There are many ways to create wealth. Stocks, bonds, businesses, inheritance, and real estate. Some of these investment methods are easy to start with, like stocks, but some of these ways are not so easy, like investing in real estate. The barrier to entry to real estate is perhaps the highest in the entire asset classes to having wealth. However, it is also the easiest path to achieve any financial goal you have and have the freedom to do whatever you want.

But why is real estate investment one of the best ways to generate wealth, and what is the difference it has from owning a business or buying stocks? There are many reasons behind that, but it is mostly stability. In this article, we will discuss real estate investing, how to start investing in real estate, and other details you must be aware of if you are thinking about the real estate investment path.

What is Real Estate Investment?

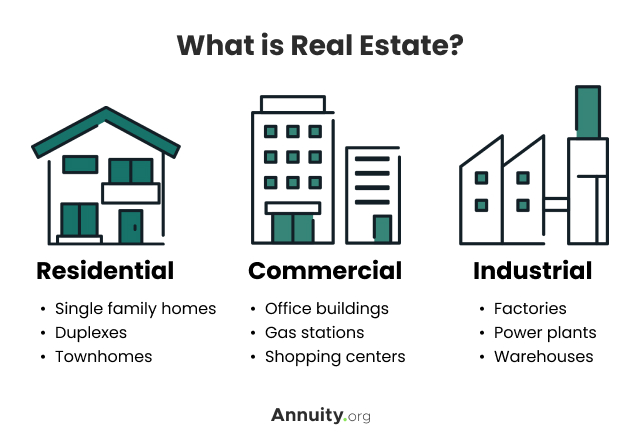

Real estate investment is putting your money in real estate or anything related to real estate. Many conceptions believe that real estate is only about purchasing a property, but this is not the reality. Your house is usually the first thing that springs to mind when you think of real estate investing. Of course, real estate investors have many additional possibilities for investing, and they are not just physical assets. Over the last 50 years or more, real estate has been a popular investment instrument. Real estate investment could come in various forms, and you can determine which one to put your money and effort in.

Investing in real estate has been providing value and sound returns for decades. Many people consider it safer than other investment options out there because the risk is lower. Even though this is true, not everyone can start with the classical method of real estate investment. However, you can use different forms of real estate investment. These different forms could be investing in Real Estate Investment Trust (REIT), renting out a room, or flipping houses. None of these involves actually owning real estate under your name. All are using real estate to generate wealth.

The Best Ways to Start Investing in Real Estate

REITs are the ideal option for beginners starting with real estate investing. You can buy shares for far less than the equity necessary for a complete property. They may also look at quarterly reports to better understand the stock’s performance and improve their real estate investment knowledge. When people are ready and have the cash to invest in rental homes, they may earn better returns.

Before renting to renters, it is preferable for newbies to select properties that are in fine condition and demand very little labour. This is also known as a turnkey. Renovations and capital improvements should be left to seasoned investors. They understand the dangers associated with undertakings of this magnitude. Until you have the capital and experience to deal with a real estate property by yourself, do not consider buying it. Take it one step at a time and learn as you go. Even if you have the capital, put off buying a property until you understand the real estate world and what it requires.

Why Should You Start Investing in Real Estate?

By owning a real estate property, one may produce a consistent cash flow, which might be a tremendous revenue stream that is not obtained by simply comparing selling prices. This means that since you don’t sell the property and only use it for cash flow, your net worth appreciates in value while you are getting income on your appreciating capital. Another reason why real estate may outperform stock market investing is that a person may readily leverage their investment, whereas equities are mostly restricted by the quantity of cash available.

What we mean by leveraging the investment is about the capital you need to start. Some investment properties demand as little as 3% down and may provide significant income flow with only a few thousand dollars upfront. That’s how one may make money with real estate. Rental real estate investment returns are tough to estimate since each instance is different, and no two pieces of real estate, markets, or taxation regimes are the same. However, it is a universal fact that real estate has helped thousands to find their way to generational wealth. That is because the entry barrier could be low with a small down payment, and it creates a continuous cash flow.

