Artificial Intelligence (AI) has become one of the most disruptive technologies of our time, revolutionizing industries and reshaping how we live and work. As AI continues to advance quickly, investors recognize its potential and want to capitalize on the opportunities. In this comprehensive guide, I will try to go into the realm of investing in AI, exploring the various aspects and considerations that come with it.

Introduction to Investing in AI

AI, in its simplest terms, refers to developing computer systems that can perform tasks that typically require human intelligence. These tasks include speech recognition, decision-making, problem-solving, and even creative endeavors. AI has the capability to analyze a lot of data, learn from patterns, and make predictions or recommendations based on the insights derived. This transformative technology has already made significant impacts across diverse sectors. Like healthcare, finance, transportation, and more.

Notable success stories of AI companies such as Alphabet’s Google, Amazon, and Tesla have also increasedthe interest in investing in AI. From self-driving cars to virtual assistants, AI is reshaping the way we understand and use technology. It also opens new ways for innovation and disruption.

AI has come a long way since its inception, with significant milestones achieved in the fields of machine learning and natural language processing. Understanding the foundations of AI sets the stage for exploring investment opportunities in this dynamic field.

Understanding the Potential of AI Investments

Investing in AI offers opportunities for individuals and organizations seeking to make use of the potential of this technology. It is essential to examine the current and projected market size of the AI industry and its potential to completely understand the AI landscape.

Current and Projected Market Size of the AI Industry

The AI industry is experiencing rapid growth, driven by advancements in technology, increasing data availability, and the need for automation and efficiency across multiple sectors. A report by Grand View Research estimates that the AI market will reach $733.7 billion by 2027. It’s estimated to grow at an annual growth rate of 42.2%.

The potential for AI investments becomes even more critical with these numbers. Since AI is basically everywhere, capitalizing on this for individuals is also possible and easy. For instance, the healthcare sector is leveraging AI. Some examples are disease diagnosis, drug discovery, and personalized medicine, while the finance industry is utilizing AI for fraud detection, algorithmic trading, and risk assessment.

Key Drivers for the Growth of AI Investments

Numerous factors are fueling the growth of AI investments and making it an attractive place for investors worldwide. Some of the key drivers include:

- Technological Advancements. The continuous advancements in AI technologies are expanding the possibilities of what AI can achieve. These advancements are creating ground for investment opportunities.

- Big Data and Cloud Computing. The availability of vast amounts of data, coupled with the advancements in cloud computing, has enabled AI systems to process and analyze data at an unprecedented scale. This data-driven approach is instrumental in training AI models and unlocking valuable insights, making AI investments highly promising.

- Cost Reduction and Efficiency. Automation of repetitive tasks, predictive analytics, and intelligent decision-making can speed up processes and increase productivity. This will lead to cost savings and automated investment decisions.

- Consumer Demand and Expectations. AI-powered technologies are being used for better customer interactions and to improve satisfaction levels.

Analysis of Different AI Investment Opportunities

Investing in AI can take various forms, each with its own set of benefits and considerations. Take a look at what options you have when investing in AI.

Investing in AI Start-ups

Investing in AI start-ups provides an opportunity to get in on the ground floor of innovative technologies and potentially earn high returns on investment. Start-ups focused on AI often bring fresh ideas and disruptive solutions to the market. However, investing in start-ups comes with its own set of risks. One of the biggest risk is the high failure rate associated with early-stage companies. It is crucial for investors to do thorough due diligence and assess certain factors.

Investing in AI-focused Venture Capital Funds

Venture capital funds specializing in AI investments offer a diversified portfolio of AI start-ups and emerging companies. These funds are managed by experienced investment professionals. They aim to provide investors with exposure to a range of AI technologies and the opportunity to benefit from their expertise. However, it is essential to carefully evaluate the track record and investment strategy of AI-focused venture capital firms. It ensures alignment with your investment goals and risk tolerance.

Investing in Established AI Companies

Investing in established AI companies allows investors to tap into the success and growth of companies that have already established a strong presence in the market. These companies often have a proven track record, established customer base, and the resources to further innovate and expand their AI capabilities. However, investing in established AI companies may require a significant upfront investment. They may also be subject to market fluctuations and competition. Thorough research and analysis of the financial performance, competitive landscape, and growth prospects of these companies are essential before making investment decisions.

Assessing Risks and Challenges of AI Investments

Investing in AI, like any other investment, comes with its risks and challenges. It is no doubt that the potential for high returns is undoubtedly attractive. However, it is crucial to be aware of the potential risks and take necessary precautions.

