Investing in the stock market offers a world of opportunities, but learning how to know which stocks to invest in is not easy. The stock market can be both exciting and daunting because of that because any wrong decision will cost you. You need to be able to navigate these challenges and strict processes.

To be able to achieve this successfully, you need to have a purpose with a stock selection guide spend some time on how to know which stocks to invest in. This guide will help you to know which stocks to invest in and what are the best stocks.

Numerous stocks are available on the market, so it’s essential to have that solid stock selection guide to help you make informed investment decisions. This blog post aims to provide you with a comprehensive stock selection guide to help you make informed investment decisions.

By understanding how to identify stocks to buy, recognizing stocks that are good to invest in, and exploring the best stocks to invest in 2023, you can increase your chances of success in the stock market.

Understanding Stock Selection

Before diving into the specifics, it’s crucial to grasp the fundamentals of stock selection. Think of it as building a sturdy foundation for your investment journey. If you don’t set the foundation strong and well, the system will collapse on its own in time. You have to have a strong stock selection understanding and find stocks that fit your needs the best.

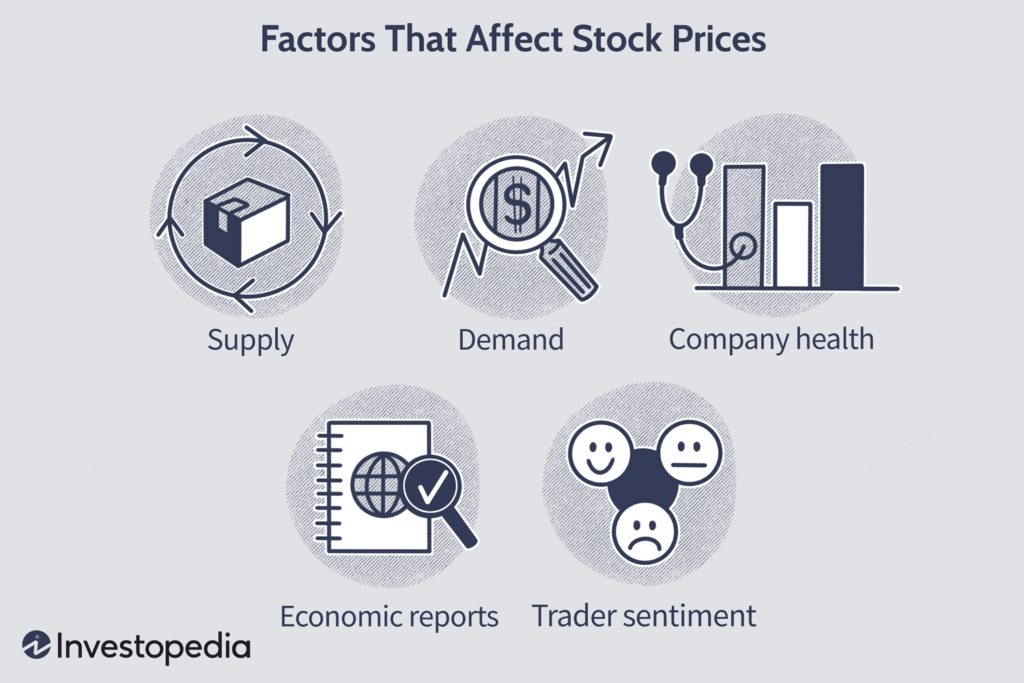

There are some vital factors you should consider. These factors include things such as financial statements, market trends, industry analysis, growth potential, and company management. If you deep dive into these, you can gain insights into the stocks you’re evaluating and know whether they are worth your time to go deeper or money to buy them.

How to Identify Stocks to Buy and Which Stocks to Invest In

The toughest thing about stocks is to identify which stocks are good to invest in and make sure that you are not making a mistake. That’s why you need to have a clear roadmap about how you identify these stocks when you find them. For this, there are several things you can check out.

- Research and analyze: Researching and analyzing financial statements is a fundamental step in selecting stocks. You can assess a company’s financial health and stability by examining revenue, earnings, cash flow, and debt levels.

- Follow the market trends: Staying informed about market trends and conducting industry analysis allows you to identify stocks with growth potential. You also determine if the stock is actually a growth stock or if there is a misunderstanding about it.

- Use tools and resources when necessary: Tools and resources like stock screeners and analysis platforms can also aid in the stock selection process. This is not the case all the time, and you might not need it, but it’s a useful tool.

- Check the management and the leadership: What makes a company great and successful in the long term is how well that company is run. This goes through good management and excellent leadership. Take a look at who is on the board, CEO, other C-level managers, etc.

- See the edge of the company: What does this company do that makes them different than their competitors? How well are they doing in developing that feature? For example, Nvidia is the leading chip provider in the world. They are managing their situation well and focusing on this. This is a good sign.

Characteristics of Stocks Good to Invest In

Stocks that are good to invest in typically exhibit certain characteristics. Of these characteristics, some of them are wide open, and some of them need research to see through. However, all these points to one thing in general, the company is sustainable and will keep increasing its profit numbers.

By looking at these, you can also find some undervalued stocks with extreme potential. However, when you are looking at these characteristics, you need to know your end goal. Do you want dividend stocks or growth stocks? Then you start examining the characteristics.

Here are some of the characteristics you can examine:

- Strong fundamentals,

- Consistent revenue growth and profitability,

- Earnings growth potential,

- A reasonable price-to-earnings ratio,

- Dividend percentage (if you want dividend stocks)

- How recession-proof the company and the industry are.

Building a Personal Stock Selection Guide

To streamline your stock selection process, it’s beneficial to create a personalized stock selection guide. This personalized stock selection guide will ideally focus on many different things, starting from your main goal to determining whether it’s worth taking the risk of buying or researching that stock.

You can include specific criteria, indicators, and metrics that align with your investment goals and risk tolerance in this guide. It should also incorporate risk management strategies to protect your capital. Regular evaluation and monitoring of your stock selections will ensure you stay on track and make necessary adjustments when needed.

Best Stocks to Invest in 2023

While the stock market’s future performance is uncertain, there are stocks that show promise for 2023. These stocks are solely my opinion and the mixture of opinions I got online and mine. That’s why only show caution to them and do your own research before actually investing in them.

Here are a few examples across different industries:

- MSFT: With a market cap of $2.8T and one of the most lucrative industries, tech, Microsoft is the leading scorer this year.

- AAPL: It has a market cap close to Microsoft, and they are one of the leading companies in the world. Even though the market has been really bad in 2023, they have a 39% increase YTD as of May 23.

- O: Advertised as the “Monthly Dividend Company,” they are a great entry to the real estate market. They lost 5% this year so far but still have strong fundamentals and a high dividend yield.

- NVDA: Future’s Apple or Microsoft. They are the leading chip provider in the world, and they have gained 117% YTD!

Conclusion

It’s easy to say that you should invest in stocks, but people rarely say how you are going to do that. Many ask, “How do I know which stocks to buy?” or “What do I invest in, ETFs or stocks?” or many other questions. Finding stocks that are good to invest in is a lot of work and requires your own personalized stock selection guide. You need to create this on your own, for yourself.

With the help of this stock selection guide, you can navigate the stock market with confidence. By understanding how to identify stocks to buy, recognizing stocks that are good to invest in, and exploring the best stocks to invest in 2023, you can increase your chances of achieving your investment goals. Remember to conduct thorough research, stay informed about market trends, and adapt your stock selection guide as needed. Happy investing!