Net worth is essential to know how good you are doing in your financial life, and calculating net worth is as important. Many people are struggling to find an answer to “how to calculate my net worth” as an individual because most of us think that net worth is for businesses. However, knowing the answer to the what is my net worth question as an individual is extremely important.

Understanding your net worth is a crucial step in assessing your financial health and planning for the future. You get an instant overview of how much you make, how much you own, and owe. In this article, I will guide you through calculating net worth and try to give you the answer to what is my net worth question.

What is Net Worth?

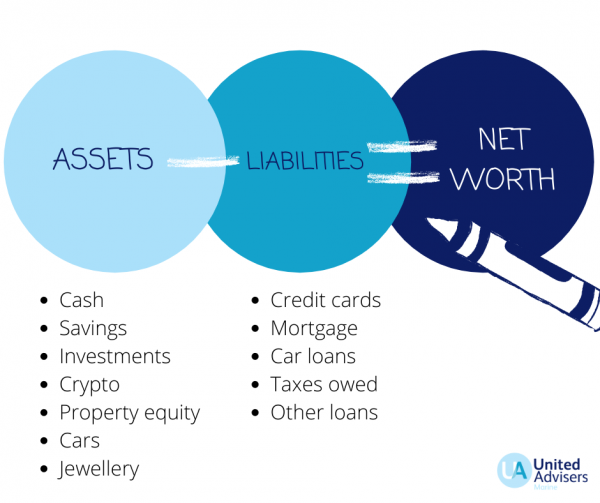

Net worth is the measure of your financial worth, calculated by subtracting your total liabilities from your total assets. It represents the value you would have if you sold all your assets and paid off all your debts. Calculating your net worth enables you to gauge your financial progress over time and identify areas for improvement.

That’s why you have to know your personal net worth, especially calculating the net worth part is important. Because there are some steps, you need to take and not miss while calculating your net worth. If you can’t calculate your net worth correctly, you won’t know exactly how much you owe and own, and you might make wrong financial decisions that will take years to fix.

Assessing Your Assets

The most important part of calculating net worth for individuals is to know what your assets are. Assets are things that you own that appreciate in value. Some tend to include things that depreciate in value, too, but then you will have to update the values constantly.

As an example, a normal car that you can buy any day will be a depreciating asset. However, a luxurious car that you can’t buy anytime you want and is only limited in the market will be an appreciating asset. Both will need revaluation constantly, and you will need to update them constantly.

That’s why it’s important to know what counts as an asset and what kind of changes you need to make in how many frequencies. To start calculating net worth, start by identifying and valuing all your assets. Here are some examples of assets.

Cash and Bank Accounts

- Checking accounts

- Savings accounts

- Certificates of deposit (CDs)

Investments

- Stocks

- Bonds

- Mutual funds

- Real estate investment trusts (REITs)

- Exchange-traded funds (ETFs)

Retirement Accounts

- 401(k)

- Individual Retirement Accounts (IRAs)

- Pension plans

Real Estate

- Primary residence

- Investment Properties

- Land or vacant properties

Vehicles and Other Possessions

- Cars

- Boats

- Jewelry

- Collectibles

Identifying Your Liabilities

Now that you know your assets and what you own, it’s now time to know what you don’t own and what you owe to others. Liabilities are an important part of calculating net worth because only then do you get a clear picture of your total financial worth. Here are examples of liabilities.

- The outstanding balance on your primary residence

- Mortgage on rental properties

- Federal or private student loans

- Total balance owed on all credit cards

- Any outstanding personal loans

- Auto loans

- Medical debts

- Outstanding taxes

Crunching the Numbers to How to Calculate My Net Worth

Now you know what consists of the individual net worth calculation. It’s now time to answer the question, “How to calculate my net worth?”. This process is fairly easy as you know all the numbers of your net worth. To calculate your net worth, subtract your total liabilities from your total assets. The formula looks like this:

Net worth = Total Assets – Total Liabilities

By using the numbers of your total assets and total liabilities and subtracting these two from each other, you will know exactly how much you are financially worth. If the value is minus, you are in trouble, and you need to start fixing things. If you are in positive, you need to see where you are standing regarding your goals and if you are close to that goal.

Regularly Updating Your Net Worth to Calculate My Net Worth

Calculating net worth is not a one-time thing. You don’t just do it once and let it slide. You need to update the values regularly, with a fixed interval, to get the latest numbers as updated as possible.

To truly understand your financial progress, it is crucial to update your net worth on a regular basis. Set a schedule—monthly, quarterly, or annually—to review and reassess your financial situation.

Tips for Improving Your Net Worth and Efficiently Calculating Net Worth

Calculating your net worth provides a starting point for financial improvement. Knowing some little tips and tricks here and there will definitely enhance your entire net worth calculation process. That’s why we compiled a list of tips and tricks in different areas of net worth for you to get an idea of it.

Consider these tips to enhance your net worth:

Reduce Debt

- Prioritize paying off high-interest debts first.

- Create a repayment plan and stick to it.

- Explore debt consolidation options if it suits your situation.

Increase Savings and Investments

- Set aside a portion of your income for emergency savings.

- Contribute regularly to retirement accounts.

- Explore investment opportunities aligned with your risk tolerance and financial goals.

Track Your Spending

- Create a budget and track your expenses.

- Identify areas where you can cut back and save more.

Grow Your Income

- Explore opportunities for career advancement.

- Consider side hustles or freelance work for additional income streams.

Conclusion

Calculating your net worth is a crucial step in understanding your financial situation and planning for the future. By evaluating your assets and liabilities, you gain clarity on your financial health and identify areas for improvement. Regularly updating your net worth and implementing strategies to reduce debt, increase savings, and grow your income will help you achieve your financial goals. Start today and take control of your financial well-being.

Remember, your net worth is not a measure of your self-worth but a tool to empower you to make informed financial decisions.