Building and preserving wealth is a goal that many people aspire to achieve. However, without a comprehensive financial plan, it can be challenging to achieve long-term financial success. This blog post will discuss how to create a comprehensive financial plan for long-term success. We will cover the key steps you need to take to manage your wealth effectively, including defining your financial goals, assessing your current financial situation, and implementing a plan to achieve your goals.

Why Having a Financial Plan is Important?

The biggest mistake people do is not caring about how much they are spending and not planning toward a budget. When you do this, you create an illusion that your money is enough for you. This might be true, you might live off of well on your income, but it rarely holds up for the future. That’s because you need to save, invest, and control your money rather than spend every penny you get each money.

To control this, you need to have a financial plan in place. In addition to controlling your money, it also helps to see the bigger picture better. You can identify financial goals, get a clear picture of your financial situation, create guidance on investment decisions and effectively manage your debt. It also helps to manage cash flow and has a framework for monitoring progress. By developing and following a comprehensive financial plan, individuals can achieve their long-term financial goals and secure their financial future.

This comprehensive financial plan shouldn’t be just about the money you spend, though. It has to include everything, from your personal goals to your future plans. All in all, it has to focus on your entire life by taking the financials in the middle. Here are some things you can consider while building your financial plan:

- Your current personal situation.

- Current financial situation.

- The goals you have in mind.

- How do you picture your financial future.

- What are your career goals, and can your financials match those goals?

There are many others, but these things can cover the basics.

Define Your Financial Goals

If you don’t know what you want, you can’t start something. This is the same in your personal finance journey, especially with your financial plan journey. Try to identify your financial goals. You can do so by looking at your current situation and your experiences in the past and by asking yourself what you want. The question should focus on what you want to achieve financially in the short and long term. You can have plans for different things.

- Do you want to save for retirement?

- Pay off debt?

- Buy a home?

- Start a business?

Once you have identified your goals, you can then prioritize your goals based on their importance to you. Take the time to set specific and measurable goals. For example, instead of just saying, “I want to save for retirement,” set a specific target, such as “I want to save $1 million for retirement by age 65.” This will give you a clear target to work towards and help you stay motivated.

Assess Your Current Financial Situation

After defining your financial goals, the next step is to assess your current financial situation. This includes analyzing your income, expenses, assets, and liabilities. Make a list of all your income sources and expenses, including debt payments, and compare them to identify areas where you can cut costs. Also, calculate your net worth by subtracting your liabilities from your assets. This will give you a better understanding of your current financial position.

When assessing your financial situation, it is important, to be honest with yourself. Don’t ignore any debt or expenses that may be difficult to manage. Instead, come up with a plan to tackle these challenges and improve your financial situation.

Develop a Wealth Management Plan

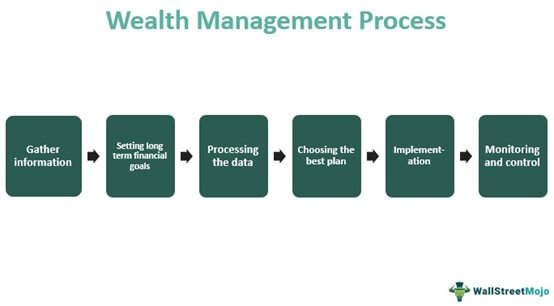

Based on your financial goals and current financial situation, the next step is to develop a comprehensive wealth management plan. This plan can be divided into different sections to make it easier. Ideally, it should have a budget, a debt management strategy, an investment strategy, an estate plan, and an insurance plan.

Budgeting is critical to managing your finances effectively. Create a budget that reflects your income, expenses, and financial goals. Your budget should be realistic and flexible enough to accommodate unexpected expenses.

If you have debt, create a debt management strategy. The strategy should include paying off high-interest debt first and negotiating with creditors to reduce interest rates or monthly payments. Consolidating your debt can also be a viable option to make your debt more manageable.

Investing is another critical component of wealth management. Develop an investment strategy that reflects your risk tolerance and financial goals. Diversify your investment portfolio by putting your money in different asset classes. These assets could be stocks, bonds, and real estate. Consider working with a professional like a financial advisor to help you make better and more professional investment decisions.

Creating an estate plan is also important to ensure that you can distribute your assets according to your wishes after you pass away. This plan should include a will, a trust, and powers of attorney. Review and update your estate plan frequently to ensure that it reflects any changes in your life circumstances.

Finally, consider purchasing insurance to protect your assets and your family. This may include life insurance, health insurance, disability insurance, and long-term care insurance.

