One of the pillars of personal finance is knowing your net worth because it’s easier to follow up with your goals when you know your net worth. However, most people don’t know how do you calculate net worth and how do you determine your net worth. It seems hard, and the term net worth seems like it’s mostly for businesses, but that’s not true.

Knowing your net worth and knowing do you calculate your net worth is essential for understanding your overall financial health. Whether you are assessing your personal finances or evaluating the value of your business, calculating net worth provides valuable insights into your assets, liabilities, and overall financial standing.

In this article, we will explore the steps to calculate net worth for both personal and business finances and provide useful tips along the way. You will get the answers to “How do I calculate my net worth?” or “How do you determine net worth,” whether in the personal or business world.

Understanding Net Worth

Before you dive in to calculate your net worth, you must first understand net worth itself. You must take the right steps when you start calculating net worth, either for personal or business reasons. If you use a net worth formula that is not suitable for you, it will be hard to track your net worth, and you will get the wrong results.

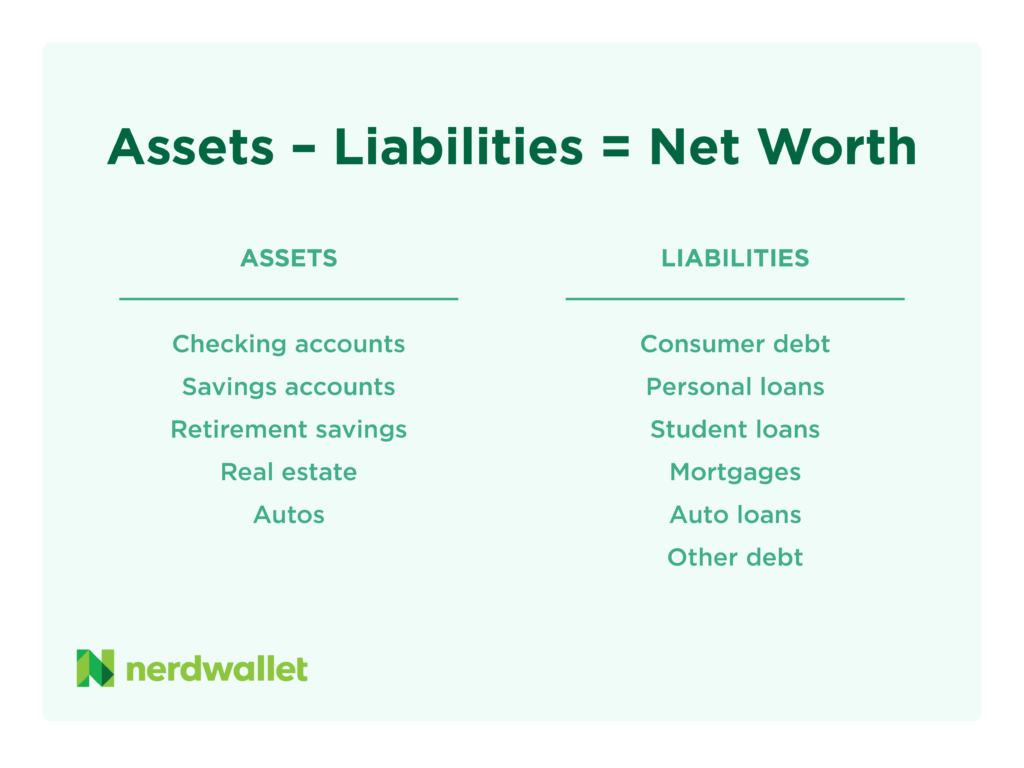

Net worth represents the difference between your total assets and liabilities. It serves as an overview of your financial position, reflecting how much you would have if you were to liquidate all your assets and settle your debts.

It is important to note that personal net worth and business net worth are calculated differently. That’s why calculating net worth could be complicated. That’s because there aren’t many sources to see what you need for personal net worth calculation.

Calculating Personal Net Worth

As an individual, you have to know your net worth, how much you own, how much you owe, and how much you make. A net worth statement allows you to get a clearer picture, and it will be easier for you to achieve your financial goals. There are certain steps you need to take when you start asking the question of how you calculate your net worth. Answers to these questions will help you understand everything better in your personal finance journey.

Assess Your Assets

Your assets are what you own. Everything that you own is called an asset, whether they are depreciating or appreciating asset. Begin by listing all your assets. Some examples:

- Cash and bank accounts.

