Passive income is the bedrock of achieving financial freedom, and real estate has always been one of the critical growers of passive income. With the digitization of our world, digital real estate has become a powerful passive income tool. This guide will delve into the world of digital real estate and provide you with the knowledge and strategies to create a

Digital real estate investing has many benefits, and one of the key advantages is the potential for passive income. Unlike traditional real estate, digital properties can generate income on autopilot, requiring minimal effort once set up correctly. We will explore how digital real estate generates passive income and provide successful examples to inspire you.

At first, the world of digital real estate passive income might seem very confusing and not possible at all but that is not the case. We are here to show you how you can make that process easy by providing in-depth insights and actionable steps.

The Basics of Digital Real Estate

Digital real estate is a relatively new concept that has gained significant traction recently. In this section, we will explore the basics of digital real estate, including its definition, types, and the benefits it offers.

What is Digital Real Estate?

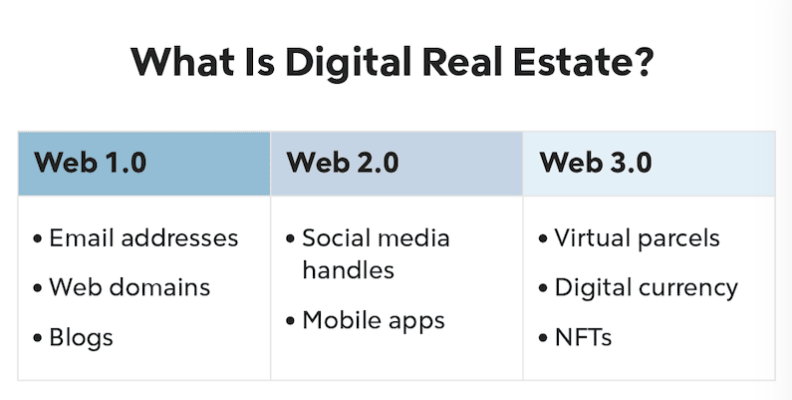

Digital real estate refers to virtual properties or assets that have value and can generate income in the digital world. These assets can include websites, blogs, domain names, social media accounts, online stores, and other online platforms. Like physical real estate, digital properties can be bought, sold, rented, or leased, providing opportunities for investment and income generation.

Types of Digital Real Estate

There are various types of digital real estate that you can invest in. Here are some common examples:

- Websites

- Blogs

- Domain Names

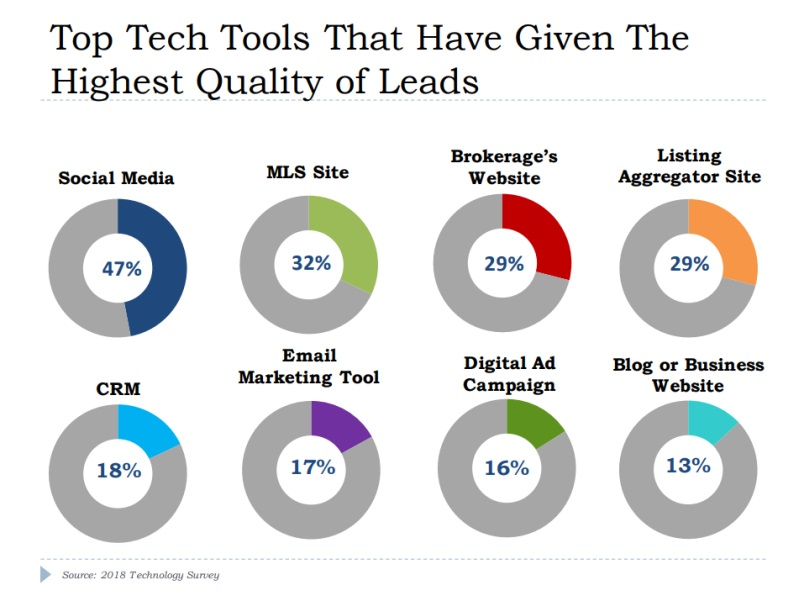

- Social Media Accounts

- Online Stores

- Digital Assets

Benefits of Investing in Digital Real Estate

Investing in digital real estate offers numerous benefits compared to traditional real estate or other investment options. Here are some key advantages.

