Personal finance is a tough journey with many things that you have to do, such as tracking your net worth. Many overlook the most important things on their financial journey and say it’s not for them. Since we are used to seeing the term “net worth” on companies or rich people’s statements, it seems absurd that an average individual should do it.

Tracking your net worth is an important financial habit that can help you make better decisions about your money and reach your financial goals. By regularly calculating and monitoring your net worth, you can gain valuable insights into your financial health, identify areas for improvement, and make informed decisions about your future.

The good part is that there are many options with the increase in digital usage. It’s not like the old times when you have to put them down on paper one by one. You can use many technologies that make it easy. Here is my complete guide to tracking your net worth.

What is Net Worth?

Your net worth is basically a snapshot of your financial health reflecting the difference between your assets and liabilities. It is a measure of your overall financial situation and can be a useful tool for managing your money and reaching your financial goals.

Net Worth gives you a detailed picture of your entire money, whether in cash or in assets. By knowing the change in your net worth or having a clear picture of how much you’re worth, you can make better and more informed financial decisions.

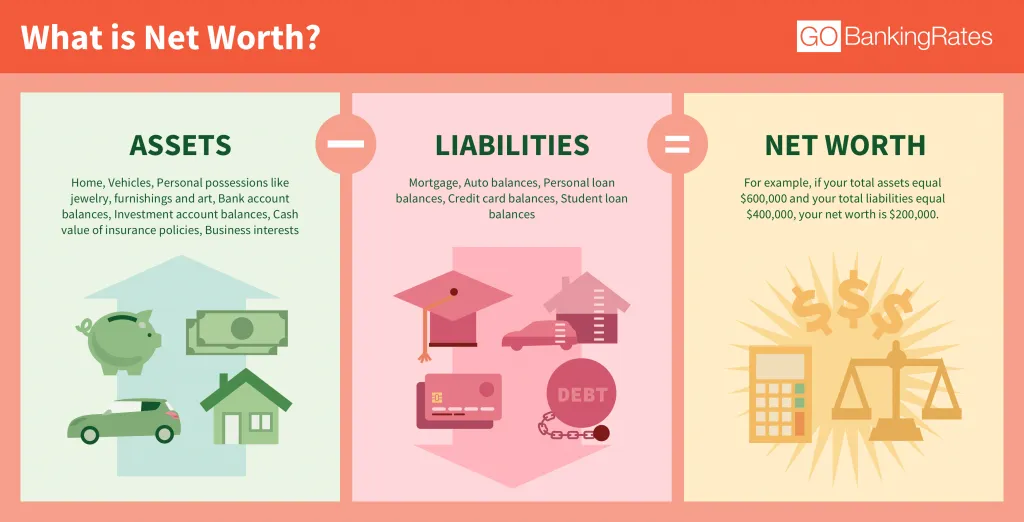

To calculate your net worth, you must add all of your assets, including your savings accounts, investments, and property. You will then need to subtract your liabilities, such as your mortgage, student loans, and credit card debt.

The resulting number is your net worth. If your assets are bigger and more than your liabilities, your net worth will be positive. If your liabilities are higher than your assets, your net worth will be negative.

Your net worth can fluctuate over time based on changes in your assets and liabilities. It is important to regularly calculate and monitor your net worth in order to get a clear picture of your financial situation and make informed decisions about your money.

What Does Track My Net Worth Mean?

Tracking your net worth means regularly calculating and monitoring your net worth over time. This involves adding up all of your assets, such as your savings accounts, investments, and property, and subtracting your liabilities, such as your mortgage, student loans, and credit card debt.

The resulting number is your net worth, and tracking it can provide valuable insights into your financial health. By regularly calculating your net worth, you can see how much you owe, how much you own, and how much you have left over after accounting for both.

Tracking your net worth can help you set and achieve financial goals, monitor your progress, make informed decisions about your money, improve your credit score, and prepare for the future. It is a simple but powerful financial habit that can help you manage your money more effectively and achieve your financial objectives.

Should You Track Your Net Worth?

Yes. Everyone should track their net worth no matter how much they have. It gets easier to understand your money habits and where you are heading.

Better Observation of Your Financial Situation

One of the most important reasons to track your net worth is to get a clear picture of your financial status. Your personal net worth is an overall view of your financial health, and it can help you understand your financial situation.

This information can help you identify areas where you might be overspending or under-saving, and it can give you a better understanding of your financial strengths and weaknesses.

Easier Setting and Achieving Financial Goals

Tracking your net worth can also help you set and achieve financial goals. Whether you want to save for a down payment on a house, pay off debt, or build up your retirement savings. You can use your net worth can help you create a plan to reach your goals.

For example, if you want to save for a down payment on a house, you can use your net worth to determine how much you need to save and how long it will take you to reach your goal. You can then create a budget and a savings plan to help you reach your goal.

Monitor Your Progress Better

Tracking your net worth can also help you monitor your progress and see how far you have come. By regularly calculating your net worth, you can see certain milestones. Such as how much you have saved, how much you have paid off in debt, and how your investments are performing.

