Since the beginning of the pandemic, the world has been witnessing things that we have never seen before. Both economically and mentally. There is a serious test about how we will move forwards since 2020. However, perhaps the financial world is in shakes and trying to figure out the best response and one of that response was to increase the interest rates.

In the modern economic world, we have never seen a situation where the entire capitalist system has to shut off. In capitalist environments, even the smallest businesses provide exceptional value to the financial ecosystem. So, everything getting closed was a huge blow. To make sure these businesses stayed afloat, governments supported these businesses. They did this while trying to not devalue the currency, but that was inevitable.

This support brought things that many governments haven’t done in a very long time, at least since the biggest economic crises in the world. To support everyone in a time when there were literally no profits to the governments, they printed out money or gave loans at very low-interest rates. Both of these are extremely dangerous when no one knows whether they will be able to pay back.

Once the governments started to lift the restrictions, things eased off, and businesses had a chance to pay them back. However, governments also gave quite a lot of free money to the markets, which is a death sentence for a currency. They have to take that money back somehow. How? Through interest rates.

Why Are Interest Rates Rising?

The loans governments provided to businesses and civilians were at close to zero interest rates. On top of the zero interest rates, they also printed money to back their support. This created a massive expansion of the monetary system that is not sustainable. Once the pandemic effects wore off, the governments started to take the money out from the streets. Taking money out of the streets means raising those interest rates that they have dropped during the pandemic.

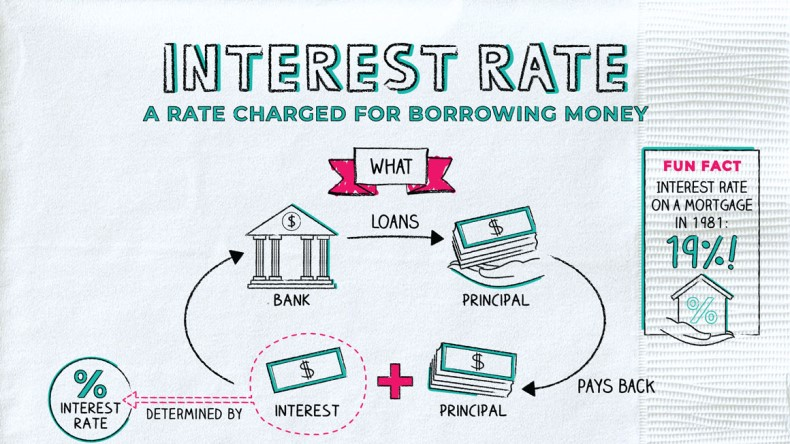

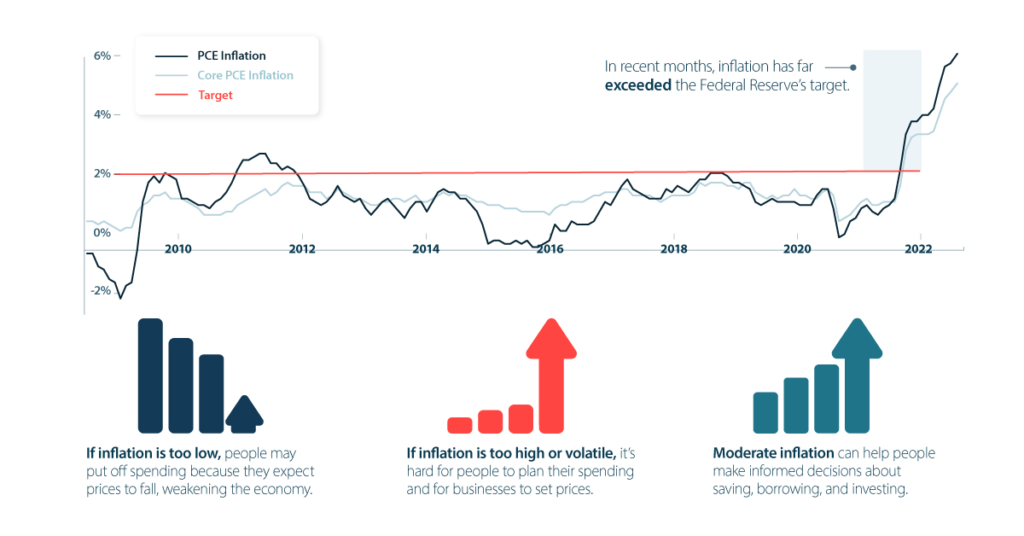

To put it simply, when the interest rates are low, no one deposits their money to the banks or the central bank to gain interest on their cash. Even businesses use these interest rates to get risk-free cash, but not as frequently as individuals. When people don’t deposit that money to receive interest, they either invest it or spend it. This is also good, but to a certain level. If there is much money roaming around the economy, it will devalue the currency, causing inflation.

