Digital real estate has emerged as a new and exciting investment opportunity in the modern age. As technology continues to shape our lives, the concept of real estate is not just physical property. It now includes valuable assets in the digital realm but is digital real estate worth it?

In many cases, digital real estate requires a lot of time, effort, and money to successfully establish and make money from it. That’s why you might wonder is digital real estate worth it? That’s a fair question, and there is a deeper answer to that. Let’s see if digital real estate is worth it or not.

Understanding Digital Real Estate

In its simplest form, digital real estate refers to virtual properties that hold value in the online world. These properties can encompass websites, domain names, social media accounts, and digital marketplaces. Just like physical real estate, you can buy, sell, lease, and earn financial gain from digital real estate. Understanding the concept of digital real estate is crucial before delving into its potential as an investment opportunity.

Websites, domain names, social media accounts, and digital marketplaces are some of the most popular and lucrative digital real estate available. The goal of digital real estate is that they serve as virtual storefronts, allowing individuals and businesses to showcase their products, services, or content to a global audience.

The goal is to create a brand, name, or just trade real estate in the short term to make simple and quick gains. These platforms provide individuals and businesses with an opportunity to build a following and engage with their target audience.

Types of Digital Real Estate

Digital real estate encompasses various types of virtual properties that hold value in the online world. You can choose one or more than one to spend your time, money, and effort on to make money from digital real estate. The important thing to make digital real estate worth it is to do something that you enjoy and can provide good potential in the long run.

Here are the types of digital real estate.

Websites

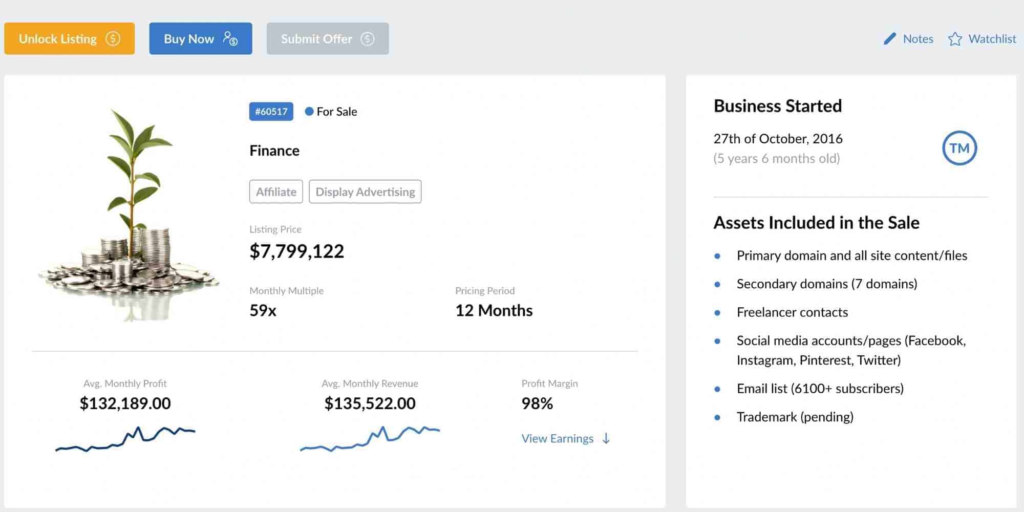

Websites are one of the most common and recognizable forms of digital real estate. They serve as online platforms where individuals and businesses can showcase their products, services, or content. Websites can generate revenue through various means, such as advertisements, affiliate marketing, or e-commerce. The value of a website is often determined by factors such as traffic, revenue, domain authority, user engagement, and niche market potential. Investing in websites can provide opportunities for passive income and potential appreciation in value.

Domain Names

Domain names act as the online address for websites. They play a crucial role in directing users to specific online destinations. Domain names can be generic or branded and can hold significant value depending on their length, memorability, relevance to popular keywords, and extension (.com, .net, .org, etc.). Investors can acquire valuable domain names with the intention of selling them for a profit or leasing them to individuals or businesses. The domain name market can be competitive, with prices varying greatly based on demand and perceived value.

