One of the simplest and most efficient methods to create long-term wealth is through stocks. While doing this, you have to pick the best investments you can. There are plenty of options. They range from cheap index funds to specific stocks. Where you choose to invest is mostly a matter of personal preference. So there isn’t always a right or wrong decision. One of those popular options is to invest in S&P 500 Index Fund.

Among many answers, there are popular and not-so-popular options. One of the most popular options is index funds. They affordably disturb your investment in large sectors or businesses. Index funds have emerged as one of the most well-liked investment options. You can buy the top 500 American blue-chip corporations with a single transaction. This is the S&P 500 Index. One share you buy of the S&P 500 index fund equals purchasing a limited number of these shares.

:max_bytes(150000):strip_icc():gifv()/SP500Index-2cf49ffba11b4eab90b2dc17d06176e9.png)

Yet some say that you can get better results by investing in individual stocks. This might be true on paper but hardly holds up in reality. The only time investing money is worth it is when an investment gets you a return on your capital. That’s why you need to pick correctly.

Let’s see why you should invest in S&P 500, what exactly it is and many more details about S&P 500.

What is S&P 500?

The S&P 500 Index is an index that measures the performance of companies with a large market value. The S&P 500 is a portfolio of approximately 500 of the top firms traded on the New York Stock Exchange. It is perhaps the most used indicator of the US economy.

S&P 500 is just one of the hundreds of index funds around the world. Every country with a stock market has an index that you can invest in. You basically invest in the stock market when you invest in index funds. Because S&P 500 is the home to the biggest economy in the world, it is popular.

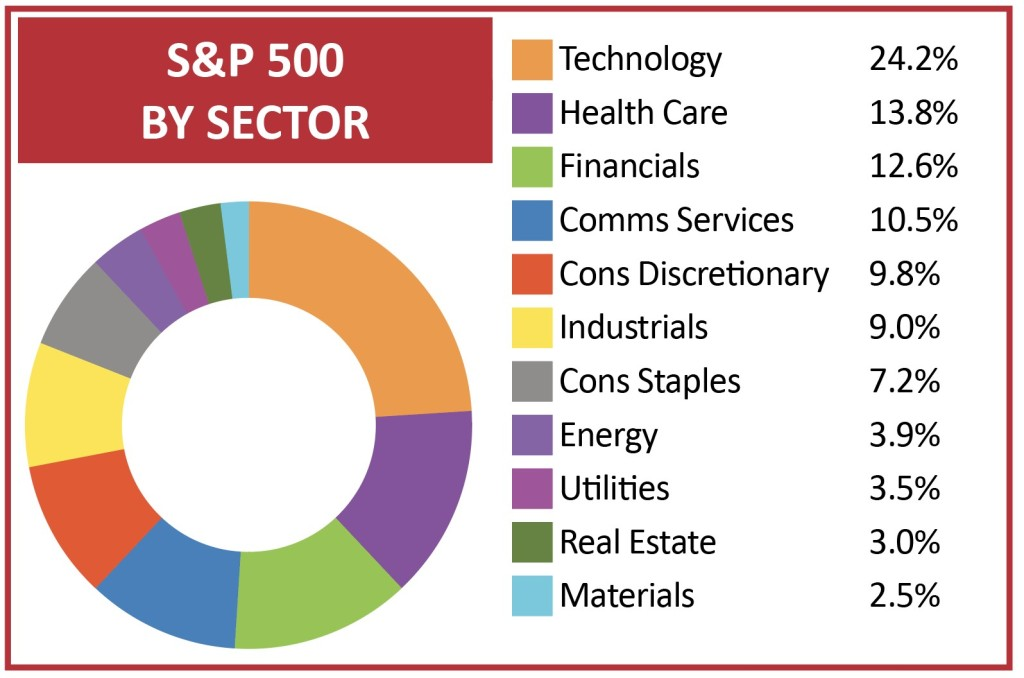

S&P 500 provides exposure to several areas of the economy. Such as the energy and finance industries and many others. This index is also weighted. This means that the largest stocks account for a larger share of the portfolio. For example, Apple is currently the largest stock in the index, accounting for around 6% of the S&P 500. The smallest stock is News Corporation Class B, which accounts for only .008% of the index.

So Apple is around 777 times the worth of the smallest share – but that doesn’t imply it’s insignificant. News Corporation Class B has a market valuation of $14.3 billion, which is the value of the company’s equity.

You’ll have exposure to these companies, as well as others. Other companies include Coca-Cola, PayPal, Disney, Home Depot, and Netflix. If you invest in S&P 500, you’ll get a piece of these companies with a single click.