- Low Barrier to Entry: Unlike physical real estate, investing in digital real estate requires relatively low upfront costs. You can start with a small budget and gradually scale your investments.

- Global Reach: Digital properties have a global audience, allowing you to reach a vast market regardless of location. This opens up opportunities for higher income potential and scalability.

- Flexibility and Freedom: Digital real estate provides flexibility and freedom in terms of managing your investments. You can work from anywhere, set your own schedule, and control your online assets.

- Scalability: With digital properties, you can scale your income exponentially. Once you establish a successful digital asset, you can replicate the model or expand into new niches, increasing your overall income.

- Passive Income Potential: One of the most appealing aspects of digital real estate is its ability to generate passive income. Once your digital properties are set up and optimized, they can generate income on autopilot, requiring minimal effort to maintain.

Understanding the basics of digital real estate is crucial before diving deeper into the world of passive income generation.

Creating Passive Income Through Digital Real Estate

Creating passive income through digital real estate is the goal of many investors and entrepreneurs in the online world. Let’s first explore what passive income is, how digital real estate can generate passive income, and provide successful examples to inspire and guide you.

What is Passive Income?

Passive income refers to earnings generated with minimal effort or direct involvement on an ongoing basis. Income continues to flow even when you’re not actively working or trading your time for money. Passive income is often the way to achieve financial freedom and create a sustainable income stream to support your lifestyle and future goals.

How Digital Real Estate Generates Passive Income

Digital real estate has the potential to generate passive income through various channels. Here are some standard methods.

- Advertising: Digital properties, such as websites and blogs, can display advertisements through ad networks like Google AdSense or direct partnerships with advertisers. You earn passive income when visitors to your site click on or view these ads.

- Affiliate Marketing: By doing affiliate programs, you can promote products or services on your digital platforms and earn a small amount of commission for every sale or lead that you generate through your referral. You can make passive income by recommending products relevant to your audience.

- Product Sales: If you have an online store or sell digital products like e-books, courses, or software, you can generate passive income from product sales. Once the products are created and listed, the sales can continue without your active involvement.

- Membership Subscriptions: Creating premium content or offering exclusive membership access can generate recurring revenue through subscription fees. This model allows you to earn passive income as long as subscribers remain engaged and continue their memberships.

- Sponsored Content: Influencers and content creators can collaborate with brands to create content for them, such as sponsored blog posts, videos, or social media promotions. This can provide a consistent source of passive income by leveraging your online presence and audience.

Successful Examples of Passive Income through Digital Real Estate

To inspire and illustrate the potential of passive income through digital real estate, here are a few successful examples.

- Niche Website: Imagine owning a website dedicated to reviewing camping gear. By generating traffic through search engine optimization (SEO) and providing valuable content, you can earn passive income through display advertising, affiliate links to camping gear, and sponsored content from outdoor brands.

- E-commerce Store: Running an online store that sells handmade jewelry allows you to generate passive income through product sales. Once you set up your store, optimize product listings, and market your brand, you can attract customers and earn income even when you’re not actively promoting or fulfilling orders.

- YouTube Channel: Creating engaging video content on a specific topic, such as fitness or cooking, can attract a large audience. By monetizing your YouTube channel through advertisements and sponsored collaborations, you can earn passive income as your videos continue to attract views and engagement.

- Membership Site: Building a membership site for a niche community, such as photography enthusiasts, can provide a consistent stream of passive income. Members pay a fee, whether monthly or annually, to access exclusive content, tutorials, or a supportive community, creating a recurring revenue stream.

