If you are new in the investment world or you are looking for ways to invest, you hear a lot of strategies. These strategies to invest is vital in the diversification. You can diversificate within these strategies. In addition, you can also choose to do several strategies in one portfolio. One of the most popular strategies is growth investing. Since it’s popular, you probably heard it before. You might wonder what is growth investing and what are the ways you can do it.

There are many different ways to do growth investing. However, the purpose of this strategy is generally the same. You try to increase your capital in the short term. You do this by finding possible profitable companies. They are generally working with developing technologies or in profitable sectors.

The greatest examples to growth stocks in recent memory includes Amazon, Apple, Microsoft. These giants provided massive returns for growth investors in the past. It might look like you missed the train with current market. However, it is still a desirable approach for investors to try to outperform the market. It comes with its risks but this is the case with every stock and time. It’s unlikely that you will earn the same returns if you invested in Apple or Amazon decades ago. What do growth investments look for? The answer to this question is pretty simple yet complicated. This article will show you what is growth investing, what do growth investors look for and some examples.

What is Growth Investing?

Growth investing is a long-term investment approach. It is about trusting on growth stocks to outperform the market. Growth stocks generally don’t provide dividends to shareholder. They choose to reinvest those dividends to help the business grow. They are also likely to be young or small-cap businesses. Growth stocks also belong to sectors of the economy that expand fast, like technology.

Consider blockchain technologies, new medical procedures, new online technologies, and information technology. One of these industries will be anything with a strong chance of growth. For example, a utilities company usually won’t have a growth potential. That’s because their clientele is different.

Sometimes growth investors can combine this approach with other strategies. The biggest example is dividend growth stocks. They are popular stocks many people invest their money in. Dividend growth stocks are rarely new or tiny businesses like classic growth stocks. They might be mid-size or big companies that have the potential to growth further at a bigger level. This is a bit riskier because mid-size companies generally don’t grow much. It is harder to grow once you are at a certain level.

Many people focus on growth investing because of the profit potential. Since such businesses are not tested, they frequently are. That is why when you are putting your money in growth stocks; you need to be careful. By selecting the wrong stock, you might lose a significant portion of your capital. Diversification becomes way more critical with growth investing due to this.

Volatility is much higher than in other strategies. For example, dividend investing or value investing do not have as high volatility as growth investing. That is why, growth investment and value investing can be contrasting.

How Does Growth Investing Work?

Growth investors seek holdings in fast-expanding sectors (or even whole markets). These sectors or markets mostly come with developing new technology and services. Growth investors seek profits through capital gain. Their aim is to realize these gains when they sell their shares. In contrast to dividends where they receive money while owning them. In reality, instead of paying dividends, most growth businesses reinvest back into the business.

These are often tiny, young businesses with great promise. They might also be corporations that have only recently begun trading publicly. The outlook is that the company will succeed and grow. This increase in earnings or revenues would eventually convert into higher stock prices. As an example, back at the beginning of the 2000s, Microsoft or Apple were a growth stock. Their business model was highly new, and no one was sure if they would make it.

The people who took risks on these two companies earned a lot of money. Because Microsoft and Apple became the two biggest companies in the entire world. But during the same period, there were many other companies that failed to make it to the big stage. These two were one of the few successes in growth investing strategy. Out of hundreds of companies, only two remain in the big stage. This is what the risk of growth investing is. Uncertainty. You don’t know what is going to happen tomorrow. With other strategies, this might not be as big of a risk.