Regulatory and Ethical Considerations in AI Investments

One of the significant challenges in AI investments revolves around the regulatory and ethical landscape. As AI technologies become more sophisticated and pervasive, questions surrounding data privacy, algorithmic biases, and accountability become important. Regulatory frameworks vary across different jurisdictions, making it essential for investors to navigate complex legal landscapes.

Technological Risks in AI Investments

AI investments are not immune to technological risks. The performance and success of AI systems heavily rely on the quality and quantity of data used for training. Inadequate or biased data can lead to flawed outcomes and inaccurate predictions, potentially impacting the value of investments. Additionally, AI models are not immune to technical glitches, vulnerabilities, or cyber threats, which can compromise the integrity and reliability of AI systems.

To mitigate technological risks, investors should carefully evaluate the quality and diversity of data used in AI models and the robustness of the underlying algorithms.

Market Risks in AI Investments

Investing in AI does not guarantee success. Market risks are inherent in any investment. The AI landscape is highly dynamic and competitive, with new players entering the market regularly. Market trends and customer preferences can change rapidly, impacting the demand for AI products and services. Additionally, the valuation of AI companies can be subject to speculation, potentially leading to market volatility.

Understanding the competitive landscape, market trends, and customer demands can help identify investment opportunities with a higher probability of success. Diversifying AI investments across different sectors, applications, and geographies can also mitigate the impact of market fluctuations.

Intellectual Property Risks in AI Investments

Intellectual property (IP) risks are another consideration when investing in AI. AI technologies often rely on proprietary algorithms, datasets, and software, making IP protection crucial for maintaining a competitive advantage. However, the rapidly evolving nature of AI and the complex interplay between different technologies can create challenges in protecting IP rights.

Investors should assess the IP landscape of AI companies before making investment decisions. Evaluating the company’s IP portfolio, including patents, trademarks, and trade secrets, can provide insights into the strengths and potential risks related to IP. Understanding the competitive landscape and any potential infringement risks is essential to safeguard investments and ensure long-term value.

Strategies for Mitigating Risks in AI Investments

Mitigating risks in AI investments requires a proactive approach and careful consideration of various strategies.

1. Conducting Thorough Due Diligence

Thorough due diligence is one of the most important things to do when investing in AI. This includes assessing the technical capabilities, track record, and financial health of AI companies. Evaluating the quality of data, algorithms, and infrastructure is essential to understand the potential risks associated with their technologies.

2. Diversifying AI Investment Portfolio

Diversification is a well-known risk management strategy in investing. By spreading investments across different AI companies, sectors, and geographies, investors can reduce the impact of any single investment’s underperformance. Diversification allows investors to capture opportunities in various AI applications while mitigating the risks associated with any single investment.

3. Staying Updated on Industry Trends and Advancements

The AI landscape is constantly evolving, with new technologies, trends, and regulations emerging regularly. Staying updated on industry developments and advancements is crucial. This helps to make informed decisions and adjust their investment strategies accordingly. Engaging in continuous learning and networking with experts in the field can help to identify new investment opportunities.

Investors can navigate the growing AI space more effectively and increase the potential for successful outcomes by understanding and creating plans for the risks associated with AI investments.

Developing an AI Investment Strategy

Just like any other investing method, a well-defined investment strategy for AI is also crucial. It involves several steps. Identifying sectors and industries with high AI adoption, determining the appropriate investment allocation, and creating a long-term investment plan are these steps.

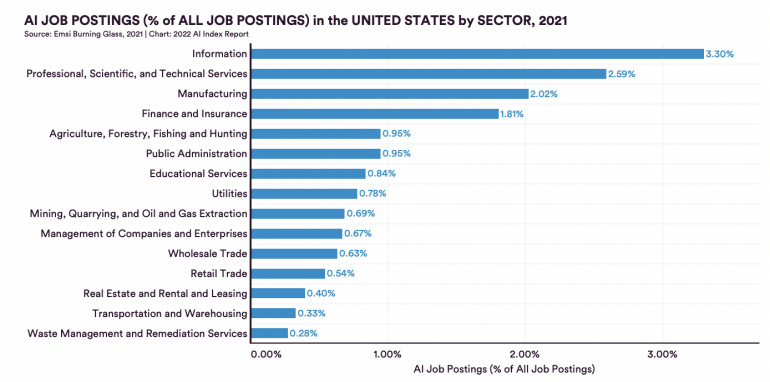

Identifying Sectors and Industries with High AI Adoption Potential

It is important to identify sectors and industries that are likely to experience significant AI adoption and growth to maximize your returns. While AI has the potential to impact almost every industry, certain sectors are particularly well-suited for AI-driven disruption.

