If you are aiming to grow your wealth, reach financial independence and retire early, you surely heard of passive income. Passive income helps you to reach your goals faster while actively not trading your time for that income. It looks all perfect and fun, but it takes a lot of work to create that passive income and people make a lot of passive income mistakes during their journey.

The passive income mistakes people make block them from achieving success and having a passive income, so it could cost you a lot. If you want to succeed and have a passive income stream or streams, you need to know what you are doing and avoid those mistakes.

Normally, many people ask what are those common mistakes people make when building passive income streams? I will explain everything about passive income and give you the seven most common passive income mistakes you should avoid for success.

What is Passive Income?

Passive income is an income that requires little to no effort to maintain. This means that once you finish the initial setup and spend the time and resources the passive income needs, the income continues to flow in with little to no additional work. There are endless passive income streams and examples. However, the most common ones are:

- Rental properties,

- Dividends from stocks,

- Royalties from a book or song,

- Creating digital products.

The key to achieving passive income is finding ways to make money without actively trading your time for money. However, it’s important to note that while the potential for passive income is high, it often requires a significant initial investment of time and/or money.

It’s also important to consider the level of risk and time commitment you need to make for each potential income stream before making any investment decisions. If you want to reduce the risks to the lowest level possible, you must have several passive income methods.

What are the Benefits of Having a Passive Income?

Passive income can bring many benefits to your financial life. The thing you need to look out for is the type of passive income to have those benefits. Because if you choose a risky option or one that you don’t particularly like, it creates problems and not benefits. That’s because you need to spend a significant amount of time in the beginning before you start getting any income. If you don’t like what you are doing, it won’t feel good, and if the risks are high, it might all be for nothing.

One of the biggest benefits of a passive income is the potential for additional income without having to actively trade your time for money. This means you can earn money while you sleep, while on vacation, or while pursuing other interests. Passive income can also provide a sense of financial security and stability, as it can act as a buffer in case of unexpected expenses or changes in your primary source of income.

Additionally, passive income can also provide a sense of freedom and flexibility, as you may have more options for how you spend your time. Passive income can also help you achieve your financial goals faster, whether that’s paying off debt, saving for retirement, or building wealth. Many people use passive income to reach financial independence and retire early.

7 Mistakes to Avoid for the Ultimate Success

Passive income creation is not always sunshine. It has its problems. Many people try to create passive income streams, but they fail. There is a reason why not many people have passive income. That’s because there are mistakes that almost everyone does. Here are seven of those most common mistakes.

Not Having a Plan

Having a plan is the most important step in the way to creating a functioning passive income. Many people miss this step when they are trying to create their passive income streams. Not having a can lead to poor returns, missed opportunities and wasted resources. A clear plan and set goals can help you avoid all this and identify financial goals, objectives and clear outlines of the passive income.

You also stay focused and motivated and have clear directions to follow. It also allows you to adjust as you need, which can help you to optimize your returns. You also waste a lot of time and resources when you don’t have a plan and do not act.

Many people just think of what to do instead of taking action because they don’t have a plan. The moment you have an idea, start creating a plan for clear thinking and know what to do. A plan can also help you to identify potential risks and challenges in your idea. You take steps to mitigate them. This is important, as it can help you to avoid unexpected losses and protect your investments.

How do I create a risk-proof and stable plan?

Creating a risk-proof and stable plan to build a passive income requires careful research, analysis, and a thorough understanding of the market, industry, and competition. You need to define your goals, research, understand diversification, look at the tax implications of the income and maybe seek professional advice.

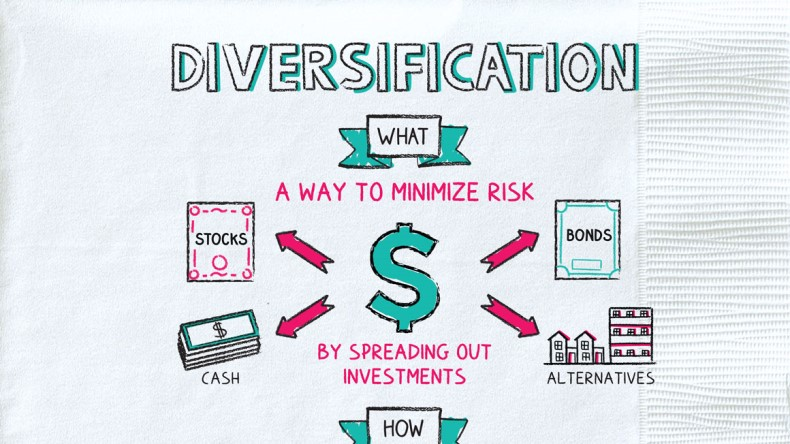

Not Diversifying Your Portfolio

Most of the risks in passive income streams come from not doing diversification. If you focus on just one income stream, you will likely lose that income when things go sideways. Don’t stick to just one income, have more than one in different industries and sectors.

Diversification is important in building a passive income portfolio as it helps spread risk and optimize returns. Diversification means spreading your investments across different asset classes, such as stocks, bonds, real estate, and digital products, rather than investing all your money in one asset class or one specific investment.