To fight this and to lower the currency in circulation, you have to raise the interest rates to get the excess cash back. With the hopes that people will deposit their money back to where they got it. This will help the economic system to sustain itself by taking out that excess money from the market. It will help to stabilize the currency and lower the inflation rate.

What Happens When Interest Rates Rise?

When interest rates rise, this doesn’t only happen with the interest you receive. It also increases the money you lend. So, if you are going to buy a house with a mortgage, you will be paying higher interest rates on your loan. The same goes for businesses that need loans to expand or invest in their businesses. When it costs higher to lend, businesses won’t borrow, and it will decrease the aggregated demand in the economy, starting a slow growth.

- Borrowing gets more expensive

- Economic growth slows down due to people not spending money

- People will put their savings into savings accounts or bonds rather than stocks because it is easier to generate income without much risk

- Buying a house gets extremely expensive, slowing down one of the most crucial parts of a working economy, housing

When borrowing is more expensive, people often spend less money. The rising interest rates will reduce their income unless their income rises as well. Customers have less money available to buy other things because they are paying more for their purchases. The aim is to “chill” consumer spending when interest rates rise, but this is risky.

Stocks Gets Less Attractive & Bond Values Decreases

Investing in stocks gets riskier when there is a good return without much risk on various assets. That’s why many investors choose to opt for other options since stocks lose their appeal when investors can earn greater interest rates on bank savings. In essence, investors can achieve the same returns on their capital with less risk. As a result, some investors liquidate a portion of their holdings and transfer the proceeds to money market accounts, CDs, and bonds.

The switch to other investments from stocks decreases the value of stocks and the overall economy. This effect results in companies going bankrupt due to high risks or not borrowing to make sure they survive the day.

In addition, bond values also go down with higher interest rates. The market for older, lower-rate bonds declines when an investor can get a better return on a newly issued bond. That’s why people will not risk buying a bond that will pay way less than the new one that will pay better.

However, you will get the whole amount of your bond will if you keep it until it matures. Bond mutual funds and exchange-traded funds don’t work like that. They keep bonds till maturity and reprice them daily based on the value of the bonds in the portfolio.

Are Existing Debts Affected?

Increasing interest rates is only for new interest rates. This means they only apply to the newly borrowed debts, not the existing ones. This is the tricky party of rising interest rates, and that’s why they are extremely unpredictable. N no government announces beforehand that they will raise the interest rates.

For example, if you get a mortgage with a 0.99% interest rate in 2021 for 25 years and the interest rates of mortgages increases to about 3-5% next year for the same mortgage, your existing mortgage’s interest rate will stay the same. Only the new lenders will have to pay that interest rate. So this pushes those who are going to borrow money to do it earlier than their plans or cancel their plans as a whole.

The same thing applies to every loan anyone takes out, both businesses and individuals. Some try to pinpoint the lowest point of interest rates and borrow as early as possible; some wait it out to see where the interest rates will go. So your existing debt with the set interest rate will stay the same and won’t change.

Can Interest Rates Go Down Again?