- Investments (stocks, bonds, mutual funds, etc.).

- Real estate properties.

- Vehicles.

- Retirement accounts.

- Other valuable possessions.

Determine Your Liabilities

Then, what increases or decreases your assets are your liabilities. These are generally things you spend money on or costing you money. Some examples of liabilities:

- Mortgage loans.

- Student loans.

- Credit card debts.

- Personal loans.

- Other outstanding debts.

Crunch the Numbers

Subtract your total liabilities from your total assets to calculate your personal net worth. You can use a net worth calculator or create a spreadsheet to simplify the process. Regularly updating these figures will help you track your financial progress over time.

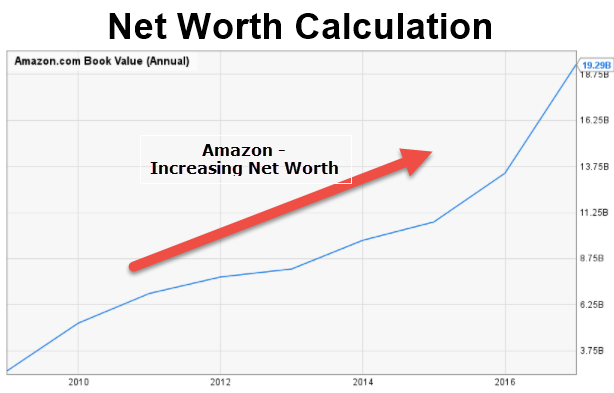

Calculating Business Net Worth

Business net worth focuses on evaluating the value of your business assets and liabilities. So that’s why when you wonder how do you determine net worth, you need to make the distinction between personal and business net worth.

In essence, they are similar because you calculate assets and liabilities and subtract them from one another. However, how you calculate your assets and liabilities is different than calculating net worth for personal reasons.

Here’s how you can calculate it:

Your Business Assets

- Physical assets. Include properties, equipment, inventory, and other tangible assets.

- Intellectual property. Consider patents, trademarks, copyrights, and proprietary software.

- Intangible assets. Consider brand value, customer relationships, and goodwill.

Your Business Liabilities

- Business loans. Include outstanding balances and debts.

- Accounts payable. Consider any unpaid bills or invoices.

- Other financial obligations. Evaluate any legal or financial commitments related to your business.

Incorporate Business Valuation Methods

So, once you have these numbers, do you calculate the net worth of a business? Depending on the nature of your business, you may need to use specific valuation methods. These methods could be a market approach, income approach, or asset-based approach to determine the worth of your business. Make the necessary research to see what fits the best into your business and use that equation to determine what is the net worth of the business.

Factors to Consider

Calculating net worth goes beyond simple addition and subtraction. It is crucial to consider additional factors that can impact your overall net worth. If you don’t consider these factors, you might come up with a misleading calculation of the net worth of your business. They might not be as relatable as it is for personal reasons. These factors are:

- Intangible assets. These include brand reputation, intellectual property, and customer loyalty.

- Future earnings potential. Evaluate your career prospects, expected income growth, and investment returns.

- Financial obligations. Take into account any pending legal or financial commitments that may affect your business’s net worth.

Tips to Improve Net Worth

Increasing your net worth requires strategic financial management. Consider the following tips:

- Reduce debt. Prioritize paying off high-interest debts and create a plan to tackle outstanding balances.

- Increase savings. Set aside a portion of your income regularly to build an emergency fund and contribute to your investments.

- Invest wisely. Explore investment opportunities that align with your financial goals and risk tolerance.

- Improve business profitability. Focus on strategies to increase revenue, manage expenses, and optimize operations.

- Manage cash flow. Implement efficient cash flow management practices to ensure healthy business finances.

Conclusion

Calculating net worth provides valuable insights into your personal and business finances. By understanding your net worth, you can make informed financial decisions, track your progress, and work towards building long-term wealth. Regularly reassessing your net worth will help you stay on track and achieve your financial goals. So, take the time to calculate your net worth and make strategic financial moves that align with your aspirations.

Overall, when you start to wonder how do you calculate your net worth, you are on the right path. You just need to understand the term net worth better, get a net worth formula that fits you, and start tracking your net worth. However, remember that calculating net worth is not a one-time activity but an ongoing process. Embrace it as a tool to measure your financial health and guide your journey toward financial success.