Real estate syndication has become quite interesting among investors lately and it could be a great real estate investment strategy. This is because it allows investors with limited funds to get together and invest in more profitable real estate. These real estate syndication companies play a vital role in connecting investors with high-quality real estate projects. Top real estate syndication companies are especially famous for providing a seamless experience.

If you’re considering investing in real estate syndication, you must understand the concept. Then, you must identify the top real estate syndication companies that can maximize your returns and mitigate risks. In this post, we will explore the world of real estate syndication and highlight the top real estate syndication companies that are leading the industry.

Introduction to Real Estate Syndication

Real estate syndication is a real estate investment strategy that allows investors to gather resources and invest in real estate projects that would normally be too expensive for one. Syndication revolves around leveraging capital and expertise to boost returns and cut risks.

The group of investors gets together to form a syndicate or partnership for the real estate syndication company. This syndicate identifies, acquires, and manages profitable real estate assets. These assets are generally apartment complexes, office buildings, retail spaces, or industrial properties. The syndication company, also known as the sponsor, acts as the entity that manages the investment process from start to finish.

Real Estate Syndication Process

The syndication process typically begins with the sponsor sourcing potential investment opportunities. They conduct thorough market research, due diligence, and financial analysis. This helps to identify properties with high growth potential and attractive returns. Once they identify a suitable property, the process starts. The syndication company negotiates the sale, finds financing, and structures the investment offering.

Investors who wish to take part in the syndication can contribute capital to the investment. This capital is pooled together to fund the property’s acquisition and ongoing operational expenses. In return for their investment, investors receive ownership shares or equity in the property. They could also earn passive income through rental profits and potential property appreciation.

Real Estate Syndication Companies Benefits

Real estate syndication offers several benefits for both investors and syndication companies. Investors get access to larger and more diverse real estate projects that would be too expensive. It also allows investors to leverage the expertise of the syndication company. These companies often have a track record of successful investments and industry knowledge.

Syndication companies enjoy the ability to raise capital from many investors, allowing them to take on larger and more ambitious projects. They also earn management fees and a share of the profits generated by the investment. This creates a win-win situation for both parties involved.

What is a Real Estate Syndication Company?

A real estate syndication company is the main entity that identifies, acquires, and manages real estate investment opportunities on behalf of investors. Real estate syndication companies are often referred to as syndicators or sponsors. These companies have the expertise and resources to navigate the complex real estate market. They can ensure that investors can access high-quality investment opportunities.

Real estate syndication companies act as the driving force behind the syndication process. They are responsible for sourcing potential investment properties, conducting thorough due diligence, negotiating acquisitions, securing financing, and managing the ongoing operations of the properties. They also handle investor relations, providing regular updates and distributions to investors.

How Do Real Estate Syndication Companies Operate?

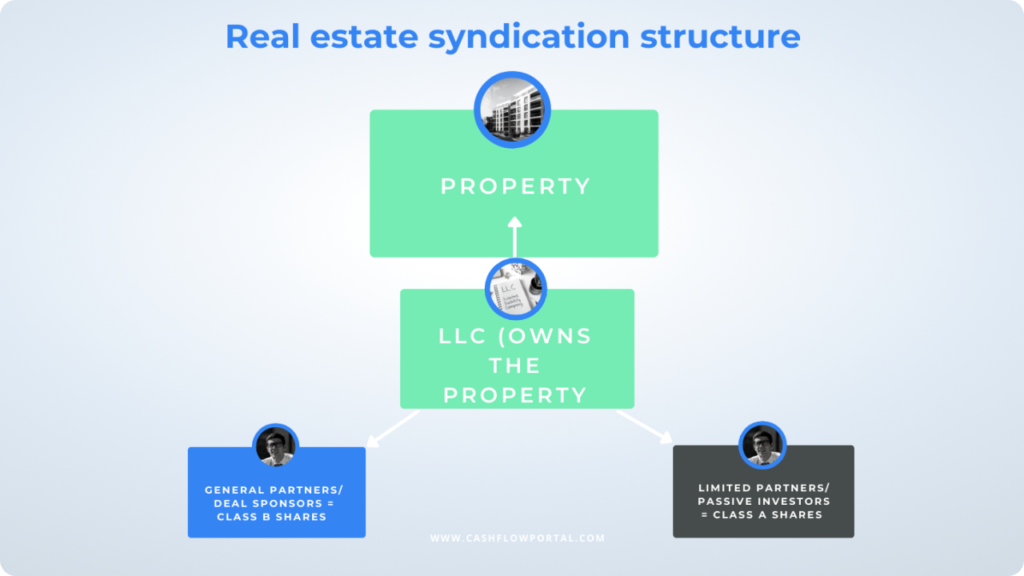

Real estate syndication companies operate by forming partnerships or limited liability companies (LLCs). This way, they can gather individual money in one entity and invest in real estate projects. These partnerships’ structure aligns the interests of both the syndication company and the investors.