This can be a great way to stay motivated and on track with your financial goals. It can also help you identify financial areas where you might need to make changes to your financial plan in order to reach your goals faster.

Make Better Informed Decisions

Tracking your net worth can also help you make more informed decisions about your money. For example, if you are considering making a major purchase, such as a new car or a second home, you can use your net worth to determine if it is a financially viable option.

Your net worth can also help you decide whether to invest in a particular stock or mutual fund or whether to take out a loan. By knowing your net worth, you can make more informed and confident financial decisions.

Improve Your Credit Score

Your net worth can also have an impact on your credit score, which is a key factor in your ability to borrow money. By tracking your net worth, you can identify areas where you might be able to improve your credit score, such as paying off debt or increasing your savings.

A higher credit score can help you qualify for lower interest rates on loans and credit cards, which can save you a significant amount of money over time.

Prepare Better for the Future

Your net worth can also help you prepare for the future. By regularly calculating your net worth, you can see how much you have saved for retirement and whether you are on track to meet your retirement goals.

You can also use your net worth to determine if you have enough savings to cover unexpected expenses, such as a medical emergency or job loss. By tracking your net worth, you can ensure that you are financially prepared for the future.

How Do I Keep Track of My Net Worth?

There are a few different ways that you can keep track of your net worth. These methods all serve the same purpose, but some of them make it easier to write everything down, and some of them offer complete customization to you. It all depends on what you want and what you would like to have.

Spreadsheets

You can create a spreadsheet to track your net worth on either Google Sheets or Excel. You will list all of your assets and liabilities and then calculate the difference between the two. You can then update the spreadsheet periodically to see how your net worth changes over time.

Net Worth Calculator

There are many online net worth calculators that can help you calculate and track your net worth. These calculators typically ask for information about your assets and liabilities and then calculate your net worth for you.

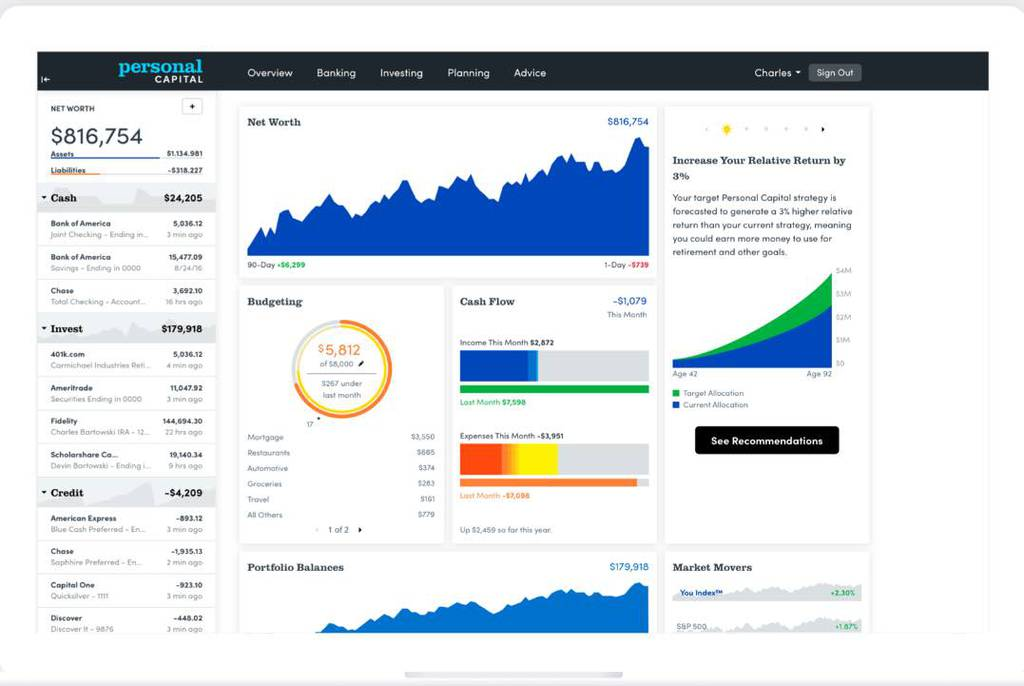

Personal Finance Software

Personal finance software, such as Mint or Personal Capital, can help you track your net worth by automatically importing your financial information and calculating your net worth. This can be a convenient and efficient way to track your net worth, as the software does the work for you.

Regardless of which method you choose, it is important to regularly update your net worth calculation in order to get an accurate picture of your financial situation. You should aim to calculate your net worth at least once per month and more often if you are working to achieve specific financial goals.

What Should I Exclude from My Net Worth?