Types of Real Estate Investment

REITs

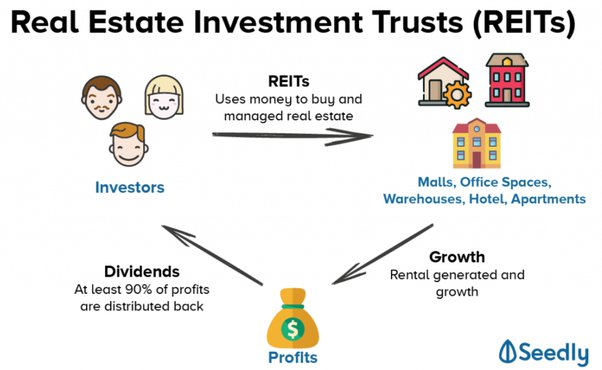

A real estate investment trust (REIT) is for investors seeking portfolio exposure to real estate without committing to a classical purchase of the real estate. A REIT is when a corporation (or trust) utilizes money from investors to buy and run the real estate. You can trade REITs, like other individual stocks, on the main markets. To keep its REIT designation, a firm must pay out 90 percent of its taxable income in dividends. REITs avoid corporate income tax by doing so, whereas a typical corporation would be taxed on its profits and then have to determine whether or not to distribute its after-tax gains as dividends.

Like normal dividend-paying equities, REITs are a smart investment for stock market investors seeking consistent income. In comparison to the other kinds of real estate investment, REITs provide investors with access to nonresidential ventures, such as malls or office buildings, that are often inaccessible to individual investors. More significantly, because they are exchange-traded trusts, REITs are extremely liquid. To explain differently, you won’t need a realtor or a title transfer to cash out your investments. REITs are a more structured type of real estate investment trust.

Buy Real Estate Properties

Individuals with do-it-yourself (DIY) renovation abilities and the patience to supervise renters may find owning rental homes a terrific possibility. This technique, however, necessitates significant expenditure to cover initial maintenance expenses and offset unoccupied months. Looking at the data from the U.S. Census Bureau, new house sales prices (a rough estimate of real estate values) grew steadily from the 1960s through 2007 before falling during the financial crisis. Right after that, sales prices of real estate properties began to rise again, eventually approaching pre-crisis levels.

Owning and running your own real estate property is a hell of a lot of work and could cost a lot compared to owning a REIT or using another way of real estate investment. However, it could provide more in value and a more solid cash investment since you are handling it. You also need way more capital than you need to invest in REITs. Weighing the pros and cons and deciding on buying a real estate property should be your way to go. However, owning your own rental real estate should be the last step on your real estate journey because it requires a lot of information and work.

Rent Out a Room

Renting out a room in the apartment you are living in is something that you can either do as a tenant (requires the permission of your landlord) or as a landlord. Both are less troublesome than renting out an entire apartment because you will be living there and can see what the tenant is doing to your apartment. It will be easier to handle the problems, rent issues, and many others.

Many people call this house-hacking if you buy an apartment with at least two rooms and live in one and rent out the others. It helps to pay off the mortgage and create a cash flow without too much trouble. Effectively you are participating in real estate investment.

House Flipping

House flipping is not for beginners or even intermediate real estate investors. This method works best for those who have extensive knowledge in real estate appraisal, marketing, and remodeling. House flipping necessitates cash as well as the capacity to do or supervise repairs as needed. This real estate investing’s famous “wild side.”

Real estate flippers are separate from buy-and-hold investors, just as day traders are unique from buy-and-hold investors. For example, real estate flippers frequently seek to financially sell the discounted houses they acquire in less than six months. Pure property flippers frequently do not invest in property improvement. As a result, the investment you made on the property must already have the inherent worth required to earn a profit without any changes, or they will remove the property from contention.

Flippers who are unable to quickly offload a property may be in difficulty since they often do not retain enough uncommitted cash on hand to pay the mortgage on a property over time. This might lead to further escalating losses. A different type of real estate flipper earns money by purchasing low-cost houses and increasing value by remodeling them. This is a longer-term investment, as investors can only afford one or two properties at a time.

FAQ

What is the best way to add Real Estate to my Investment Portfolio?

Aside from directly purchasing properties, regular people can acquire REITs or funds that invest in REITs. REITs are pooled securities that hold and/or manage real estate or mortgages.

Is Real Estate really an inflation hedge?

Home prices often grow in lockstep with inflation. This is because the expenses of homebuilders grow with inflation, which must be passed on to new home purchasers. Existing property prices climb in lockstep with inflation. If you have a fixed-rate mortgage, your regular monthly payments become more reasonable when inflation rises. Furthermore, as a landlord, you can raise the rent to keep up with inflation.

Why do the home prices get affected by interest rates?

Since real estate is such a vast and expensive asset, loans are frequently required to fund its acquisition. As a result, rising interest rates make new mortgage payments more expensive (or on existing adjustable-rate loans like ARMs). This may deter purchasers, who must consider the expense of carrying the property on a month-to-month basis.