITs provide targeted investments, the potential for higher returns, and the ability to diversify within specific sectors or regions.

Public REITs offer greater liquidity, diversification, transparency, and accessibility to individual investors. Assessing your risk tolerance, investment horizon, available capital, desired diversification, and transparency requirements will help guide you in selecting the right investment option.

In navigating the dynamic landscape of real estate investment, understanding the nuances between Private REITs and Public REITs is extremely crucial for informed decision-making. I tried to shed light on the similarities and differences between Private REITs and Public REITs.