Social Media Accounts

In the age of social media, having a significant following on platforms like Facebook, Instagram, Twitter, or YouTube can be considered valuable digital real estate. Social media accounts with a large and engaged audience offer direct access to a specific demographic, making them attractive to advertisers or individuals seeking to promote their products, services, or personal brand. The value of a social media account is influenced by factors such as the number of followers, engagement rate, niche relevance, and the quality of content. Investing in social media accounts can provide opportunities for monetization through sponsored posts, brand collaborations, or advertising revenue.

Digital Marketplaces

Digital marketplaces are online platforms where individuals can buy and sell digital products or services. Examples include Etsy for handmade goods, Amazon for e-books, or Shutterstock for stock photos. Owning a successful digital marketplace can be a lucrative form of digital real estate, as it provides a platform for individuals to showcase and sell their digital creations. The value of a digital marketplace is determined by factors such as user base, transaction volume, reputation, and the quality and diversity of products or services offered.

Pros of Investing in Digital Real Estate

Investing in digital real estate offers several advantages that make it an attractive option for individuals looking to diversify their investment portfolio. In this section, we will explore the benefits and potential rewards of investing in digital real estate.

Potential for High Returns

One of the primary advantages of investing in digital real estate is the potential for high returns. As the internet continues to grow and become an integral part of our daily lives, the demand for digital properties is increasing. Well-established websites, popular domain names, and social media accounts with a large following can command significant value. By acquiring and developing digital properties strategically, investors can benefit from potential appreciation in value and generate substantial returns on their investment.

Lower Entry Costs

Compared to traditional real estate, the entry costs for investing in digital real estate are significantly lower. Purchasing a physical property often requires a substantial amount of capital, including down payments, closing costs, and ongoing maintenance expenses. In contrast, digital real estate investments typically have lower upfront costs. Websites can be developed and optimized on a budget, domain names can be acquired at varying price points, and social media accounts can be built organically. This lower barrier to entry allows a wider range of individuals to participate in the digital real estate market.

Flexibility and Remote Control

Investing in digital real estate offers flexibility and remote control over your investments. Unlike physical properties that may require hands-on management or geographical proximity, digital properties can be managed from anywhere with an internet connection. This remote control allows investors to monitor, update, and optimize their digital assets without being tied to a specific location. The ability to work remotely provides freedom and flexibility, making digital real estate an attractive option for those seeking a more flexible lifestyle or location-independent income streams.

Growing Demand in the Digital Age

The digital landscape is constantly evolving, and the demand for online businesses and services continues to grow. As more people rely on the internet for information, products, and entertainment, the value of digital properties increases. Investing in digital real estate allows you to tap into this growing demand and position yourself for potential long-term growth. Whether through website monetization, domain name sales, or leveraging social media accounts, investing in digital real estate aligns with the trends and opportunities of the digital age.