These examples highlight the potential for passive income through digital real estate. However, it’s important to note that creating a successful passive income stream requires initial effort and ongoing maintenance to optimize and grow your digital properties.

Investing in Digital Real Estate for Passive Income

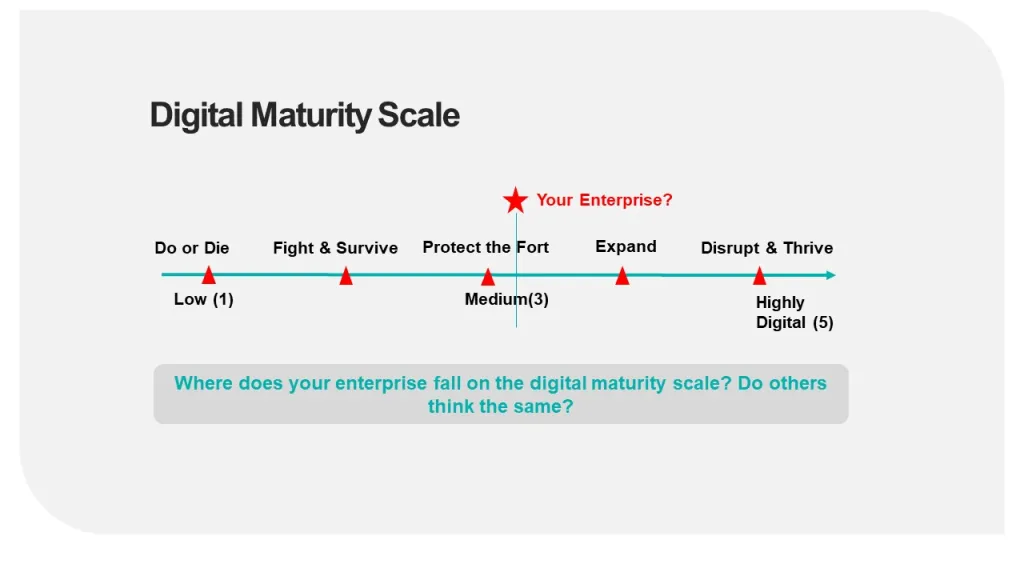

Now that you know what digital real estate and passive income are individually, you can see how you can combine digital real estate with passive income. You need to approach it strategically and with a plan to get started with investing in digital real estate for passive income.

When it comes to investing in digital real estate, there are several strategies you can employ to maximize your passive income potential. Here are some effective strategies to consider.

Niche Website Acquisition

Find niches with high profitability, high demand, and low competition. Instead of building a website from scratch, consider acquiring existing niche websites that have established traffic, revenue, and a strong content foundation. This strategy allows you to fast-track your passive income generation by leveraging existing assets.

Domain Name Flipping

Invest in premium domain names that have the potential to be in high demand. Conduct thorough research to identify valuable domain names with commercial appeal. Once acquired, you can sell them at a higher price to interested buyers. This strategy requires knowledge of the domain market and an understanding of market trends.

E-commerce Store Purchase

Rather than starting an e-commerce store from scratch, consider purchasing an existing online store that is already generating revenue. Look for stores with a solid customer base, established supplier relationships, and a proven track record of sales. This strategy allows you to skip the initial setup phase and start generating passive income immediately.

Content Website Creation

Create high-quality content websites targeting specific niches or industries. Focus on producing valuable and evergreen content that attracts organic traffic from search engines. Monetize the website through various passive income channels such as display advertising, affiliate marketing, and sponsored content. This strategy requires consistency in content creation, SEO optimization, and audience engagement.

Social Media Account Acquisition

Identify social media accounts with a large and engaged following in a niche relevant to your interests or expertise. Acquire these accounts and monetize them through sponsored posts, brand collaborations, and advertising. This strategy allows you to leverage an existing audience to generate passive income.

Risks and Challenges in Digital Real Estate Investing

While investing in digital real estate offers immense potential, it’s important to be aware of the risks and challenges involved.