The syndication company takes on the role of the general partner (GP). They manage the day-to-day operations of the investment. Investors, on the other hand, become limited partners (LPs) and contribute capital to the investment. The syndication company earns a management fee and a share of the profits. At the same time, investors receive ownership shares and potential returns from the investment.

Types of Real Estate Syndication Companies

- Development Syndicators. Development companies specialize in acquiring undeveloped land or properties needing significant renovations. They oversee the development or repositioning of the property to increase its value before selling or leasing it.

- Income Syndicators. As the name suggests, income companies acquire income-generating properties. These are generally apartment complexes, office buildings, or retail spaces. Their primary goal is to generate consistent cash flow for investors through rental income.

- Debt Syndicators. These companies primarily invest in real estate debt instruments such as mortgages or real estate-backed securities. They allow investors to earn fixed-interest income by lending money to real estate projects.

- Hybrid Syndicators. These companies combine elements of both development and income syndication. They invest in properties with a value-add component, aiming to increase cash flow while realizing long-term appreciation.

Identifying Top Real Estate Syndication Companies

Identifying the top-performing syndication companies is crucial when investing in real estate syndication. The top real estate syndication have a proven track record of success, consistently delivering attractive returns to their investors.

Criteria for Evaluating Syndication Companies

- Track Record. One of the key criteria for evaluating syndication companies is their track record of successful investments. Investors should look for companies with a history of delivering attractive returns and successfully navigating various market cycles.

- Experience and Expertise. The experience and expertise of the syndication company’s management team are vital factors to consider. Companies with seasoned professionals who deeply understand the real estate market and investment strategies are more likely to make informed decisions and generate favorable outcomes.

- Investment Strategy. It is essential to evaluate the investment strategy of syndication companies. Different companies may focus on specific types of properties or investment approaches. Investors must align their investment goals with the company’s strategy to ensure compatibility.

- Transparency and Communication. Syndication companies that prioritize transparency and effective communication with their investors are highly valued. Regular updates, detailed financial reporting, and clear communication about investment processes and risks contribute to a positive investor experience.

- Risk Management. Assessing a syndication company’s risk management practices is crucial. Companies with robust risk assessment processes, contingency plans, and a focus on mitigating potential risks are more likely to protect investors’ capital.

Key Success Factors of Top Companies

The success of top real estate syndication companies can be attributed to several factors:

- Thorough Due Diligence. Successful syndication companies conduct comprehensive due diligence on potential investment opportunities, carefully assessing market conditions, property fundamentals, and financial projections.

- Strong Network. Top companies have developed extensive networks of industry professionals, allowing them to access exclusive deals and leverage their relationships for favorable terms and opportunities.

- Investor-Centric Approach. These companies prioritize the needs and interests of their investors, offering transparent communication, regular updates, and a personalized approach to investor relations.

- Proactive Asset Management. Successful syndication companies actively manage their properties, implementing strategies to maximize cash flow, minimize expenses, and enhance property value.

The Top Real Estate Syndication Companies

While the real estate syndication landscape is vast, several noteworthy companies have consistently performed well. These companies have demonstrated their ability to deliver attractive returns and effectively manage investments.

CrowdStreet

CrowdStreet is one of the most popular real estate syndication companies. They have been in operation for decades and they invest in variety of real estate. Some of their investments include debt and private equity investment, and the also do crowdfunding real estate. Their platform makes them one of the best real estate syndication companies out there.

CrowdStreet’s platform provides investors with access to detailed information about each investment opportunity, including property details, financial projections, and the track record of the project sponsor or operator. Investors can browse and invest in deals directly through the platform, allowing them to diversify their portfolios across different property types and geographic locations.

Realty Mogul

Realty Mogul is a real estate crowdfunding platform that enables individual investors to access commercial real estate investments. The company was founded in 2012 by Jilliene Helman and Justin Hughes. The platform was created with the aim of democratizing real estate investing by providing access to private real estate deals to a broader investor base.

As Realty Mogul gained traction in the real estate crowdfunding space, it expanded its offerings to include various types of investment opportunities, including equity investments, debt investments, and real estate investment trusts (REITs). Overall, Realty Mogul has played a significant role in democratizing access to commercial real estate investments, allowing individual investors to participate in opportunities that were traditionally only available to institutional investors.

