The best way to grow wealth, keep it, and not work for it again to retire early is mostly possible passive income through. I’ve talked about passive income, what it is, and how you can get started with it quite frequently. That’s because, as I said, I believe passive income is the ultimate method to grow your wealth, reach financial independence and retire without thinking about money.

However, it’s not that easy. There are many risks involved passive income and passive income streams. One of those risks is putting all your eggs in one basket and not diversifying your passive income streams. Many people do this mistake. You need to avoid it if you want to actually succeed. You might be getting income from one passive income source, but how do you know that stream will keep going for a very long time? To avoid this issue, you need to do diversification.

I will talk about passive income diversification and how you can do diversification easily and reduce your risks. This way, your financial future will be more secure.

What is passive income?

Passive income is a type of income that requires little to no ongoing work to maintain. This means that you can earn money without actively working for it. There are several ways to create a passive income stream, but one common strategy is to invest in assets that generate revenue. These assets might be:

- Rental properties

- Dividend-paying stocks,

- Interest-bearing accounts,

- Royalties.

The key to passive income is to set up streams of income that bring in money without your involvement. They continue to bring in money even when you’re not actively working on them. However, you must put in the effort before generating income from the passive income methods you choose.

For example, let’s think you own a house. In this scenario, you can rent this house to others. That way, you will earn rental income even when you’re not working on it. But you need capital to purchase that property. The same applies to digital products. Once you create and sell them, they can continue to bring in money even when you’re not working on them. But you need to invest time and potentially money before starting to generate revenue.

The importance of diversification in a passive income portfolio

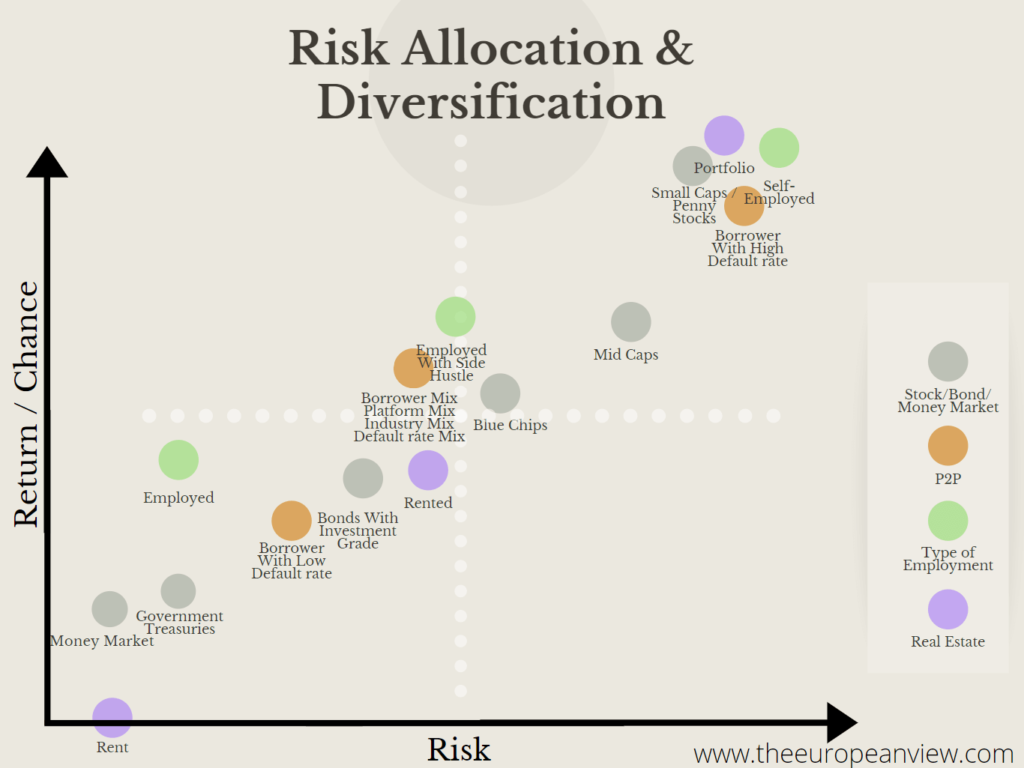

Diversification is crucial when it comes to building a passive income portfolio. It is spreading your investments across different assets, industries, and sectors instead of putting all your eggs in one basket. By diversifying your portfolio, you minimize your risk and maximize your potential for returns.