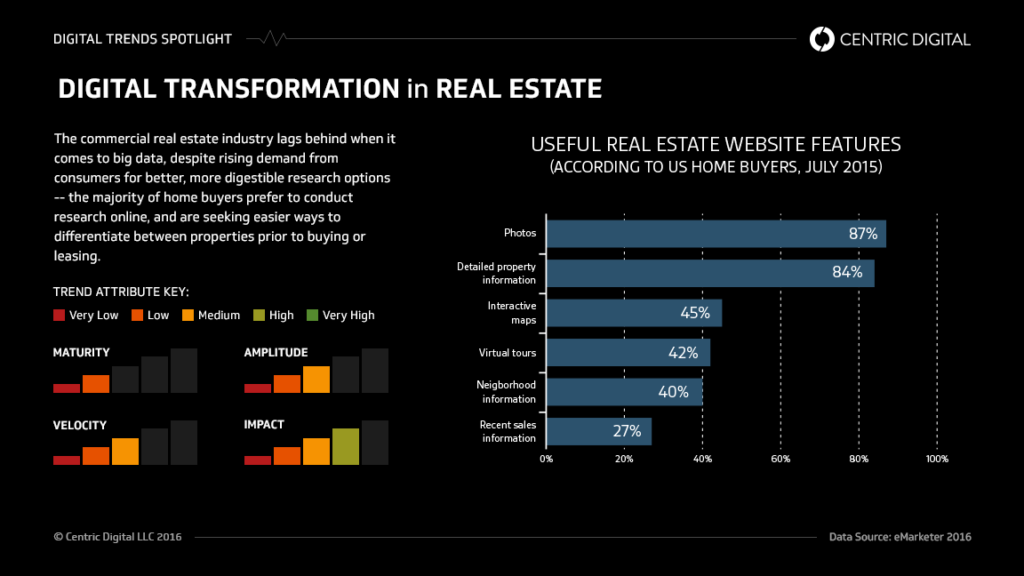

- Market Volatility: The digital landscape is dynamic and constantly evolving. Trends, algorithms, and user behavior can change rapidly, affecting the value and profitability of digital assets. Stay informed and adapt your strategies accordingly to mitigate the risks associated with market volatility.

- Competition: As digital real estate becomes more popular, the competition in various niches increases. It’s essential to conduct thorough research and identify unique opportunities or niches that have the potential for sustainable passive income.

- Technical Skills and Knowledge: Building and managing digital properties requires technical skills and knowledge. Ensure you have the necessary expertise, or consider partnering with professionals who can assist you with website development, SEO, marketing, and other technical aspects.

- Maintenance and Updates: Digital properties require regular maintenance, updates, and optimization to remain relevant and profitable. This includes content creation, SEO improvements, security measures, and staying up-to-date with industry trends. Allocate time and resources for ongoing maintenance to ensure the long-term success of your investments.

Tips for Successful Investment

Just like any other investment, you also need to be careful and have tips up your sleeve to succeed. These tips could help you to run away from unsuccessful digital real estate investments or find success more easily.

- Thorough Due Diligence: Conduct comprehensive research and due diligence before investing in any digital property. Analyze traffic, revenue, expenses, growth potential, and any associated risks. Seek professional advice if needed to make informed investment decisions.

- Diversify Your Portfolio: Spread your investments across different types of digital real estate to minimize risks. Diversification can include owning multiple websites in different niches, investing in various domain names, or acquiring social media accounts in different industries.

- Stay Updated with the Trends: The digital landscape is constantly evolving, and staying updated with the latest industry trends and changes is crucial. Attend conferences, join forums and communities, and follow industry experts to stay ahead of the curve.

- Network and Collaborate: Network with other digital real estate investors, entrepreneurs, and professionals in the industry. Collaboration can lead to joint ventures, shared knowledge, and new investment opportunities.

