Stocks are the pillar of growing wealth and preserving the value of your money. Everyone invests in stocks in one part of their lives to grow their wealth. It’s a basic starting point for your personal finance journey. There is a reason why many people do it, and that’s because it’s simple and proven. However, there are different aspects to investing in stocks, and that’s the time horizon.

Many statistics prove that the longer you stay invested in the stock market (not individual stocks but the overall market), the lower your chances of you losing money on your investment. This means that short-term investments are the riskiest. But how do you invest in stocks for the long-term? What makes an investment long-term? Let’s discuss all of that here.

Are stocks a good long-term investment?

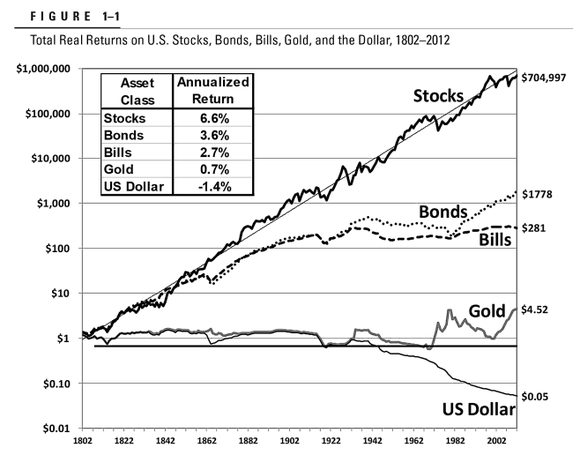

Historically, stocks have been a good long-term investment and have outperformed other asset classes, such as bonds and cash, over the long run. Looking at the stock’s statistics, they outperform most of the asset classes in the long run. But this doesn’t mean that you should go all in with your stock investments. They generally perform better, but considering other options is always good.

When we examine asset class returns over several decades, we find that stocks beat almost all other types of assets over a period of at least two decades. Between 1928 and 2021, the S&P 500 gained an average of 11.82% every year. This compares well to the three-month Treasury bill (T-bill) return of 3.33% and the 10-year Treasury note return of 5.11%. For example, from 1975 to 2022, the S&P 500 recorded yearly losses in only 11 of the 47 years, illustrating that the stock market creates returns far more often than it does not.

Individuals rarely lose money investing in the S&P 500 over a 20-year period, according to stock market returns since the 1920s. Even after accounting for setbacks such as the Great Depression, Black Monday, the IT boom, and the financial crisis, investors would have made money if they had invested in the S&P 500 and held it for 20 years.

Should you consider holding stocks for the short-term?

It’s generally not advisable to hold stocks for the short-term, as the value of individual stocks can fluctuate significantly over short periods of time, and there is a higher level of risk involved in this type of investing. If you’re looking to invest in stocks with a short-term horizon, you may be more susceptible to the effects of market volatility, which can make it more difficult to achieve your financial goals.

Instead of focusing on short-term investments, it’s usually a better idea to adopt a long-term perspective when it comes to investing in stocks. This means holding onto your investments for a period of several years or more and taking a more measured approach to buying and selling. This can help you ride out the ups and downs of the market and potentially achieve better returns over the long run.

However, if you don’t mind losing your money and want to take risks, stocks are again a great option for growing your wealth, even in the short-term. But there are better gains you can make by keeping your money in your stocks for longer periods of time.

Short-Term vs. Long-Term

The main difference between short-term and long-term stock investments is the length of time that you hold onto your investments.

- Short-term stock investments are those that you hold onto for a period of one year or less,

- Long-term stock investments are those that you hold onto for a period of several years or more. Generally, at least a decade.

Both short-term and long-term stock investments have their own unique set of risks and potential rewards. Whatever the risks are, which type of investment is better for you will depend on your financial goals, risk tolerance, and investment horizon.

However, numbers suggest that those who stay in the stock market for more than a decade rarely lose money on their investment. Those who invest for the short-term, like a year or so, risk losing their investment.

Risk

Short-term investments tend to carry a higher level of risk, as the value of individual stocks can fluctuate significantly over short periods of time. This means that you may be more susceptible to the effects of market volatility when investing in stocks for the short term. Long-term investments, on the other hand, tend to be less risky, as the value of stocks tends to increase over longer periods of time, and there is more time to ride out any market fluctuations.

Potential returns

Short-term investments may offer the potential for higher returns, as you have the opportunity to take advantage of price movements in the market. However, the potential for higher returns also means that there is a higher level of risk involved. Long-term investments may offer more modest returns, but they also carry a lower level of risk.

Tax implications

Short-term investments may be subject to higher tax rates, as they are typically taxed at your ordinary income tax rate. Long-term investments, on the other hand, may be taxed at a lower rate, as they are typically taxed at the capital gains rate. The United States also has benefits for stocks that you hold for a certain period of time, tax-wise.