How do I diversify my portfolio in the most optimal way?

The best way to diversify your passive income portfolio the optimal way is to understand other assets, sectors, industries, and methods. If you have a stock portfolio and you are receiving dividends, try to look for something other than the stock market. Maybe bonds or real estate. The ideal way is to not concentrate on one thing. You must have some sort of exposure to almost everything.

Choosing Unreliable or High-Risk Opportunities

Choosing unreliable or high-risk opportunities in passive income streams is another common mistake. Having these type of streams might lead to poor returns, missed opportunities, and unexpected losses. Unreliable or high-risk opportunities are a mistake because they mostly don’t have a proven track record of success. Without a proven track record, it can be difficult to know what to expect in terms of returns, and it increases the chances of unexpected losses.

They also often require a significant initial investment of time and/or money and may not offer a good return on investment. This can lead to missed opportunities and poor returns. High-risk opportunities also have a higher chance of failure. This can cause a significant loss of capital and can take a long time to recover, if at all. Furthermore, high-risk opportunities often require constant monitoring and management, which can be time-consuming and stressful. This can take away from other important activities and responsibilities in your life.

How do I choose reliable and low-risk passive income opportunities?

Choosing reliable and low-risk passive income opportunities is important to ensure the stability and growth of your investments. Here are some tips on how to choose reliable and low-risk passive income opportunities:

- Conduct thorough research and analysis.

- Look for proven track records.

- Consider the level of risk.

- Consider the time commitment.

- Seek professional advice.

Not Monitoring and Adjusting Your Passive Income Streams

Not monitoring and adjusting your passive income streams is another common mistake. One of the biggest reasons you should monitor is to see the market’s conditions. Market conditions change and you might need to do adjusting. You also keep track of the performance of your passive income streams and identify the potential risks on the way.

When you think that your passive income streams are getting out of fashion or your income is going down, you can rebalance your portfolio as needed. If you don’t monitor, you can’t rebalance or adjust when there is a problem and you might end up losing your passive income stream.

How can I monitor and adjust my passive income streams for maximum success?

Create a time interval as to when you should take a look at your passive income streams. Compare the income from past months or years to now and see what the difference is. If you see a problem, try to locate the core of that problem and adjust as necessary. The best way to monitor and adjust is simply to locate the problem and fix that problem. You shouldn’t go too deep as to break what’s working.

Giving Up Too Soon

Building passive income streams take time, persistence, and patience. They don’t happen overnight or in a month. It takes months or even years for some. When you start building a passive income stream, never give up too soon. Try everything you can and give it the time it needs. Monitor your situation and see where you’re heading.

Research what other people have done and how long it took for them. Take that as an average and optimal timeframe for your own passive income stream. Never give up too soon; always grind and hustle for the best success. The more time you spend on a passive income stream, the more chances you get to succeed.

Not Fully Researching the Potentials

Researching the potential of a passive income stream can help you understand the market, industry, and competition, which can help you make informed decisions about your investments. If you don’t do this research, you might waste a lot of time and resources in the wrong direction.

By conducting thorough research, you can learn about the potential return on investment, risk, and time commitment it requires for each passive income stream. This can help you identify the best opportunities that align with your financial goals and risk tolerance.

Researching the potentials of a passive income stream can also help you to identify potential risks, such as changes in regulations or market trends, and take steps to mitigate them. This can help you to protect your investments and preserve your capital.

Furthermore, not researching the potential of a passive income stream can lead to missed opportunities. By not understanding the full potential of a passive income stream, you might miss out on a profitable opportunity that aligns with your financial goals and risk tolerance. If you don’t know its potential, you can skip a very lucrative passive income stream.

How do I make sure that I make solid research?

Here are some steps that can help you conduct solid research for any passive income stream:

- Define your financial goals,

- Research the industry and competition,

- Look for performance history,

- Gather information from reliable sources,

- Consult with experts,

- Evaluate the potential return on investment, risk, and time commitment,

By following these steps, you can conduct solid research for any passive income stream before starting. You can use these to make informed decisions that align with your financial goals and risk tolerance.

Underestimating the Time Commitment

This aligns with number five. If you underestimate the time commitment a particular passive income stream needs, you will end up giving up too early. Use your thorough research to really understand what kind of time commitment you need until the passive income becomes lucrative. Lucrative means whatever is enough for you. For some, $100 is a good income, but for some, $1,000 is good.

What is the right way to assess the time commitment of a passive income stream?

Assessing the time commitment of a potentially passive income stream is definitely not easy. You could be extremely wrong and have a completely wrong timeline in your mind, which is okay. But you can minimize these risks and correctly asses the timeframe as much as you can. The best way to do this is to look at the past. See what other people did with their experiences or if it’s available, see the past performance.

The Verdict

To conclude, creating a passive income is not easy. It takes time, money, effort, persistence, and a lot of patience. There are many mistakes that you can do when you are building out your passive income portfolio, but some are more common than others. Some common mistakes include not having a plan, not diversifying, giving up too soon, and underestimating the commitment. Make your research well and spend your time to avoid these mistakes, and create your passive income streams risk-free and stress-free.