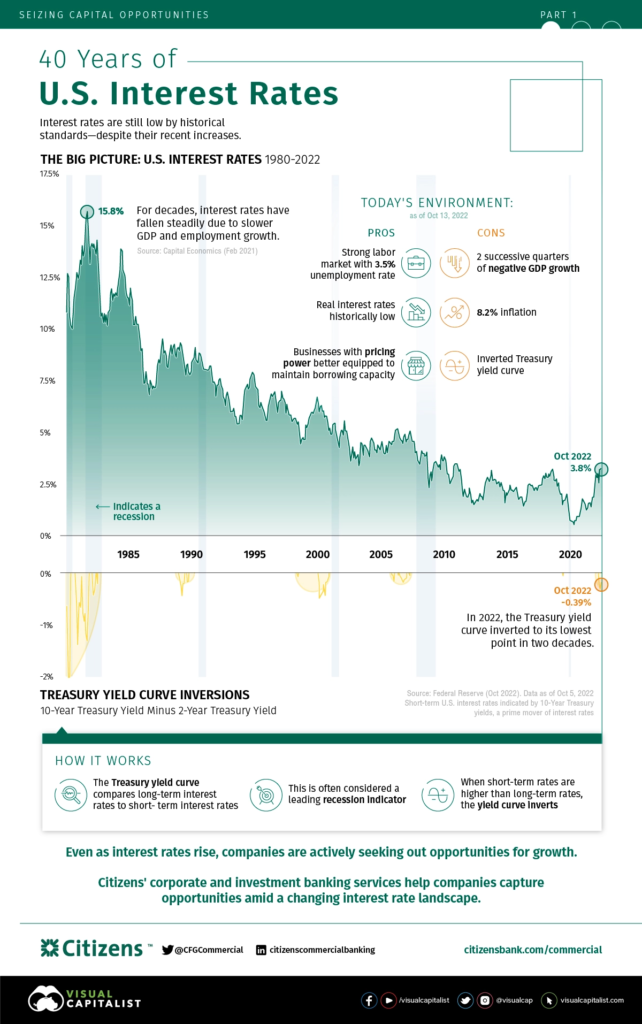

The Federal Reserve has been increasing the interest rates continuously for several months, and they will keep on rising for a while. When the interest rates rise, the systems try to get used to that to ensure that everything works smoothly. However, this accommodation to the current situation is not permanent. They are ready to change it according to the given situation.

This means that the interest will go down in time, just like it went up. The goal of rising interest rates is pretty clear. To gather back the money in circulation to stop the devaluation of the currency and get inflation back in control of the markets. Once the Federal Reserve – or any other central bank – achieves its aim, it will start to decrease the interest rates.

When the time comes to lower the interest rates, that will not happen in a month. Just like rising interest rates, it will happen step by step. This helps the markets adjust to the situation perfectly and slowly increase spending without breaking the banks. That is why the whole process of increasing interest rates is extremely painful for everyone because it is a very long process.

What is the Future Outlook?

When it comes to interest rates, it is hard to guess what is going to happen due to their unprecedented nature of it. No one from the government will give a hint as to what the future plans are. In addition, because the economic situations always change, it puts another problem in guessing it. You have to understand the most basic pillars of the current situation and track the statistics and data to see where it’s going.

Even then, you have to be very lucky to guess the right move by the Federal Reserve or the central banks of other countries. Because they might not do what many people expect. Analysts from many institutions, banks, and agencies make their own conclusions from the world’s and country’s current economic situation. Even though these expectations often come out to be true, there are cases that it doesn’t.

Short-Term Interest Rates Will Keep Rising

The vast majority of economists and other professionals believe that short-term interest rates will keep increasing as it has been since the middle of 2022. Although not as swiftly, long-term rates will likely increase as well. In particular, in 2023, the Federal Reserve will likely keep raising short-term rates. The Fed wants to bring inflation back down to a healthy level because they view it as a serious threat. As a result, they’ll probably boost rates until inflation is in check. Since 2016, short-term rates have been below 4%. Many analysts predict that they will rise to 5-6% or more during the next year or two.

What About the Long-Term Interest Rates?

Long-term interest rates will increase, but how much will depend on how well the economy is doing. Many experts predict that they will increase to at least 5-1/2%. Experts anticipate a sharp increase in long-term rates if the economy keeps improving. However, long-term rates will likely remain low or decrease if the economy deteriorates.

Long-term interest rates currently remain very close to their lowest levels in 50 years. Analysts anticipate that long-term rates will increase because there are so many signs that the economy is robust. This will affect the long-term outlook of the economy. However, it is unclear how much they will rise. Long-term interest rates are currently about 4%, and many analysts expect that they will increase to at least 5% within the next few years.

Will the Economy Get Better or Go Bottom?

Over the coming few years, many experts anticipate that the economy will expand at a solid rate. Others anticipate a bust that would trigger a recession. The state of the business and consumer sectors is what differentiates these two points of view. Many experts are expecting a strong performance from the stock market and economy if corporate confidence keeps rising.

Experts also predict that the economy will suffer if business confidence declines as a result of a large event or shift. Likewise, consumer confidence also plays a crucial role. Many experts expect that the economy and stock market will improve if it keeps rising. But if there is a big shift or an event, economists predict that consumer confidence will decline and the economy will suffer. The future of the general state of the business and consumer sectors will determine the fate of the economy.

The Verdict

To conclude, interest rates are not favorable for many. Because they make everything more expensive for everyone. That’s why both businesses and individuals always want to avoid high-interest rate environments since it makes life harder. It’s bad for countries’ economies as well, as it slows down spending on everything, and businesses could go bankrupt because of this. The current state of the world economy is not going well, and governments – including the Federal Reserve – are trying to reverse that by taking back the excess money they printed during the pandemic. This will take some time, and the future is unstable since governments never say what they will do with the interest rates.