Dividend investing journey is complicated and choosing among the best brokers for dividend investing is even more complciated. There many options for different investment strategies. ETF investing, dividend investing, growth investing, and many more. Choosing the right path and knowing whether that path is the right fit for you is getting harder and harder. One of the most popular options is the dividend investing strategy, and many wonder if dividend investing is worth it. That’s mainly because dividend investing requires a lot of time and capital.

Dividend investing has gained popularity among investors seeking steady income and long-term wealth accumulation. In this comprehensive guide, we’ll explore the world of dividend investing and talk about the best brokers for dividend investing. We’ll deep dive into dividend strategies, the worthiness of this investment approach, and how to select the best broker for dividend ivnesting. Whether you’re a beginner investor or looking to diversify your portfolio, understanding dividend investing is essential to achieve your financial goals.

What is Dividend Investing?

Dividend investing is an investment strategy focused on purchasing stocks that regularly pay dividends to shareholders. Dividends are a share of a company’s earnings distributed to investors as cash payments or additional shares of stock. Dividend-paying companies are often established, financially stable, and generate consistent profits. Investors who embrace dividend investing prioritize regular income, capital appreciation, and the potential for dividend growth over time.

Understanding Dividend Investing

A dividend investing strategy is a strategy that focuses on selecting stocks of companies that pay regular dividends. Dividends are payments made in cash by companies to the shareholders, usually on a quarterly basis. These dividends are a share of the company’s profits and can be a valuable source of passive income for investors.

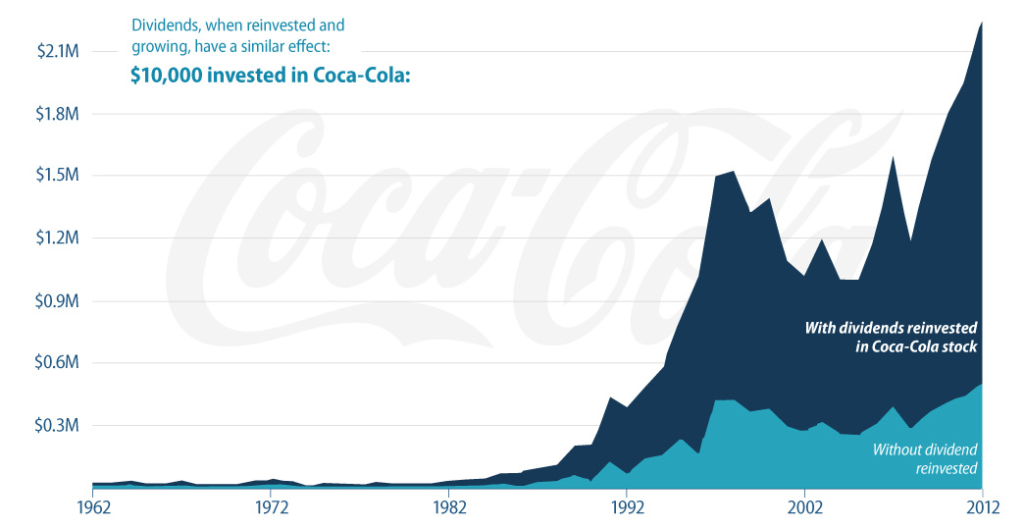

One of the key benefits of dividend investing is the potential for consistent income. Unlike other investment strategies that rely solely on capital appreciation, dividend investing provides a regular stream of cash flow. This income can be reinvested to acquire additional shares, further compounding your returns over time.

The Benefits of Dividend Investing

- Steady Income. Dividend-paying stocks provide a reliable income stream. This makes them attractive for income-focused investors, retirees, or those seeking passive income.

- Long-Term Wealth. Reinvesting dividends can accelerate the growth of your investment portfolio over time. Because compounding is a key component to dividend investing.

- Inflation Hedge. Dividend payments often increase over time. This helps investors preserve purchasing power against inflation.