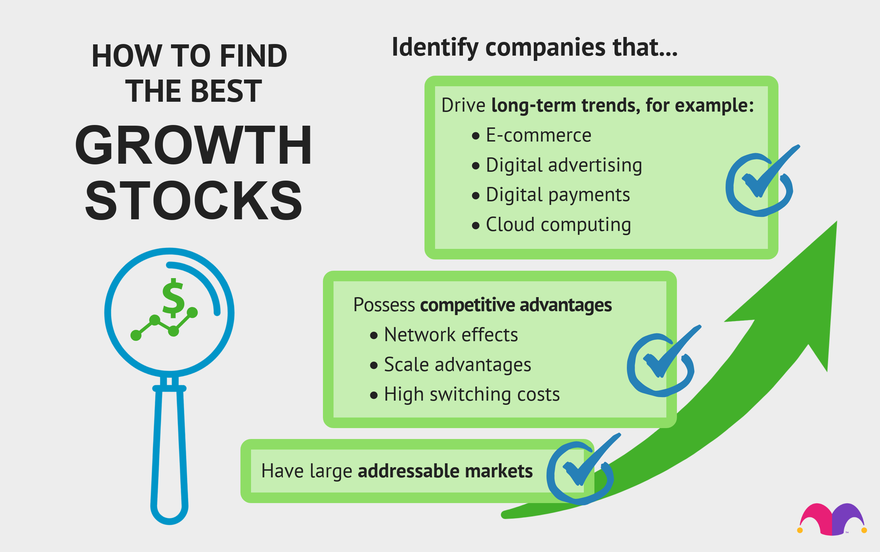

How to Find Growth Stocks

You have to look at many statistics while attempting to find grwoth stocks. Those statistics will also help you to determine the valuation of any growth stock. Investors who examine growth stocks may see that not all growth stocks are the same. This diversity offers both short- and long-term investment opportunities.

Successful growth stocks exhibit many of the same traits. These include a potent leadership group and promising future growth. Innovative concepts are welcome in the mix. These characteristics, along with the others listed below, can point to a stock that may about to increase in price.

Strong Management

Growth businesses focus on boosting their sales and profits. That is why the management’s vision and competency matter. A creative team of leaders is necessary for business growth. If there is a weak management without compecenty, it might block growth.

Growth investors should focus on businesses with strong management and a CEO. This strength could come from a solid track record of success and set goals for the future. Also, keep an eye out for fresh thinking. Bill Gates and Steve Jobs serve as illustrative examples of inventive business entrepreneurs. Anything that is new on the market is hard to maintain. Yet, when the management is competent enough, they will likely to overcome that.

Many growing companies are new with few historical points to look at. When this is the case, you can’t look at how the company performed in the past. The past successes and records of the management comes in. If they are successful enough and have enough experience, this is a good sign. Finding the next big growth firm or innovator may not be simple. Studying leadership teams might be a good start. Avoid investing in a firm that lags behind. Prefer one that leads the pack.

Increasing Market Share

A growth stock should not only a sector with significant potential. It should also have a significant market share. Market share is the ratio of a company’s total sales to those of its sector. It serves as a gauge of how competitive a business is in relation to its competitors. Growing revenues also increases the market share of a company.

The new growth businesses might not have a high market share at first. A good role of thumb is whether their sales are increasing. This will increase the market share, as well. In a market with potential for growth, you might not want to invest in the third or fourth competitor. Investors seek out businesses that can maintain their competitive advantage.

Does the business produce a lot of popular products? Are there any innovations having an impact? Or does a business keep riding the success of its first accomplishment? Investors should think about these issues. Finding answers to these questions is important. New and dynamic businesses could answer these questions perfectly. They rather don’t match the metrics you are looking for besides these questions.

Solid Sales Growth

Management and increasing market share is one thing about growth stocks. These are important and could determine the future of the company. Both of these should account for high sales growth. If the sales are not going up, neither of those matter. A good management and an increasing market share generally gets you a solid sales growth. You can start by looking for businesses with growth in sales, revenue, and earnings in the past.

Look for metrics for rising sales growth related to the company itself or the industry in general. You should avoid companies with decreasing or steady sales growth. A growth business must grow in most of the economic scenarios to not go bankrupt. A stock’s price is more likely to increase the faster the growth rate. Bsinesses that are increasing their sales and profits will make good investment. There is no set formula for determining how well a winning stock will do.

To find growth stocks, look for firms that are transforming the way people do things or live their lives. For example, firms with a concentration on the Metaverse could be good growth stocks. Because the market anticipates enormous profit possibilities from this new technology. Fool.com has some ideas about which growth stocks could be safer than others. Which could also provide some value in the future.