The Cons of Investing in Digital Real Estate

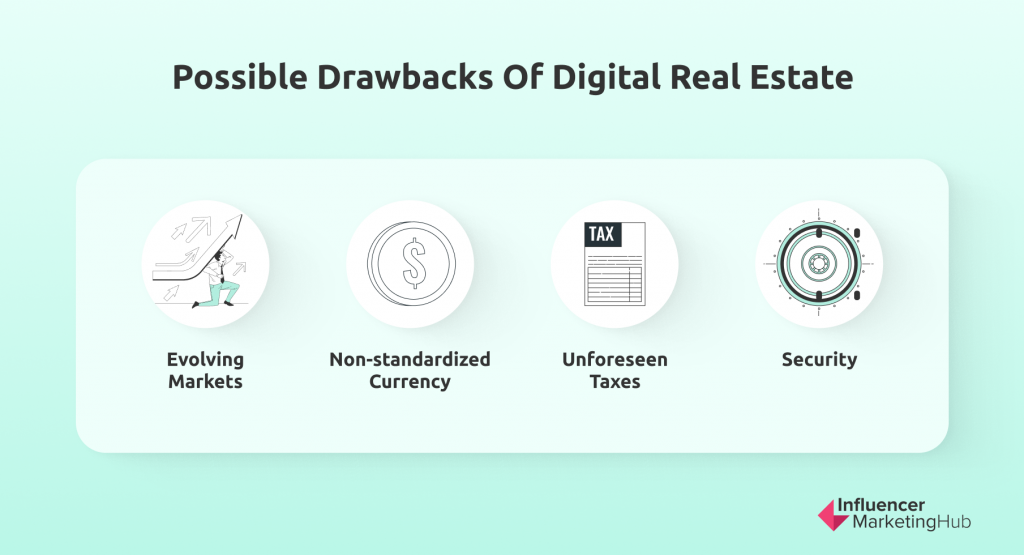

While investing in digital real estate offers many advantages, it is essential to consider the potential drawbacks and challenges associated with this investment strategy. In this section, we will explore the cons of investing in digital real estate, providing a balanced perspective to help you make informed decisions.

Risk of Scams

The digital world is not immune to scams and fraudulent activities. Investing in digital real estate requires careful due diligence to avoid falling victim to scams. There are instances where fraudulent websites, domain names, or social media accounts are misrepresented or sold with inflated value. It is crucial to thoroughly research the legitimacy and potential risks associated with any digital property before making a purchase. Engaging with reputable platforms, conducting background checks, and seeking professional advice can help mitigate the risk of scams.

Requires Technical Knowledge

Investing in digital real estate often requires a certain level of technical knowledge and expertise. Understanding website development, search engine optimization (SEO), digital marketing strategies, and social media management are essential skills for maximizing the potential of your digital properties. Without the necessary technical know-how, it can be challenging to effectively manage and grow your investments. However, it is worth noting that acquiring these skills is possible through self-education, online courses, or hiring professionals to assist in the management of your digital assets.

Fluctuating Market Trends

The digital real estate market has fluctuating trends and dynamics. What may be a popular website or domain name today may lose its value or relevance in the future. Staying up-to-date with market trends, emerging technologies, and changing consumer preferences is crucial to make informed investment decisions. Additionally, the value of digital properties can be influenced by factors beyond your control, such as changes in search engine algorithms or shifts in social media platforms’ policies. It is important to regularly assess and adapt your digital real estate portfolio to stay competitive in the ever-evolving digital landscape.

Time and Effort

Investing in digital real estate is not a passive endeavor. It requires significant time and effort to research, acquire, develop, and maintain digital properties. Managing websites, optimizing content, engaging with audiences, or negotiating domain name sales all demand ongoing dedication. Additionally, staying abreast of industry trends, learning new technologies, and implementing effective marketing strategies require continuous learning and adaptation. It is crucial to assess your available time and resources to ensure you can commit to the necessary efforts involved in managing digital real estate investments.

Understanding and considering these potential drawbacks is essential when evaluating the worth of investing in digital real estate.

Steps to Start Investing in Digital Real Estate

To start investing in digital real estate, it is important to follow a systematic approach that ensures informed decision-making and maximizes your chances of success. In this section, we will outline the key steps involved in starting your journey as a digital real estate investor.

- Research and Education

- Choosing the Right Type of Digital Property

- Making the Purchase

- Maintaining and Growing Your Digital Property

Conclusion

In conclusion, investing in digital real estate offers both advantages and disadvantages that must be carefully considered. By weighing the pros and cons, you can make an informed decision about whether digital real estate is worth it or not.

Ultimately, the worth of digital real estate as an investment depends on your individual circumstances, goals, and risk appetite. It offers the potential for high returns, lower entry costs, flexibility, and remote control. However, it also carries risks such as scams, the need for technical knowledge, fluctuating market trends, and the requirement of time and effort.

Before diving into digital real estate, conduct thorough research, seek advice from experienced investors, and assess your own capabilities and resources. Consider diversifying your investment portfolio to spread risks and explore other asset classes alongside digital real estate.

By carefully weighing the pros and cons, aligning your investment goals, and staying informed, you can make a well-informed decision about whether digital real estate is worth pursuing as a valuable addition to your investment strategy.