Anyone who has dealt with banks, personal finance, and debit cards has probably heard of credit cards, too. Many people also, in fact, use credit cards, either for special purchases or for everything. But how frequently should you use credit cards? You might ask, should I use a credit card for everything?

That’s a good question. Credit cards are convenient, secure, and rewarding if you use them every day for everything, but they also come with risks and responsibilities. If you are wondering whether you should use your credit card for everything, the answer is that it depends.

Let’s dive deeper into whether you should use credit cards for everything, how frequently you should use them, what are the benefits and disadvantages, and every other detail about credit card usage.

What is a Credit Card?

First things first, we must understand what a credit card is before we can understand the pros and cons of using a credit card for everything. A credit card is actually a payment card that lets you buy things or get cash on credit.

This means that you can use the card to spend money that you don’t have right now, but you must pay it back later with interest. A credit card is usually issued by a bank or a financial company, and it has a limit on how much you can borrow. A credit card has a number, a chip, and a magnetic stripe that identifies your account and allows you to make transactions with merchants that accept cards for payment. So, the concept of the card is pretty much the same.

Only the balance connected to that card is not real cash you own. With every spending you make on your credit card, you borrow money from your bank with a due date for the next month with interest on top of the amount you spend.

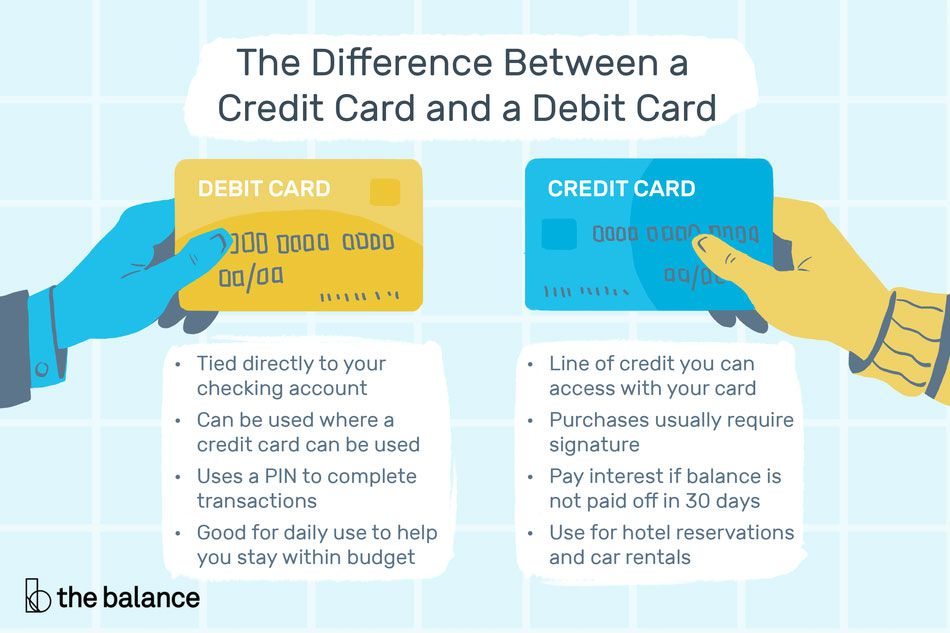

That’s why a credit card differs from a debit card. A debit card takes money directly from your bank account, which requires you to pay the full monthly balance. A credit card is one of the most common ways of paying for goods and services around the world.

However, the biggest threat to credit card usage is the interest rate. If you miss a payment, the interest rates on credit cards are extremely high, generally four to five times higher than the market interest rates.

Importance of Credit Card Usage

Now, credit cards’ benefits probably outweigh the risks and cons. Credit cards provide convenience, security, financial rewards, ease of use, and, more importantly, a higher credit history. With every payment you make, you show the banks that they can rely on you to pay your debt, no matter how big or small that debt is.

However, credit cards also have risks like fees, interest, debt, and fraud. If you miss a payment, you will pay a lot of interest, removing all the benefits we just listed above. People generally use credit cards to pay for items that they either don’t have the cash for or just simply don’t want to pay in cash at the moment. That’s why people might struggle to pay their balances back when it’s due time. Therefore, it is important to use credit cards responsibly and wisely.