Let’s say, for example, you invest all your money in a single stock. If that stock performs poorly, you will suffer significant losses. However, if you spread your investments across different stocks, bonds, and real estate properties, for example, the impact of a single stock performing poorly on your portfolio will be less severe.

In addition, diversifying your passive income portfolio allows you to take advantage of different market conditions. For example, if the stock market is down, your rental property may be performing well. By having a diverse portfolio, you can minimize the impact of any downturns in one area and take advantage of opportunities in other areas.

Assessing Your Current Passive Income Streams

Assessing your current passive income streams is important when it comes to building a diversified portfolio. By taking stock of the different sources of passive income that you have, you can identify any areas that may be lacking and adjust accordingly. This allows you to ensure that your portfolio is well-rounded and able to weather any market fluctuations.

Additionally, It can also reveal any income streams that may be generating lower returns and require you to rethink them or add other sources of income. In order to create a truly diversified passive income portfolio, it is important to evaluate your current streams of income and make changes as needed to ensure that you are well-positioned for long-term success.

Identify your current passive income streams

Identifying your current passive income streams is important in building a diversified portfolio. One way to do this is by reviewing your financial statements and looking for any income sources that come in regularly without your active involvement. As I mentioned previously, examples of passive income could be:

- Rental income

- Dividends

- Royalties

- Interests.

You can also take a look at your current investments and see if they are generating any passive income. Identifying where you stand with your passive income streams is a good way to understand how you can diversify and how much you need.

How can I diversify my passive income portfolio for stability and growth?

Both your current passive income streams and the ones you are thinking of starting need stability and room for growth. That’s why whatever you have or are thinking of having, you must evaluate them for how stable they are and how much they can grow. There are several ways to do this evaluation.

First, look at whether there are any continuous risks associated with this income? Can the income go to zero or go down drastically from month to month. If yes, then that might not be the best option for you. Then look at how much the income can grow over time. Do you think you can increase the business you are doing and increase your income over time? Some businesses, such as one-item dropshipping stores, don’t have this capacity. Try to stay away from those.

You can start diversification by answering these questions and ensuring that the passive income ideas in mind match these evaluations for stability and growth. The more stability and growth a passive income stream has, the more reliable it is. Try to find one or two streams from different industries, sectors, or areas that have these features.

Determine which streams to keep, modify, or eliminate

If you already have some working passive income streams, you might need to make some decisions. Not all of your passive income might be performing well with this new information. You might realize that some of them are not stable or have no room for growth.

Determine which of these passive income streams you should keep, change a little bit, or eliminate. This will remove some burden on your shoulders, and you can focus more on the more important passive income methods.

Determine Your Passive Income Goals

Determining your passive income goals is important in building a diversified portfolio. Start by identifying the amount of money you want to earn from your passive income streams, whether it’s to supplement your current income, reach financial independence, or retire early. This will give you a clear target to work towards.

Next, consider the different types of passive income you are interested in. Examples of passive income include rental income, dividends, and royalties. By understanding your interests, you’ll be better equipped to find the right opportunities for your portfolio.

Also, it’s important to set a realistic time frame for your goals, whether it’s short-term or long-term. It will help you measure the progress and make necessary changes if the results are not as expected.