What Makes it Great?

As I mentioned above, S&P 500 is popular and better than other index funds. There are many reasons why this particular index fund is better. The first reason is that it holds the biggest companies in the entire world. Most of the corporations on this index fund are worth tens or hundreds of billions of dollars. Two of the most known and valuable companies in the world- Apple & Microsoft – is in this fund. This makes it more attractive to every kind of investor.

Another thing is that S&P 500 has been providing an average annual return since its inception. This means that you will get an average annual return when you invest in this index fund and do not touch it at all. There might be some downturns in the market like now, but your average return will be the same in the long run. That is why people choose to invest in S&P 500 over other index funds. It is reliable and is the biggest in the world.

There are no other better guarantees than this, as there is also no fund that can race with it. Some people also say that there are better alternatives than S&P 500 that could generate better returns. This could be true, but it will be riskier. S&P 500 is one of the minimal risks for investment in the long-term

Should You Invest in S&P 500 or NASDAQ?

There are main differences between indexes and how they work. Indexes cover things that they believe to be the best performer. This might depend on the sector, market value, or something else. Biggest indexes in the US are the Nasdaq and the S&P 500. They do not have significant differences. They are mostly similar to each other. The difference we can talk about is very slim, making it even harder to choose.

Their coverage universe and the sectors in the index are not so much different. The Nasdaq and the S&P 500 both cover a wide range of companies from various industries. They also give weights to specific companies in their index. The Nasdaq and S&P 500 indexes rank their constituents based on market value.

At this point, choosing which one to invest in totally depends on your choices. Which type of companies do you like, and which type of sectors do you like. Nasdaq is heavy in high-tech stocks. It also includes other sectors, but high-tech takes the lead. S&P 500 is way more diversified than NASDAQ. Taking a look at the companies within the indexes might help you make a better decision. Although it is worth remembering that one will not necessarily provide a better return than the other. They provide similar returns.

How Should a Beginner Start Investing?

Investing in the S&P 500 as a beginner might seem tricky. The thing here is that you can’t directly invest in S&P 500. You have to buy index funds or ETFs that track the performance of the S&P 500. Investing in the right index fund or ETF is totally okay. The tricky part is choosing the right fund. There are several considerations to make. These considerations might include the expense ratio, the minimum investment amount if there is any dividend, and so on.

Overall, how you start is pretty simple. You need to open a brokerage account and look at the funds available. Every fund is different from one another. Most of their fundamentals are the same because they are tracking the S&P 500. But the details surrounding the investment you make are different. How much fee do you have to pay, the minimum, etc. Sort the funds by these principles:

Expense Ratio

Index funds management is passive. This means that the managers buy and sell equities to keep the fund’s asset allocation in line with the benchmark. There is no need to extensively study or trade to take place. This keeps cost ratios, or the fees you pay for fund management, to a minimum. Almost all S&P 500 index funds perform identically. Selecting a fund with the lowest feasible expense ratio is critical.

Minimum investment amount

The investment minimums for index funds fluctuate. This amount depends on different accounts. Whether you buy them for taxable investment accounts or tax-advantaged retirement accounts matters in terms of the minimums. When comparing several S&P 500 index funds, check the minimum amounts. Ensure that they correspond to the amount you have to invest. After you invest, you should be able to purchase fractional shares.

Does S&P 500 Pay Dividends?

As I mentioned before, you can’t directly invest in the S&P 500 Index. Because the S&P 500 Index is an index in which investors cannot invest. That is why S&P 500 Index doesn’t pay dividends. Some companies in the index do pay dividends. These dividends that the companies pay to shareholders are not included in the performance of the index. So dividends are not directly a thing of the S&P 500 index. Dividends are a thing of the companies within the index.

At this point, the fund you invest in matters. As you know, investors who want to invest in the Index must do so through funds that track it. Some of these funds decide to pay the dividends of these companies. Be careful about the payments of the dividends. Some of these dividend-paying funds do not directly pay out the dividends. They automatically reinvest it back into the fund. So you don’t get the dividend in cash.

Some of the funds, however, do pay dividends in cash. This would mean that you will get dividends according to the fund’s payment calendar. These funds pay the dividends that corporations pay to their stockholders. You have to decide which one of these options fits your purpose the best.

If you think you don’t need to deal with the cash, opt for a fund that reinvests it directly. If you want to take the dividend and play a role in what you’ll do with it, go with a fund that pays it in cash.

S&P 500 or Individual Stocks?

Being stuck between S&P 500 and individual stocks is normal in your investing journey. Because there are an infinite number of alternatives. When it comes to which one to invest in, there are no right or wrong answers. It will mostly depend on what you actually want. Here’s how to choose between S&P 500 index funds and individual equities for your portfolio.