Implement Your Plan

Once you have developed your wealth management plan, it is time to implement it. This may involve opening investment accounts, setting up a budget, and taking steps to pay off debt. The important thing is to not spend a lot of time perfecting your plan. No plan is perfect unless you take action. There are going to be mistakes and things you are going to need to change, and that’s fine. Always put taking action at the top of the to-do list than talking, planning, or other phases. It’s fine if your plan doesn’t look like anything solid right now. It’s not supposed to be.

The idea is to have some sort of a picture of what you want. As you go, you will realize some things you planned are not for you, or there are better versions of them. Then, you adjust the plan, which is the next step in your journey. When you start to implement your plan, remember to be patient and stay committed to your plan. It may take time to see the results, but over time, you will start to see progress toward your financial goals.

Monitor Your Progress and Adjust Your Plan

As I mentioned above, the initial plan you made and started with is not going to be perfect. You are going to realize that there are things you can change and do better. At this point, it’s extremely important to monitor your progress as perfectly as you can. Don’t blindly follow your initial plan. Always monitor to see what is working and what is not.

Monitoring progress could look in different forms. During the monitoring phase, you can periodically check these five things below.

- Review your budget.

- Debt management strategy.

- Investment strategy.

- Estate plan.

- Insurance plan.

This ensures that they are still aligned with your financial goals, and if not, you can change them. When you see what is not working, then you take action and start adjusting. Make sure to adjust your plan as necessary to accommodate changes in your life circumstances or financial goals. Regularly monitoring your progress will help you stay on track and make any necessary adjustments to ensure that you achieve your financial goals.

Seek Professional Advice

Doing all these things I mentioned above can be very overwhelming. If you don’t know anything about these things, it might be hard to dip your toes in the water. That’s why, if you feel this way and don’t know where to start, you can consider seeking professional advice.

A professional like a financial advisor can help you navigate the complexities of financial planning. They will help you make informed investment decisions, and develop a plan tailored to your specific financial goals and circumstances.

When selecting a financial advisor, look for someone who is experienced, licensed, and has a fiduciary duty to act in your best interests. Ask for referrals for a good financial advisor from friends and family, or search for advisors online. Schedule a consultation with several advisors to determine which advisor is the best fit for you.

Stay Disciplined and Consistent

Creating a comprehensive financial plan is just the first step toward achieving long-term financial success. Staying disciplined and consistent in implementing and following your plan is essential to achieving your financial goals.

It is important to resist the temptation to deviate from your plan, especially during market downturns or unexpected financial events. Remember that investing is a long-term strategy, and it is normal to experience market fluctuations along the way.

Stay focused on your long-term financial goals, and be patient. It may take time to achieve your goals, but with discipline and consistency, you can achieve financial success.

Celebrate Your Achievements

Finally, celebrate your achievements along the way. Reaching your financial goals is a significant accomplishment, and it is important to acknowledge and celebrate your progress. You can do this celebration in different ways, whether small celebrations with small milestones or big celebrations with big milestones. Understand yourself and see what works best for you.

Celebrate small milestones along the way, such as paying off a credit card or reaching a savings goal. This will help you stay motivated and committed to your financial plan.

Three Best Free Financial Planners

If you can manage to create a plan and have already started your journey, you can use free tools to help you keep track. There are many financial planners on the market that you can use, whether free or not. I’ve listed the three best financial planners that you can use today. They are not sponsored, and they are only my opinion.

Mint

Mint is a free online budgeting tool that helps users track their spending, manage bills, and create a budget. This tool automatically categorizes transactions and provides personalized insights to help users make informed financial decisions. It also offers free credit score monitoring and alerts for suspicious activity on accounts. Mint is available on both desktop and mobile devices.

Personal Capital

Personal Capital is a free financial management tool that helps users track their net worth, manage their investments, and plan for retirement. Personal Capital aggregates all financial accounts, including bank accounts, credit cards, and investments, into one dashboard for easy management. It also provides investment analysis and personalized retirement planning tools. They are one of the most extensive tools you can use for your personal finance journey. Personal Capital is available on both desktop and mobile devices.

BudgetPulse

BudgetPulse is a free online budgeting tool that helps users track their spending, manage bills, and create a budget. BudgetPulse allows users to create custom categories for expenses and provides charts and graphs to help visualize spending habits. It also offers a debt reduction tool to help users pay off debt faster. BudgetPulse is available on both desktop and mobile devices.

Conclusion

In conclusion, creating a comprehensive financial plan is critical to achieving long-term financial success. By defining your financial goals, assessing your current financial situation, developing a wealth management plan, implementing your plan, and monitoring your progress, you can achieve your financial goals and secure your financial future.