Set specific, measurable, attainable, relevant, and time-bound (SMART) goals

SMART goals are one of the most useful methods of keeping track of your goals and aims. By creating these specific SMART goals, you should also set clear and achievable targets for your passive income. These goals should be:

- Specific: clearly defined and focused,

- Measurable: able to track progress,

- Attainable: realistic and achievable,

- Relevant: aligned with your overall goals,

- Time-bound: with a set deadline.

By setting these types of goals, you will have a clear plan and direction to reach your financial objectives. This will help you focus on what you want to achieve, track your progress, and make adjustments to reach your financial goals.

How can I determine my passive income goals, time horizon and risk tolerance?

Determining your end goals, time horizon, and risk tolerance all depend on your overall aim of creating a passive income. They are all related, and without knowing one, you can’t come up with another. Discover your financial goals, time frame and risk tolerance by assessing your current income, expenses, and savings.

Determine your passive income goals by considering your desired lifestyle and future plans. Set a realistic time horizon for achieving your goals and evaluate your risk tolerance to find the right investment strategies that align with your financial objectives. With this information, you can create a clear plan to achieve your financial goals and success.

Decide on a balance of stability and potential growth in your portfolio

Whatever path you decide to go, always make sure that your passive income streams are stable and have room for potential growth. All your passive income streams must have sustainable stability and potential growth. Both of these will help you keep your income balanced without increasing your risk levels too much.

How to Research and Evaluate Potential Passive Income Opportunities

Researching and evaluating potential passive income opportunities is important in building a diversified portfolio. One way to do this is by researching different investment options and reviewing their past performance and risk level. This can include researching stocks, bonds, and real estate properties.

Another way to research potential passive income opportunities is by seeking advice from financial experts and reading online articles and reviews. By researching the potential opportunities, you can better understand each option’s risks, potential returns, and overall feasibility.

Evaluate the potential return on investment, risk, and time commitment for each opportunity

Researching potential passive income streams might be overwhelming. However, there are three things that you have to always look out for:

- The potential return on your investment,

- Risks,

- Time horizon.

Research and analyze the market, competition and industry trends to understand all three of these on each potential passive income stream.

Evaluate the return on investment by calculating the potential income, costs, and taxes. Consider the level of risk involved and your risk tolerance. Also, evaluate the time commitment required to maintain and manage the income stream. By carefully evaluating these factors, you can make informed decisions and choose the right passive income streams that align with your financial goals and risk tolerance.

Implement and Monitor Your Passive Income Plan

Once you have identified your passive income goals and researched potential opportunities, it’s time to start taking action. It’s important to create a system for tracking your progress and monitoring your investments. This can include regularly reviewing your financial statements, setting up alerts for any changes in your investments, and keeping detailed records of your income and expenses.

Additionally, it’s important to remember that passive income is not a set-and-forget. It’s important to regularly review and adjust your plan as market conditions change. By taking action, tracking your progress and making necessary adjustments, you can ensure that your portfolio is well-rounded and able to withstand market fluctuations, providing you with a steady stream of passive income.

Set up your passive income streams

The most important thing about passive income is that it takes time. You can’t expect any income from day one or from the first month. Just start with setting everything up, even if you don’t know how to do it. If you have an idea of doing podcasts, start coming up with the topics and just start talking. Figure out the other details later.

You don’t know how to share your podcast? Record the episode and try to learn how to share it. You don’t know how to market your podcast? Upload your episodes and figure out how to best market them as you go. Don’t lose time thinking. Just do it.

Monitor your progress and adjust your plan as needed

Once you start it, keep monitoring how you are doing. See the mistakes, areas to improve, and missing things. Improvise and put more effort into fixing that. This will allow you to not lose time and also get better as you go. No one starts perfectly.

The Verdict

Passive income is important if you want to grow your wealth, keep it that way, and also retire without having to work. However, they are a lot of work. On top of that, you can’t also rely on just one passive income stream. You need to have multiple. You must diversify your passive income streams. This helps you to avoid the risks of losing your income and have more potential to grow your income.