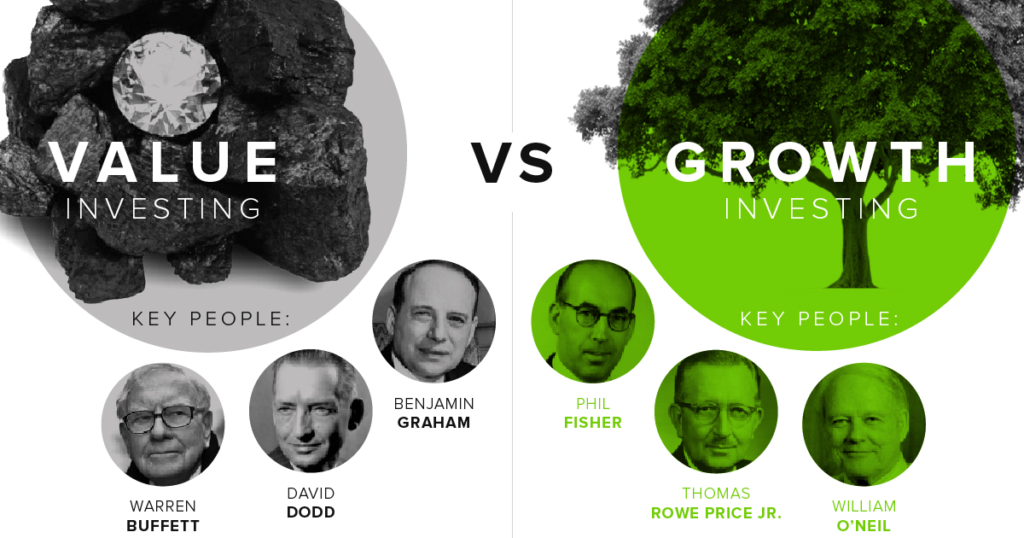

Growth Investing vs. Value Investing: Is Growth Investing Better?

Determining which investment style is better is not easy. It is worth remembering that there is no good answer for this. Everyone chooses a style that fits the best for them. The future goals, personality, risk appetiate, all matters. Some investment styles perform better than others in various economic situations. That’s where your risk appetiate comes in.

There is no formula or style to win all the time. Growth investment function best when interest rates are low and likely to remain low. Many investors chooses to migrate to value investing when rates increase. Growth stocks have had a better recent run since the COVID-19 pandemic. Yet, value stocks have a better long-term track record. According to Dr. Robert Johnson, co-author of “Strategic Value Investing”, growth companies is for the short-term. Growth stocks focuses on the short-term gains. Value investing focuses on sometimes both and sometimes for long-term.

What is the Overlap?

You might see stocks listed in both growth and value lists. Depending on which criteria you look for, they might fall under the same criteria. Why does that happen? Aren’t they different things? Even though they are different, they share some similarities. Most investment strategies are very different from each other. There are also strategies that could be similar. These similarities lead to some stocks falling under same categories. A stock could also change from value to growth throughout the course of its lifespan, or vice versa.

With valeu and growth investors, the aim is also the same. They want to buy at a low price and sell at a high price. Only the way they go around to achieve this is different. Because the aim is the same, seeing overlapping is normal. Overlap mostly focuses on the criteria you look at. The time you hold doesn’t really matter much. If the criteria fits into what you want, they can both be growth and value stock.

Value investors want businesses with a track record of success. An undervalued stock price is also something they look for. Growth investors look for businesses with the potential to grow in the future. Thus, they expect an increase in the stock price as those businesses grow. This could be the fundamental difference. The time they want to sell in could seem different but it could be close to each other.

Are Growth Stocks Safe?

You can’t outperform the market if you don’t take risks. Growth stocks are one of the most risky stocks available to buy next to penny stocks. That is pretty obvious. After all, there is not one thing set about these companies. You bet on the future and how well they will perform. That’s why growth stocks are not safe at all. Be aware of this if you decide to opt for this strategy.

Growth businesses’ model is not proven to be efficient. There is nothing to look at for indicators. Most of the time and they are most likely to not stay afloat for long times. If the company doesn’t stay afloat, you will lose your money. One of the best examples to growth stock successes is the biggest tech companies of today. Google, Microsoft, or Apple is the biggest example. They were a huge risk two decades ago.

It is true that the more risk you take, the bigger the potential profits. That is why many investors like growth stocks with high levels of risk. This is safe to say that growth stocks are some of the less safe stocks you can have in your portfolio. If your risk appetite is not big and you don’t want the obvious risk of losing money, don’t meddle with growth stocks. Rather go with bonds or dividend investing.

Best Growth Stocks for 2022

Any of the stocks I give here is only for information purposes. They are in any way a recommendation to buy. I think they might increase in the future with strong growth potential. Make your own research before deciding to buy any of them.

- Advanced Micro Devices (NASDAQ: AMD)

- Salesforce.com (NYSE: CRM)

- Synopsys, Inc. (NASDAQ: SNPS)

- Nvidia (NASDAQ: NVDA)

- VISA (NYSE: V)

- Adobe Stock (NASDAQ: ADBE)

- Alphabet Inc. (NASDAQ: GOOG, GOOGL)