Fundrise

Fundrise was founded in 2010 by brothers Ben and Dan Miller. The platform was created with the goal of providing access to real estate investments to a wider audience by leveraging technology and crowdfunding principles. Fundrise initially focused on providing access to commercial real estate investments through crowdfunding. The platform allowed individual investors to pool their funds and invest in a variety of real estate projects, including residential, commercial, and mixed-use properties.

Fundrise was one of the pioneers in utilizing Regulation A+ of the JOBS Act, which allows companies to raise capital from both accredited and non-accredited investors through crowdfunding platforms. This regulatory innovation enabled Fundrise to offer investment opportunities to a broader range of investors. Fundrise is known for its user-friendly platform and transparent approach to real estate investing. The platform provides investors with detailed information about each investment opportunity, including property details, financial projections, and the track record of the sponsor or operator managing the project.

EquityMultiple

EquityMultiple is a real estate investment platform that connects accredited investors with institutional-quality commercial real estate opportunities. The company was founded in 2015 by Charles Clinton, Marious Sjulsen, and Conor Kelly. The platform was created to address the lack of transparency and accessibility in commercial real estate investing by providing individual investors with access to high-quality real estate deals typically reserved for institutional investors.

EquityMultiple employs rigorous due diligence processes to select investment opportunities that meet its strict criteria for quality and risk-adjusted returns. The platform focuses on partnering with experienced sponsors and operators with a track record of success in the real estate industry. Since its founding, EquityMultiple has experienced significant growth and has been recognized within the real estate and financial technology sectors for its innovative approach to real estate investing. The platform has received positive reviews from investors and has been featured in various media outlets.

Risks and Rewards of Investing with Syndication Companies

Investing with real estate syndication companies offers both potential rewards and risks.

Benefits

- Access to larger and more lucrative real estate projects.

- Diversification of investment portfolio.

- Passive income generation through rental profits.

- Potential appreciation of the property over time.

Risks

- Market fluctuations and economic downturns.

- Property-specific risks such as vacancy rates or unforeseen expenses.

- Lack of control over the investment decisions.

- Illiquidity, as real estate investments are typically long-term.

Current Trends in Real Estate Syndication

- Increased Demand. Real estate syndication has gained popularity among investors seeking alternative investment options that offer potentially higher returns compared to traditional investments.

- Focus on Niche Markets. Syndication companies are increasingly targeting niche markets such as senior housing, student housing, co-working spaces, and sustainable or green properties. These specialized sectors offer unique investment opportunities and cater to specific market demands.

- Geographic Diversification. Syndication companies are expanding their investment portfolios geographically, seeking opportunities in emerging markets or regions with favorable market conditions. This diversification helps mitigate risks and gives investors access to diversified real estate projects.

- Technology Integration. Syndication companies are leveraging technology to streamline processes, enhance investor communication, and improve operational efficiency. Online platforms, investor portals, and crowdfunding platforms are becoming more prevalent, making it easier for investors to access and participate in syndication opportunities.

Predicted Future Developments

- Continued Growth. The markets expect the demand for real estate syndication to continue growing as more investors recognize the benefits of passive real estate investing and seek diversification in their portfolios.

- Expansion into International Markets. Syndication companies may explore opportunities in international markets, capitalizing on globalization and expanding investment options beyond domestic borders.

- Impact Investing. As sustainability and social responsibility become more important to investors, syndication companies may focus on impact investing, seeking properties and projects that align with environmental, social, and governance (ESG) criteria.

- Embracing Technology. Technology will play an increasingly vital role in real estate syndication, with advancements in artificial intelligence, data analytics, and blockchain potentially revolutionizing the industry. These technologies can streamline processes, enhance due diligence, and provide greater transparency for investors.

Impact of Technology on Real Estate Syndication

- Enhanced Due Diligence. Technology enables syndication companies to leverage data analytics and machine learning algorithms to conduct more comprehensive due diligence on investment opportunities, resulting in better-informed investment decisions.

- Investor Access and Communication. Online platforms and investor portals allow syndication companies to provide real-time updates, financial reporting, and communication channels for investors. This improves transparency and enhances the investor experience.

- Crowdfunding and Tokenization. Technology has facilitated the rise of real estate crowdfunding platforms, allowing smaller investors to participate in syndication opportunities. Tokenization, utilizing blockchain technology, may provide increased liquidity and fractional ownership in real estate assets.

- Smart Contract Automation. Smart contracts can automate various processes in real estate syndication, including capital contributions, distributions, and compliance with regulatory requirements. This technology reduces administrative burdens and enables faster execution of transactions.