- Track and Analyze Performance: Regularly track and analyze the performance of your digital properties. Monitor crucial metrics like traffic, conversion rates, revenue, and expenses. This data will help you identify areas for improvement and make data-driven decisions to optimize your passive income generation.

Investing in digital real estate can be a rewarding venture that generates sustainable passive income. However, it’s essential to have a well-defined investment strategy, understand the risks involved, and stay proactive in managing your digital assets.

Maintaining Your Digital Real Estate Portfolio

Maintaining your digital real estate portfolio is crucial for long-term success and maximizing the passive income generated from your online assets. In this section, we will explore key aspects of maintaining your digital properties, including regular assessment and updates, the importance of SEO, and ways to protect your digital assets.

Regularly Assess and Update Your Digital Properties

To ensure the continued profitability of your digital real estate portfolio, it’s essential to regularly assess and update your digital properties. Here are some important considerations.

- Content Quality: Regularly review and update the content on your websites, blogs, and social media accounts. Ensure the information is accurate, valuable, and engaging for your target audience. Update outdated content, add new content, and address any user feedback or queries in a timely manner.

- User Experience (UX): Pay attention to the user experience of your digital properties. Make sure they are mobile-friendly, easy to navigate, and visually appealing. Optimize page load times and ensure a seamless experience for visitors across different devices and browsers.

- Website Design: Periodically evaluate the design of your websites and consider updating them to match current design trends and user preferences. A modern and visually appealing design can enhance user engagement and improve conversion rates.

- Functionality and Performance: Regularly test the functionality of your websites, online stores, and other digital assets. Check for broken links, optimize forms and checkout processes, and ensure that all features are working smoothly. Monitor website performance and address any speed or performance issues promptly.

Legal Compliance: Make sure that your digital

- properties follow the relevant local and federal laws and regulations

- . There are specific laws like data protection regulations (e.g., GDPR), consumer protection laws, and advertising guidelines.

- Keep yourself updated constantly about any legal updates that may impact your online activities.

Scaling and Growing Your Digital Real Estate Passive Income

Scaling and growing your digital real estate passive income is an exciting phase of your journey. In this section, we will explore strategies to reinvest your profits, expand your digital real estate portfolio, and leverage social media and online marketing to take your passive income to new heights.

Reinvesting Profits for Growth

Reinvesting your profits is a key strategy for scaling your digital real estate passive income. Here are some ways to reinvest your earnings effectively.

- Acquiring Additional Digital Properties

- Outsourcing and Delegating

- Improving Existing Digital Properties

- Developing New Products or Services

Expanding Your Digital Real Estate Portfolio

Expanding your digital real estate portfolio is a strategic approach to growing your passive income. Consider the following avenues for portfolio expansion:

- Identify New Niches: Research and identify untapped niches or emerging industries where you can establish a presence. Look for gaps in the market and leverage your expertise or interests to create new digital properties that cater to those niches.

- Strategic Partnerships: Collaborate with other digital real estate investors or entrepreneurs to form strategic partnerships. Pool your resources, knowledge, and networks to acquire larger and more profitable digital properties or launch joint ventures that can generate significant passive income.

- Diversify Income Streams: Expand your income streams by exploring new monetization methods within your existing digital properties. For example, if you have a successful blog, consider launching a podcast or a YouTube channel to reach a bigger audience and generate additional revenue through sponsorships or advertising.

- International Expansion: Consider expanding your digital real estate portfolio to international markets. Localize your content, optimize for different languages, and tap into new audiences and markets to increase your passive income potential.

Creating a continuously flowing passive income with digital real estate is not easy. You need to understand everything about digital real estate passive income to start getting a decent amount of income flow. You need to understand the type of digital real estate passive income methods, know your strengths and weaknesses, read your situation, and always keep yourself updated. However, you need to take a step and start getting your hands dirty. That is the only way to start, learn, and succeed.