Healthcare is a sector where AI has the potential to revolutionize diagnostics, drug discovery, personalized medicine, and patient care. The finance industry is also another one for AI adoption. They have applications ranging from fraud detection and risk assessment to algorithmic trading and robo-advisory services.

Investors should conduct thorough market research and analysis to identify sectors that align with their investment goals, risk tolerance, and expertise. Understanding the specific challenges and opportunities within each industry will help investors make informed decisions and capitalize on the growth potential of AI in those sectors.

Evaluating AI Investment Opportunities Based on Risk and Return

When evaluating AI investment opportunities, considering both the potential risks and returns is crucial. AI investments can range from high-risk, high-reward opportunities in early-stage start-ups to more stable investments in established AI companies or AI-focused venture capital funds.

Investors should assess various factors, including the technological readiness of the AI solution, the market potential, the competitive landscape, and the growth prospects of the company. Conducting thorough due diligence, analyzing financial statements, and understanding the business model are essential steps in evaluating investment opportunities.

Investors should also consider the risk-return profile of their overall investment portfolio and allocate their investments accordingly. Balancing high-risk investments with more stable options can help manage risk exposure while maximizing the potential for returns. It is important to align investment decisions with individual risk appetite and financial goals.

Determining the Appropriate Investment Allocation for AI

Determining the appropriate investment allocation for AI is a critical step in developing an investment strategy. The allocation will depend on factors such as risk tolerance, investment horizon, and overall investment objectives.

Investors can choose to allocate a specific percentage of their portfolio to AI investments, taking into account their risk appetite and the potential for growth in the AI industry. Some investors may opt for a more aggressive allocation to capture the potential high returns of AI investments, while others may prefer a more conservative approach to balance risk.

It is also important to diversify AI investments within the allocated portion of the portfolio. Diversification helps mitigate the impact of any single investment’s underperformance and reduces overall portfolio risk. By spreading investments across different AI companies, sectors, and investment vehicles, investors can capture opportunities while minimizing concentration risk.

Creating a Long-Term AI Investment Plan

Creating a long-term investment plan is essential for successful AI investing. AI is a rapidly evolving field, and investments should be aligned with a long-term perspective. Developing a clear investment thesis, setting realistic expectations, and establishing specific investment criteria will guide decision-making and ensure a disciplined approach.

Investors should regularly review and reassess their investment plans to adapt to changing market dynamics and industry trends. Staying informed about the latest developments in AI, attending industry conferences, and engaging with experts can provide valuable insights for refining the investment plan.

Investors should also consider the exit strategy for their AI investments. Whether through mergers and acquisitions, initial public offerings, or secondary market transactions, having a clear plan for exiting investments is crucial for realizing returns and managing liquidity.

Outlook and Trends in AI Investments

As the AI industry continues to advance at a rapid pace, the outlook for AI investments appears highly promising. In this section, we will explore the predicted growth of AI investments, emerging trends and technologies shaping the AI investment landscape, the potential impact of AI on traditional investment strategies, and the role of government and public-private partnerships in supporting AI investments.

Predictions for the Future Growth of AI Investments

Industry experts and market research reports predict significant growth in AI investments in the coming years. The AI market is expected to continue its upward trajectory, driven by advancements in technology, increasing adoption across industries, and the growing demand for AI-powered solutions.

Investors can expect the AI market to expand across various sectors, including healthcare, finance, retail, manufacturing, and more. The potential for AI to disrupt traditional industries, enhance productivity, and drive innovation makes it an attractive investment opportunity.

Emerging Trends and Technologies Shaping the AI Investment Landscape

Several emerging trends and technologies are shaping the AI investment landscape, presenting new opportunities for investors. Some noteworthy trends include:

- Edge AI. Edge AI refers to the deployment of AI algorithms and models directly on edge devices, such as smartphones, IoT devices, and autonomous vehicles. This trend enables real-time processing and analysis of data at the edge, reducing latency and enhancing privacy. Edge AI presents investment opportunities in areas such as autonomous vehicles, smart cities, and smart homes.

- Explainable AI. As AI becomes more pervasive, the need for transparency and explainability is gaining importance. Explainable AI focuses on developing AI systems that can provide understandable explanations for their decisions and actions. Investing in companies that specialize in explainable AI can be a strategic move, considering the potential regulatory and ethical implications of AI.