- Stability. Dividend-paying companies tend to be more stable during market downturns. Their consistent cash flow can cushion the impact of market volatility.

- Tax Advantages. In some jurisdictions, dividend income may receive favorable tax treatment, potentially reducing your tax liability.

Developing a Dividend Investing Strategy

To make the most of dividend investing, it’s important to develop a well-thought-out strategy. Here are some key considerations.

Identifying Dividend Stocks

Look for companies with a history of consistent dividend payments, solid financials, sustainable payout ratios, and potential for future growth. Conduct thorough research on their financial health, competitive position, and industry trends.

Dividend Reinvestment

Reinvesting dividends allows you to purchase additional shares, compounding your investment and increasing future dividend income. Take advantage of dividend reinvestment plans (DRIPs) offered by some companies and brokers.

Dividend Yield vs. Dividend Growth

Consider your investment goals—whether you prioritize high current income (high dividend yield) or potential for future income growth (dividend growth stocks).

A higher yield indicates a higher potential return. Additionally, assess the payout ratio, which represents the proportion of earnings paid out as dividends. Look for companies with a reasonable payout ratio to ensure the sustainability of their dividends.

Diversification

As with any investment strategy, diversification is crucial. Spread your investments across various sectors and industries to mitigate risk and balance your dividend income sources.

Monitoring and Adjusting

Regularly review your dividend stocks, ensuring they continue to meet your investment criteria. Be prepared to make adjustments when necessary.

Evaluate Dividend Growth

Look for companies that have a history of increasing their dividends consistently. A rising dividend is an indication of a company’s financial strength and confidence in its future prospects.

Is Dividend Investing Worth It?

Dividend investing can be a rewarding strategy, but it’s important to assess its suitability for your financial goals and risk tolerance. That’s why many investors wonder if dividend investing is worth pursuing. The answer lies in the advantages it offers over other investment strategies. The most important thing is generally, dividend-paying stocks tend to be more stable and less volatile, making them attractive to risk-averse investors.

However, there are many other things to consider to see whether dividend investing is worth it or not. Consider the following factors:

- Income Needs: If you require regular income to cover living expenses or achieve financial independence, dividend investing can be an attractive option.

- Long-Term Focus: Dividend investing aligns well with long-term investment goals, as it emphasizes consistent income and potential for capital appreciation.

- Risk and Return: Like any investment, dividend stocks come with risks. Evaluate the risk-return tradeoff, considering factors such as market volatility, company-specific risks, and dividend sustainability.

- Personal Preferences: Assess whether dividend investing aligns with your investment philosophy, beliefs, and values. Some investors prefer growth-focused strategies or a mix of income and growth investments.

Choosing the Best Broker for Dividend Investing

Selecting the right broker is crucial for effective dividend investing. Consider the following factors:

- Dividend-Friendly Features: Look for brokers that offer dividend reinvestment plans (DRIPs), commission-free dividend reinvestment, and timely dividend payment processing.

- Research and Tools: Access to comprehensive research, stock screeners, and analysis tools can assist in identifying high-quality dividend stocks.

- Cost Structure: Compare commission fees, account maintenance fees, and other charges. Opt for a broker that offers competitive pricing and value for your investment.

- Broker Reputation: Consider the broker’s track record, customer service, and user experience. Read reviews and seek recommendations from trusted sources.

Best Brokers for Dividend Investing 2023

There are many popular brokers out there; some are better options for dividend investing than others. These are solely my opinions and are not advertisements, and make sure to do your own research before using them.

Conclusion

Dividend investing can be a valuable addition to your investment strategy, providing regular income, long-term wealth accumulation, and stability in your portfolio. By understanding the principles of dividend investing, developing a sound strategy, and selecting the best broker to support your goals, you can navigate the dividend investing landscape with confidence. Remember to conduct thorough research, diversify your holdings, and stay informed about market trends. Happy dividend investing!