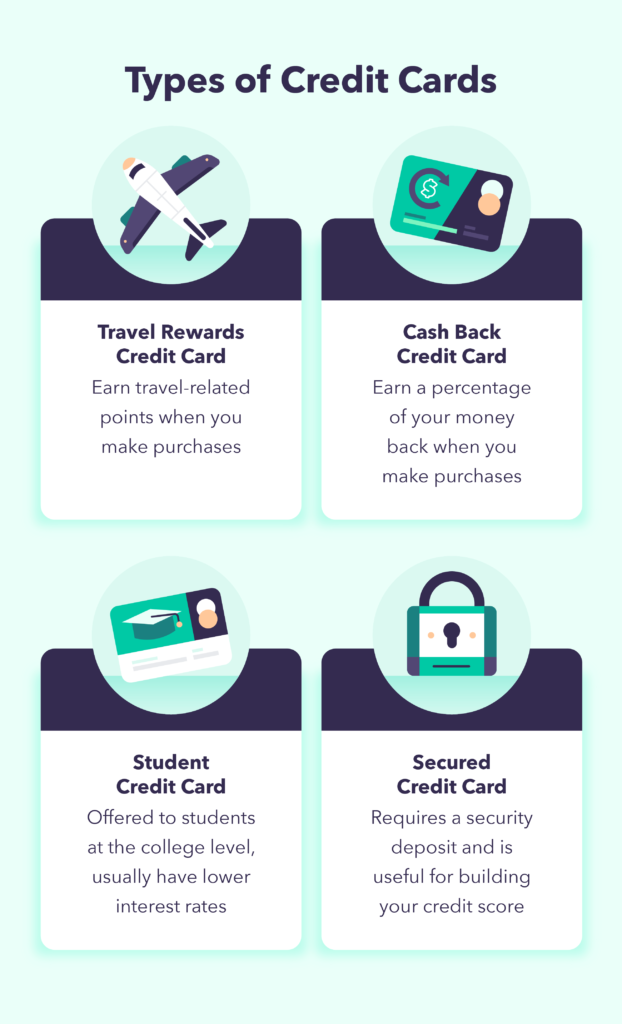

Responsible credit card usage means paying your bills on time, staying within your credit limit, avoiding unnecessary fees, and checking your statements regularly. Responsible card usage also means choosing a card type that will fit your needs and budget and comparing different offers and terms before applying. If you use credit cards responsibly, you can enjoy their benefits while avoiding their pitfalls and improving your financial health and well-being.

Factors to Consider When Using Credit Cards for Everyday Expenses

Personal Financial Goals. Aligning credit card usage with financial goals and priorities is crucial.

Reward Assessment. Evaluating the value of rewards against potential risks helps make informed choices.

Financial Situation Analysis. Understanding individual financial circumstances influences credit card usage decisions.

Advantages

There are some advantages to using your card for everything, such as:

- You can earn rewards points, cash back, miles, or other benefits from your card issuer, depending on the type of card you have.

- You can build your credit history and improve your credit score by paying your bills on time and keeping your credit utilization low.

- You can enjoy consumer protections, such as fraud protection, purchase protection, extended warranty, and chargeback rights, that may not be available with other payment methods.

- You can avoid carrying cash or coins, which can be lost, stolen, or inconvenient to use.

Disadvantages

However, there are also some disadvantages to using your card for everything, such as:

- You may overspend or accumulate debt if you are not careful with your budget and spending habits. Credit cards can push you more to buy things you don’t need or can’t afford, especially if you are influenced by marketing or peer pressure.

- You may pay high-interest rates and fees if you don’t pay your balance in full every month or if you miss a payment. Credit cards can get quite expensive quickly if you don’t pay your balance in full or incur late fees, penalty fees, annual fees, or foreign transaction fees.

- You may damage your credit score if you max out your credit limit or default on your payments. Credit cards can negatively affect your credit history and score if you misuse them or abuse them.

- You may lose some of the benefits of using cash or other payment methods, such as discounts, cash back, rewards, or incentives offered by merchants or service providers.

Tips on Credit Card Use

- Use your card for everything only if you can pay your balance in full every month and avoid interest charges and fees. You can enjoy the benefits of using your credit card without paying extra costs.

- Make sure that you have a good credit score and a low credit utilization ratio. This way, you can maintain or improve your credit history and score without hurting them.

- Use the card only if you are confident that you can manage your spending and stick to your budget. This will allow you to avoid overspending or accumulating debt that you can’t repay.

- Check the rewards that your card offers. Make sure to use your card if you value the rewards and protections that your card offers more than the alternatives. This way, you can maximize the value of using your credit card without missing out on other opportunities.

Conclusion

In conclusion, using your credit card for everything can be a smart or foolish decision, depending on how you use it. If you are responsible, disciplined, and savvy with your card, you can reap the benefits of convenience, security, and rewards. If you are careless, impulsive, and ignorant with your card, you can suffer the consequences of debt, fees, and damage to your credit. The choice is yours.