The world of cryptocurrency is extremely exciting nowadays. Mainly because digital assets have revolutionized the way we perceive and handle money. In this article, I will try to explore the vast opportunities for those looking to learn how to make money with cryptocurrency. Whether you are an experienced investor or a curious beginner, this blog post will give you the basic knowledge and strategies you need to make money with cryptocurrency.

Introduction to Cryptocurrency and its Potential for Profit

Before learning how you can make money with cryptocurrencies, you should know one thing. What is cryptocurrency? The term cryptocurrency means digital or virtual currencies that utilize cryptography for secure transactions. Unlike traditional fiat currencies, cryptocurrencies operate on decentralized networks called blockchains, which ensure transparency, security, and immutability. The first and most well-known cryptocurrency, Bitcoin, burst onto the scene in 2009. It opened the way for thousands of alternative coins (altcoins).

Understanding the potential to make money with cryptocurrency

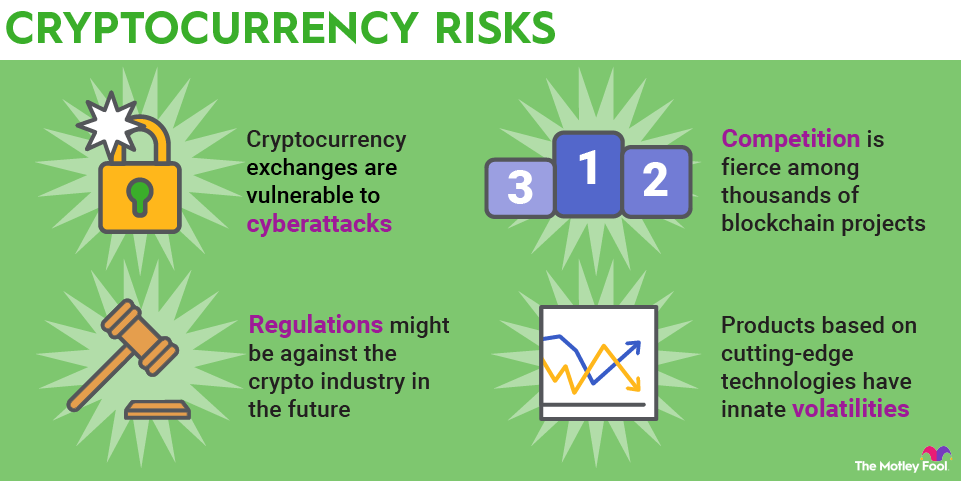

The cryptocurrency market is known for its extreme volatility. Just like in any other financial market, this can be a double-edged sword for investors. On the one hand, significant price fluctuations provide ample opportunities for substantial gains. On the other hand, the market’s unpredictability poses risks that must be carefully managed. To make money with cryptocurrency, it is crucial to grasp the various investment strategies, weigh the associated risks, and stay informed about market trends.

Getting Started with Cryptocurrency Investments

Getting started with the cryptocurrency world is actually quite simple. You just need to know where to look and how to start. To make money with cryptocurrencies, you first need to make some cryptocurrency investments. Without making investments, you can’t start making money as it’s not a side hustle to actively work on.

Setting up a cryptocurrency wallet

Before diving into the world of cryptocurrency investments, it is essential to secure a reliable and secure wallet. Wallets serve as digital repositories for storing, sending, and receiving cryptocurrencies. You first need to choose a trustworthy and reputable wallet for yourself. You make this decision by checking out the reviews, weighing pros and cons, and seeing what you need first. It’s also vital to understand the concept of public and private keys, which are fundamental to the security of your crypto assets.

Selecting the right cryptocurrency exchange

Cryptocurrency exchanges act as intermediaries. They open the way for investors to buy and sell digital assets. With countless exchanges available, selecting the right one can be overwhelming. Some popular ones include Coinbase, Binance, and Kraken. Their features, fees, and security measures are some of the most important factors. If you go by these basic things and ensure that they meet your needs, it will be easier to choose an exchange.

Buying and selling cryptocurrencies

Once you have set up your wallet and chosen an exchange, it’s time to enter the cryptocurrency market. The process of purchasing cryptocurrencies is quite simple as buying stocks on the stock market. However, you must ensure that you understand the mechanics of buying and selling digital assets. Since cryptocurrencies are volatile, timing your trades, selecting the right order types, and deciding how you are going to trade are important things to understand.

Investment Strategies for Profiting with Cryptocurrency

Just like stock investing, the cryptocurrency world also comes with different investment strategies. You can choose whichever you want, depending on your risk profile and your financial goals for the future. All come with their own risk.

Long-term investment strategies

Long-term investments in cryptocurrency involve holding onto digital assets with the expectation of future price appreciation. The “HODLing” (holding) strategy is one of the most popular ones in the crypto exchange world. You need to learn how to identify promising projects and emphasize the importance of diversifying your cryptocurrency portfolio.

Day trading and short-term strategies

Day trading aims to profit from short-term price fluctuations in the cryptocurrency market. It follows the same principles as day trading in the stock markets. You can use the same tools and techniques, such as technical analysis tools, indicators, and risk management strategies. Your aim is try to successfully make trades and set stop-loss orders to stop potential losses by focusing on maximizing your short-term gains.

Staking and earning passive income

Staking is a strategy that involves actively participating in a cryptocurrency network and earning rewards for validating transactions. It’s similar to the dividend stocks in the financial stock markets, where you get money just by holding a coin. The fundamentals behind it are a little different than dividend stocks but as a consumer, you receive money just because you hold a specific coin.

Mining cryptocurrencies

Cryptocurrency mining is a process that involves validating and adding transactions to a blockchain while being rewarded with newly created coins. You need solid hardware and software, evaluate the profitability minus the costs, and have enough space to create a mining room. By utilizing the energy, you create coins instead of buying them on the market.

Participating in Initial Coin Offerings (ICOs)

Initial Coin Offerings (ICOs) allow individuals to invest in early-stage cryptocurrency projects. You need to do a solid due diligence process for evaluating ICO projects before you invest, as they are one of the riskiest investment strategies to invest in cryptocurrencies. They are similar to Initial Public Offerings (IPOs) in the stock market.

Generating income through cryptocurrency lending

Cryptocurrency lending platforms provide an opportunity to earn interest by lending your digital assets to borrowers. There are various lending platforms that allow cryptocurrency lending to make money with cryptocurrency.

Managing Risk and Maximizing Profit in Cryptocurrency Investments

You have to understand market trends and make use of analysis tools if you want to make informed investment decisions. Fundamental analysis, technical analysis, and the significance of staying updated with news and market updates are some of the most important things to know to manage your risk and maximize your profits.

Just like when you invest in anything else, diversification is also important in cryptocurrency investment. Whether you are investing for the long-term or lending your cryptocurrencies, holding more than one cryptocurrency is a key risk management strategy in cryptocurrency investments.

Additionally, you also require proper risk management during your investment journey. This involves setting realistic investment goals, assessing your risk tolerance, and developing a personalized investment plan.

Conclusion

The cryptocurrency market offers an unlimited and vast place for making money. This article covered the fundamentals of making use of this place and learning how to make money with cryptocurrency. From understanding the basics of cryptocurrency to exploring various investment strategies and risk management techniques, all are crucial in your journey.