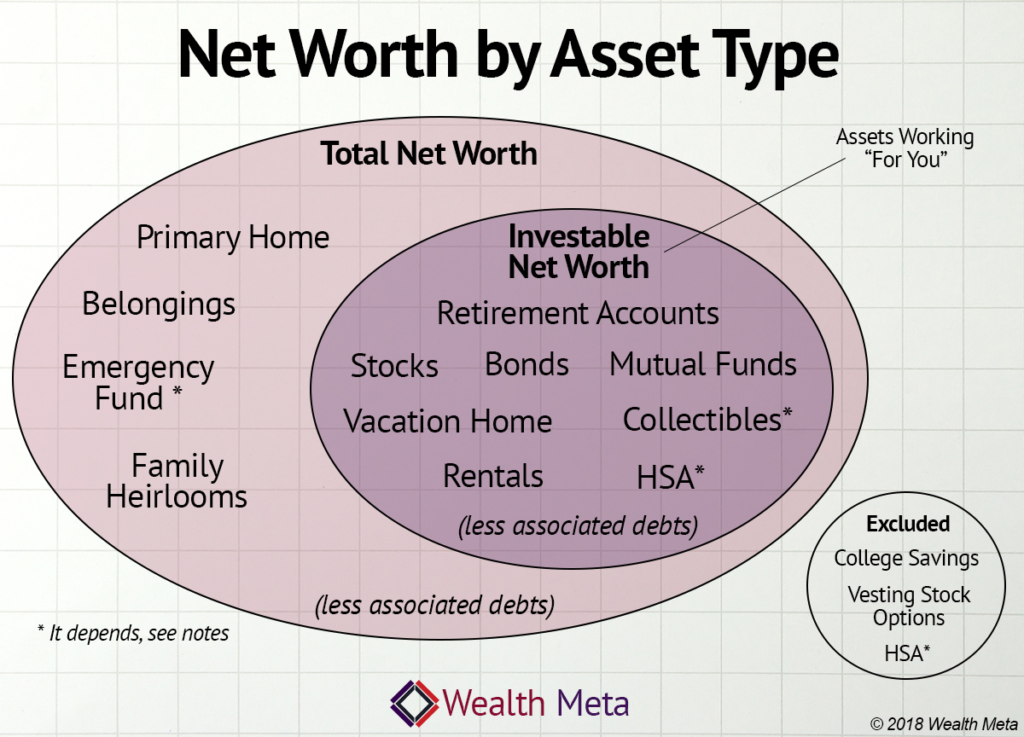

When calculating your net worth, you should include all of your assets, such as your savings accounts, investments, and property. You should also include any other assets that have value, such as jewelry, artwork, or collectibles.

On the liability side, you should include all of your debts, such as your mortgage, student loans, credit card debt, and car loans. You should also include any other liabilities that you are responsible for, such as a business loan or personal loan.,

You might want to exclude a few things from your net worth calculation, depending on your circumstances. These might include:

- Personal possessions that have no significant monetary value, such as clothing or household items

- Gifts or inheritances that you have not yet received or that are not yet in your possession

- Future earnings or income that you have not yet received

It is generally best not to include all of your assets and liabilities in your net worth calculation if they are not yet realized or in your possession. This will give you a more accurate picture of your financial situation and help you make better-informed decisions about your money.

What Net Worth is Considered Rich?

It is difficult to define exactly what net worth is considered “rich,” as this can vary greatly depending on a variety of factors, such as your age, location, and personal financial goals.

In general, a net worth of $1 million or more is often considered a benchmark for financial independence and security. This is because a net worth of $1 million can provide a comfortable level of financial security and allow you to live a comfortable lifestyle without having to work.

That being said, it is important to remember that net worth is just one factor in determining your overall financial health. It is not the only measure of wealth or success and is not the only factor you should consider when making financial decisions.

Ultimately, what is considered “rich” depends on your financial goals and circumstances. It is important to focus on building and maintaining a strong financial foundation, regardless of your net worth, in order to achieve financial stability and security.

What is a Good Net Worth by Age?

It is difficult to determine a specific “good” net worth by age, as this can vary greatly depending on various factors, such as your financial goals, income, and lifestyle.

However, some financial experts suggest that the following net worth benchmarks may be appropriate for certain age groups:

- By the age 25: Net worth of at least 3 times your annual salary

- When you hit age 35: Net worth of at least 6 times your annual salary

- At the age 45: Net worth of at least 8 times your annual salary

- When you are age 55: Net worth of at least 10 times your annual salary

- Age 65: Net worth of at least 12 times your annual salary

Keep in mind that these are just rough benchmarks and are not meant to be rigid rules. Your net worth may be higher or lower than these benchmarks depending on your personal financial situation and goals.

You also shouldn’t forget to remember that net worth is just one factor in determining your overall financial health. It is not the only measure of wealth or success. This is not the only factor you should consider when making financial decisions.

The Verdict

To conclude, net worth is an important part of your financial journey. It shows you how much money you have, how much you are making and the current prices of your assets. Without having a clear picture of everything in one sheet or page, you might lose track of what you own. Letting everything go and failing at your personal finance journey then gets really easy.

That’s why tracking your net worth is as essential as investing or buying groceries. You can use several methods and see which one you like the most. However, my experience tells me that Google Sheets is the best method for this as you can do whatever you want.