How Do You Determine Good Stocks for Long-Term?

It is true that stocks perform better over the long run, but there are also hundreds, if not thousands, of stocks that just disappear over the years. You shouldn’t fall into that trap and invest in safer stocks.

The best method to avoid that risk is to just invest in an ETF that tracks the US stock market. However, if you want to take control of what you invest in and invest in individual stocks, you can. You just need to be a little bit more careful. Here are a few factors to consider when choosing stocks for long-term investing:

- You should do diversification. Invest in large-cap, mid-cap, and small-cap stocks, as well as stocks from different sectors and industries. This can help to reduce risk by spreading your investment across a variety of different assets.

- Look for stocks with strong financials, healthy balance sheets, stable earnings, and a track record of growth. These types of stocks may be more resilient in times of market volatility and may offer more stability over the long term.

- See if the stock is overvalued. If a stock is overvalued, it may be riskier to invest in, as there is a higher chance that the price could decline. On the other hand, if a stock is undervalued, it may offer more upside potential.

- Make sure that the stocks you invest in align with your financial goals. If you’re investing for retirement, you may want to focus on stocks that offer a combination of growth and income.

On top of these things, always make sure to follow your investments. Spend a few hours a month or a week to see how they are doing. If you think the company has no future, you might want to sell it before the stock disappears in value.

Strategies for Long-Term Investment

A long-term investment is not just buying and letting it go for years. That might work, but it is not the most optimal. You can employ several strategies to get the best results according to your own goals. Here are a few options to consider:

Dollar-cost averaging

This involves investing a fixed amount of money at regular intervals, regardless of the price of the stock. This can help to smooth out the effects of market fluctuations and may be a good strategy for risk-averse investors who don’t want to try to time the market. In the long run, you will always win if the company continues to be successful.

Value Investing

This strategy is looking for undervalued stocks that have the potential to increase in value over the long term. Value investors typically focus on stocks with strong financials and a track record of growth. They may be willing to hold onto their investments for an extended period to realize their potential. This is one of the riskiest long-term investing strategies, as the company might not grow as you hoped it would.

Growth investing

The growth investing strategy is for stocks with the potential for high levels of growth. Growth investors may be willing to pay a premium for stocks with strong earnings and revenue growth prospects, and they may be more focused on the long-term potential of their investments. Similar to value investing, it involves the highest risk.

Dividend Investing

This involves investing in stocks that pay dividends, which can provide a steady stream of income. Dividend investors may be more focused on income and stability rather than growth. They may also be willing to hold onto their investments for an extended period of time to benefit from the dividends. Dividend investing is the pillar of long-term stock investment. They not only give you a steady income but also increase in value, most of the time.

Why Long-Term Investment for Stocks are Better

Long-term investing is better in numbers, as I mentioned. But it’s not just the numbers, though. There are some other things that make sense to invest in stocks for the long-term. Here are some of the benefits, both in numbers and in other things.

Lower risk

Long-term investments tend to be less risky than short-term investments, as the value of stocks tends to increase over longer periods of time, and there is more time to ride out any market fluctuations. This means that you may be less likely to experience significant losses when you hold onto your investments for the long term. This is generally for stocks that are established and will most likely stay afloat for decades.

Better returns

It is obvious that stocks outperform almost all of the asset classes in the long run. By holding onto your investments for an extended period, you may achieve better returns and potentially build wealth over the long term. Compound interest comes into play here as your returns increase.

Less impact of market volatilit

Short-term investments may be more susceptible to the effects of market volatility, as the value of individual stocks can fluctuate significantly over short periods of time. Even a small event could trigger the values of the stocks to go down by tens of percentages. However, these will not matter in the long run as long as the company or the index is alive. By adopting a long-term perspective, you may be able to minimize the impact of market fluctuations and focus on the long-term potential of your investments.

Tax benefits

When you invest in stocks for longer terms, there are tax benefits associated with it when you sell it. You should read these tax regulations or talk to your accountant to get a better picture. Because apart from the federal regulations, your state might have even better benefits.

5 Best Long-Term Stocks for 2023

I am a dividend investor, always investing for the long-term. Here are my five recommendations for the best long-term stocks for 2023. Please note that these are not investment advice, and do your own research before deciding to invest in them.

- Apple Inc. (AAPL)

- Microsoft (MSFT)

- McDonald’s Corp (MCD)

- Royalty Income (O)

- NVIDIA Corporation (NVDA)

The Verdict

In short, stocks are the best investment asset classes for whatever reason you invest. They are an amazing way to grow your wealth in the long run. However, they carry some risks, so you should focus on removing them. The best way to do that is to invest in stocks in the long run.

I recommend just investing in an ETF that tracks the US stock market. If you want to invest in individual stocks (which is what I do), you should research, read their balance sheet, and conclude that they will be around for a very long time.