S&P 500

Investing in S&P 500 index funds has various advantages. For one thing, it’s a rather simple approach to increasing your savings over time. The longer you keep investing and leave your money in these funds, the more you’ll earn via compound earnings. You must invest a small amount each month and let the fund handle the rest.

Furthermore, S&P 500 index funds are often safer during periods of volatility. While your assets are likely to suffer in the short term, the S&P 500 has a lengthy track record of recovering. It will eventually recover from crashes, bear markets, and recessions. It can take months, if not years, for the market to fully recover. Investing in the S&P 500 nearly guarantees a recovery at some point.

S&P500 could be a safer option, but it might not give you the best results. Even though its annual average return is around 8%, individual stocks could give you a higher return. But the risk levels play a major role in S&P500 because it’s almost zero risk and individual stocks has a higher risk.

Individual Stocks

The major disadvantage of S&P 500 index funds is that you can’t modify them. It can also only produce average returns – exactly where individual stocks perform better. That is if you do it right.

When investing in an S&P 500 index fund, you must hold all the stocks in the index. But if you like to invest more in particular companies, you can’t do it. Individual stock investment, on the other hand, gives you complete control. Control over every part of your portfolio. And when you own S&P500, you own 500 companies. Furthermore, the weights of the investments will also be automatic. You can’t invest more in a specific company.

The biggest risk of individual stocks is that you might lose your money if you bet on the wrong horse. You have to be more careful and spend more time. Its risk is much more. The rewards might be higher than an S&P 500 fund.

What is the Average Annual Return?

Since its establishment in 1926, the S&P 500 index’s average annual return has been between 10% to 11%. This includes the S&P 90, which consisted of only 90 stocks between 1926 and 1957. Since the introduction of 500 stocks in 1957, the average annual return has been roughly 8%.

But that doesn’t imply things are always easy. There are occasions when the market is bearish for an extended length of time. But the market’s good times will make up for those losses. Your return will probably be in the single or double digits over a long period of time. Also a buy-and-hold strategy will get investors through the market’s ups and downs.

In addition, the S&P 500 index’s value has grown in 40 of the last 50 years, which is an excellent track record. The market had its time of ups and downs. If you have several decades before retirement, the S&P 500 has shown to be a rewarding and stable investment.

5 Best S&P 500 ETFs to Invest in

Here are five of the most popular S&P500 ETFs. These are not investment advice, and we ask you to do your own due diligence before investing in them. It is also equally important to research about the fundamentals of these ETFs. In addition to their performances, they have their own expense ratios.

SPDR S&P 500 ETF (SPY)

The State Street SPDR S&P 500 ETF is the oldest exchange-traded fund in the United States. It also has the most assets under management (AUM) and trading volume of any ETF. By itself, the SPY is the mother of all S&P 500 ETFs.

iShares Core S&P 500 ETF (IVV)

Blackrock’s iShares Core S&P 500 ETF is second only to the SPY in terms of asset base and duration. Its expense ratio is also lower than most of the S&P 500 ETFs. The average daily volume is a fraction of that of the SPY. Yet, it is still respectable and perfectly liquid for long-term investors.

Vanguard S&P 500 ETF (VOO)

This ETF matches the discount pricing of IVV for investors who like the Vanguard family of funds. Also Vanguard’s ETFs are one of the most popular ETFs on the market. In addition to their popularity, they are also very cheap in terms of expense ratio. But, Vanguard’s VOO hasn’t been around much. VOO has only been around for about a decade. VOO lacks the longevity of its counterparts on this list. It has a good average trading volume. Buy-and-hold investors do not need to have concerns about liquidity.

SPDR Portfolio S&P 500 ETF (SPLG)

The SPDR Portfolio S&P 500 ETF is State Street’s SPY fund’s cousin. It has a reduced expense ratio geared toward price-conscious everyday investors. In addition to having a cheap expense ratio, it is also fairly new. SPLG was only recently modified to track the S&P 500. Before January 2020, it tracked the SSgA Large Cap Index.

iShares S&P 500 Growth ETF (IVW)

IVW employs a distinct investment approach from the other ETFs mentioned above. Rather than monitoring the performance of the S&P 500, the iShares S&P 500 Growth ETF focuses on mostly growth. This means that growth plays a major role in this ETF. But you might think that than this is not a S&P 500. It might be partially true but it’s actually not. Besides tracking growth stocks, it only tracks stocks from the index. It is a sub-index that monitors roughly half of the S&P 500 that is ready for growth.