- AI in Healthcare. The healthcare industry presents immense opportunities for AI investments. AI-based applications in healthcare include disease diagnosis, drug discovery, remote patient monitoring, and personalized medicine. Investing in AI companies that are leveraging technology to revolutionize healthcare can have a significant impact on patient outcomes and the overall efficiency of the healthcare system.

- AI in ESG Investing. Environmental, Social, and Governance (ESG) investing is gaining traction, and AI can play a crucial role in analyzing ESG data and making sustainable investment decisions. AI-powered tools can help investors assess the environmental impact, social responsibility, and governance practices of companies, enabling more informed ESG investments.

Potential Impact of AI on Traditional Investment Strategies

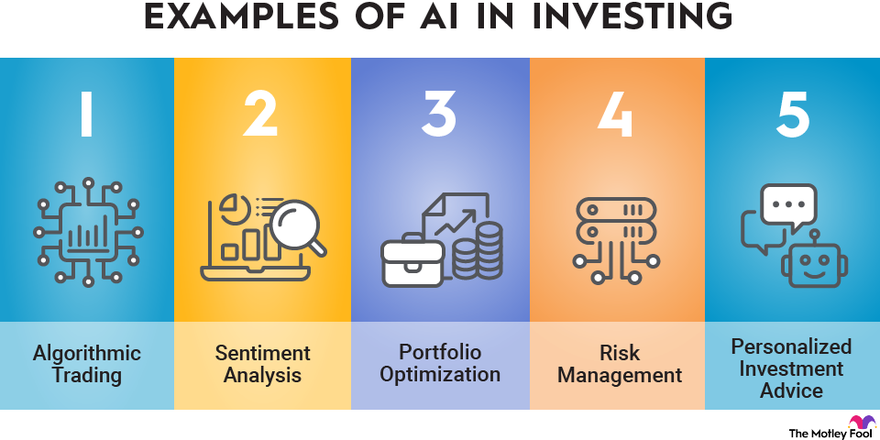

AI has the potential to disrupt traditional investment strategies and approaches. Traditional investment models often rely on historical data analysis, human judgment, and intuition. However, AI can augment investment decision-making by analyzing vast amounts of data, identifying patterns, and making data-driven predictions.

Quantitative investment strategies, such as algorithmic trading and systematic investing, are already leveraging AI to improve investment performance. AI-driven tools can help identify market trends, optimize portfolio allocation, and automate trading decisions. As AI continues to evolve, it is expected to have a profound impact on investment strategies, risk management, and portfolio optimization.

Investors can explore incorporating AI-based tools and models into their investment strategies to gain a competitive edge and enhance decision-making capabilities. However, it is important to strike a balance between the power of AI and human judgment, which is essential in assessing qualitative factors and adapting to changing market conditions.

Embracing the Future of AI Investments

Investing in AI presents an exciting opportunity to be part of a transformative technological revolution. The potential for high returns, coupled with the ability to shape industries and drive innovation, makes AI investments highly attractive. However, it is essential to approach AI investments with a thorough understanding of the risks, opportunities, and trends in this dynamic field.

Looking into the future, AI investments hold great promise. The predicted growth of the AI market, emerging trends and technologies, and the impact of AI on traditional investment strategies all contribute to a positive outlook for AI investments. With continued advancements in AI technology and the increasing adoption across industries, there are boundless opportunities for investors to capitalize on the potential of AI.

Investing in AI has challenges, but with careful planning, due diligence, and a long-term perspective, anyone can get the rewards of this transformative technology. By embracing the future of AI investments, investors can contribute to the advancement of technology, drive innovation, and shape the industries of tomorrow.

Conclusion

Investing in AI presents a compelling opportunity for individuals and organizations seeking to capitalize on the transformative power of this technology. Throughout this comprehensive guide, we have explored various aspects of investing in AI, including its definition, the potential for growth, the risks and challenges involved, developing an investment strategy, and the future outlook for AI investments.

AI has already demonstrated its impact across industries, revolutionizing sectors such as healthcare, finance, transportation, and more. The market size of the AI industry is projected to reach unprecedented figures, offering significant potential for investors. However, investing in AI also comes with risks, including regulatory and ethical considerations, technological challenges, market uncertainties, and intellectual property concerns. By carefully evaluating and mitigating these risks, investors can position themselves for success in the AI investment landscape.

Investing in AI requires continuous learning, thorough research, and a long-term perspective. AI is a rapidly evolving field, and staying updated on industry developments and engaging with experts will be key to successful investments. By embracing the potential of AI and adopting a strategic approach, investors can capitalize on the transformative power of this technology and contribute to shaping a future where AI drives innovation, efficiency, and prosperity.